Investor Insight

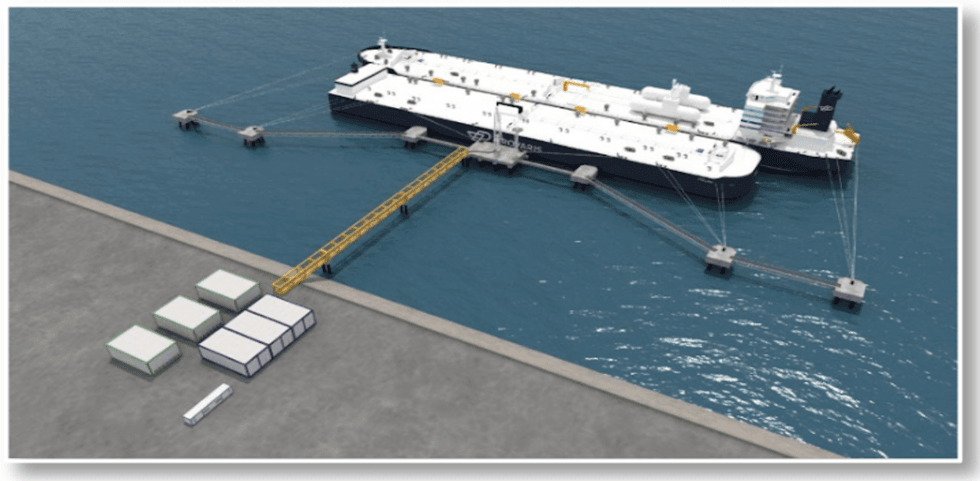

Provaris Energy is at the forefront of developing integrated compressed hydrogen and liquid CO₂ storage and transport infrastructure. With proprietary technology, a capital-light license model, and a growing portfolio of European hydrogen supply chain projects, Provaris is well-positioned to support global decarbonization efforts.

Company Highlights

- Proprietary tank IP and vessel designs enable scalable, low-cost storage and transport solutions.

- Compression technology offers the lowest cost for regional hydrogen supply.

- Term sheet signed with Uniper Global Commodities for 42,500 tpa hydrogen supply; binding Hydrogen SPA targeted mid-2025.

- Second MoU signed in March 2025 for 30,000 tpa hydrogen supply from Norway to Germany; term sheet expected Q2 2025.

- Early cash flow via license and origination fees; no capex required for Provaris to participate in shipping infrastructure.

- Partnership with Yinson Production AS to deliver new liquid CO₂ tank designs targeting maritime, floating, and onshore storage.

- High-volume inbound interest (>150 ktpa) from Nordic and Spanish developers confirms market demand.

- Prototype compressed hydrogen tank in construction, with class approvals expected Q3 2025.

Overview

Provaris (ASX:PV1) offers innovative storage and transport infrastructure essential to lowering the cost of hydrogen and CO₂ supply chains. With offices in Sydney and Oslo, the company is strategically focused on Europe, where decarbonization goals and energy security demand scalable and efficient clean energy solutions.

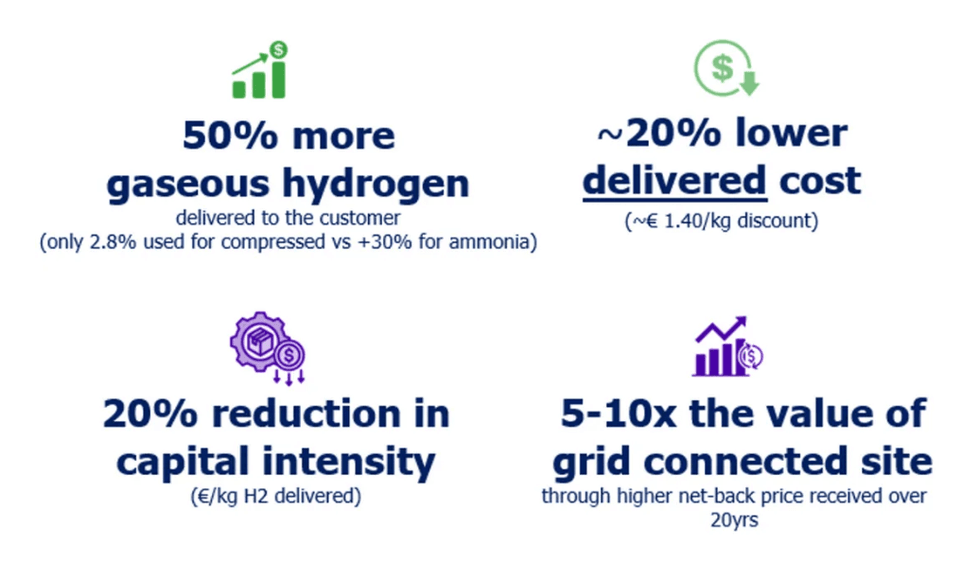

Provaris has developed a proprietary compressed hydrogen shipping solution designed to deliver “ready-to-use” green hydrogen with the lowest delivered cost for regional markets. Compression has been validated as the most energy- and cost-efficient method for hydrogen delivery, eliminating the need for complex conversion to carriers like ammonia. Studies show Provaris’ model delivers ~50 percent more hydrogen at ~20 percent lower cost compared to ammonia, with emissions well below EU RED II thresholds.

The company's “capital lite” model enables early cash flow and long-term recurring revenue through license and origination fees, without requiring ownership of ships or infrastructure. Each hydrogen supply project can generate ~US$34 million in total revenue for Provaris, including a technology license fee of ~US$16.5 million per project.

