September 19, 2023

Drilling along 2km magnetic feature intersects substantial disseminated sulphide zone, including 7.5m of net-textured and semi-massive sulphides 500m south of the current MRE.

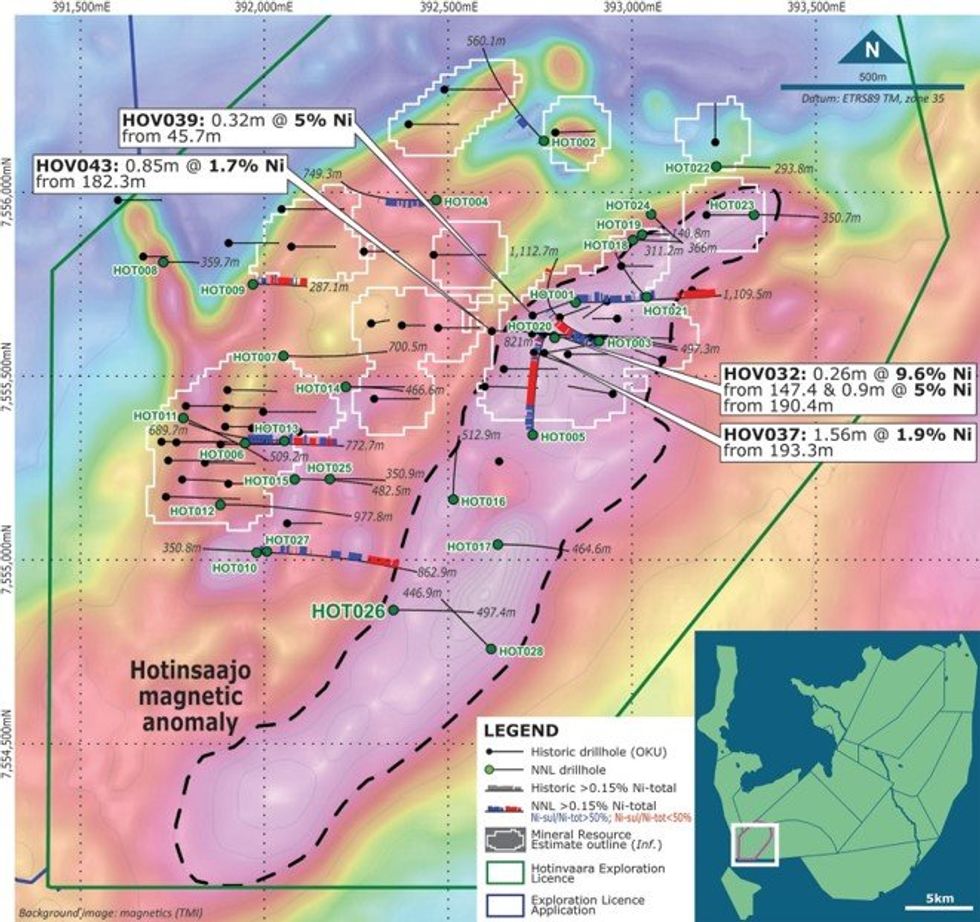

Nordic Nickel Limited’s (“Nordic Nickel” or “the Company”) (ASX: NNL) is pleased to advise that recent diamond drilling at the flagship Pulju Nickel Project (the Project) in the Central Lapland Greenstone Belt (CLGB) of northern Finland has continued to significantly expand the mineralised footprint of the key Hotinvaara Prospect.

HIGHLIGHTS

- Drilling continues to demonstrate significant potential to expand the current Mineral Resource Estimate (MRE) and intersect sulphide-rich zones.

- Step-out hole HOT026, located 500m south of the MRE boundary, but along strike of the main Hotinsaajo 2km long, NE-SW striking magnetic anomaly, has intersected disseminated sulphides over a width of 123.8m from 306.5m down- hole (based on visual logging), greatly expanding the mineralised footprint and enhancing the prospectivity of this magnetic feature.

- Net-textured and patches of semi-massive sulphide mineralisation was logged1 over a downhole length of 7.5m2 from 313.2m, highlighting the potential of this area to host higher grade zones as intersected in the northern extent of the Hotinsaajo magnetic anomaly.

- Based on visual logging, four of the six holes completed since drilling resumed after the summer break have intersected at least minor occurrences of net- textured and semi-massive sulphides, and each of the six holes has intersected the pervasive disseminated sulphides that continue to be intersected in all drilling at the Hotinvaara Prospect.

- Diamond drilling continues at Hotinvaara with 15,482m completed across 28 holes. Additional holes planned for September will test the central and southern parts of the Hotinsaajo magnetic feature adjacent to HOT026.

- Assays pending for 20 holes, with assay turnaround times now substantially reduced, resulting in significant news flow over the coming months.

- Updated MRE on track to be completed by the end of this year.

Diamond drilling resumed at Hotinvaara following the summer break in early August and has continued to intersect substantial widths of sulphides both within and outside the current Hotinvaara Mineral Resource Estimate (MRE) of 133.8Mt at 0.21% Ni and 0.01% Co.

A total of 28 holes for 15,482m have now been completed throughout the duration of the Company’s maiden drilling campaign, with assays reported so far for seven holes (Figure 1; Table 1). Up to three holes are planned to be completed by the end of September.

The drillholes completed as part of the maiden drill program have been designed to test a combination of targets, including specific electromagnetic (EM) targets, magnetic and gravity anomalies, as well as to extend the overall footprint of the MRE.

Additionally, an untested, linear and relatively contiguous north-easterly to south-westerly striking magnetic anomaly which corresponds to ultramafic packages in the north-eastern portion of this prominent geophysical feature is currently being drilled. This will enable the Company to assess the continuity of ultramafic packages in the southern extent of the Hotinvaara Exploration Licence.

Nordic is primarily targeting massive Ni-Cu sulphide mineralisation of a similar style to the nearby world-class Sakatti deposit, while also aiming to enhance its understanding of the large mineral system and the extent of disseminated nickel mineralisation, that makes up the bulk of the MRE.

Management Comment

Nordic Nickel Managing Director, Todd Ross, said: “This is a very exciting result for our team, which reinforces the enormous scale and potential of the Pulju Nickel Project. HOT026 is by far the furthest south we have drilled in the very large nickel system we are defining at Hotinvaara, sitting 500m beyond the current MRE envelope, directly along the prospective magnetic anomaly.

“To encounter a broad zone of potential disseminated sulphide mineralisation this far outside the MRE bounds shows that we are only just beginning to understand the true potential of what we have on our hands at Pulju – especially as Hotinvaara covers just 2% of the total project area.

“With assays pending for 20 holes and additional holes planned to be completed by the end of