With binding commercial milestones targeted for 2025, including two supply agreements with German utilities totaling over 70,000 tonnes per annum of hydrogen, Provaris is well positioned to enable Europe’s transition to clean hydrogen. Europe's hydrogen import needs are forecast to reach 7 million tonnes (Mt) by 2030, with less than 1 percent of that currently supplied by low-carbon sources.

The company is also pioneering bulk liquid CO₂ tank technology in partnership with Yinson Production AS, opening a second stream of licensing revenue and addressing bottlenecks in carbon capture and storage infrastructure. This innovation aligns with Provaris’ mission to enable practical, efficient, and scalable zero-carbon energy supply chains across Europe and beyond.

Advanced Supply Chain Project Pipeline in Europe

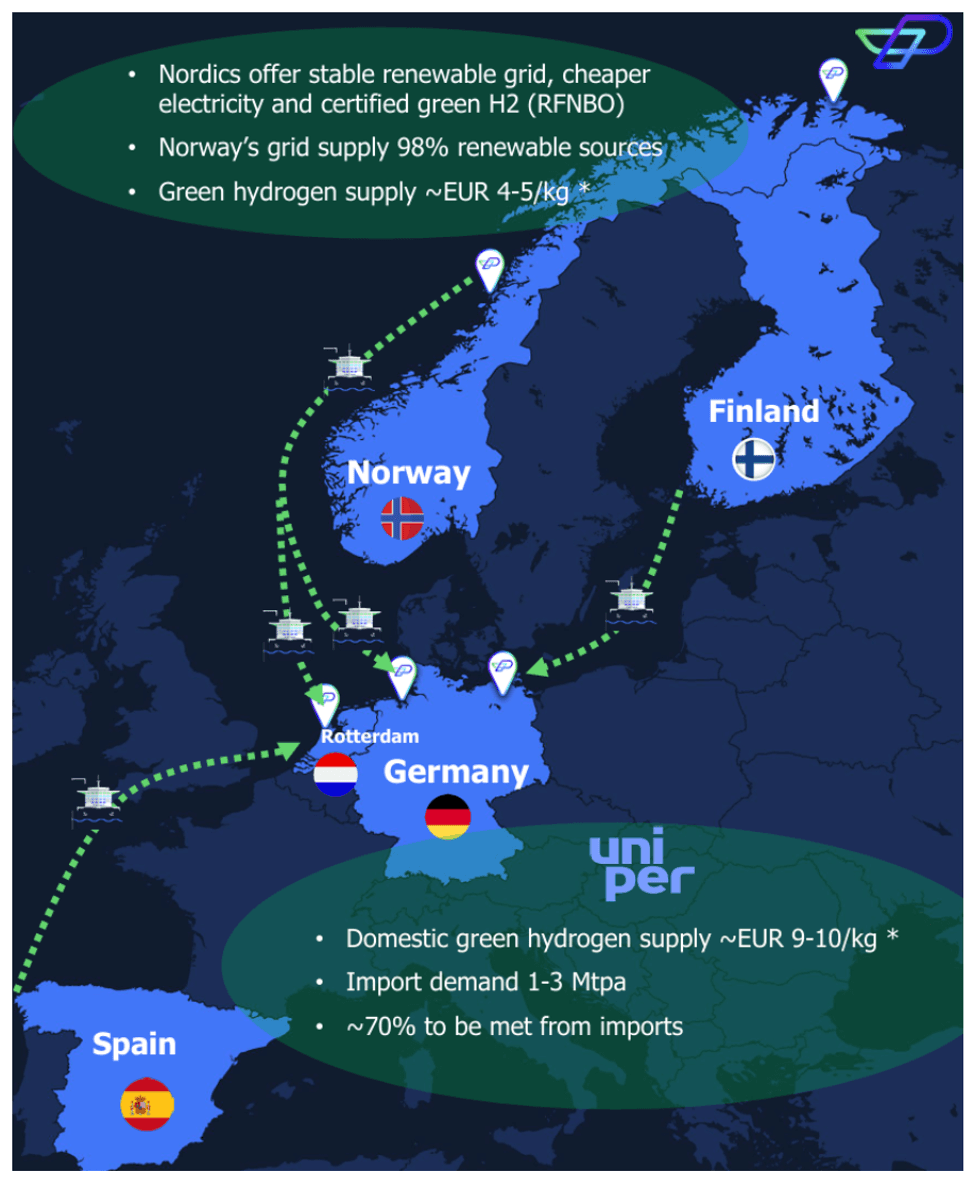

Provaris is advancing several green hydrogen export projects from the Nordics to continental Europe:

- Norway: Two hydrogen export projects under MoUs with German utilities (Uniper and a second unnamed utility).

- Germany: Import infrastructure collaboration with utilities; aligned with TSO build-out and industrial decarbonization targets.

- Spain: Ongoing discussions with developers and offtake partners for hydrogen export hubs.

- Finland: Working with local partners to identify export-capable hydrogen production sites.

- The Netherlands: Joint pre-feasibility with Global Energy Storage (GES) for 40,000 tpa hydrogen import terminal in Rotterdam.

These projects underpin a cumulative pipeline of over 150 ktpa and demonstrate Provaris’ ability to meet Europe’s growing hydrogen demand.

*Disclaimer: This profile is sponsored by Provaris Energy ( ASX:PV1 ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Provaris Energy in order to help investors learn more about the company. Provaris Energy is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Provaris Energy and seek advice from a qualified investment advisor.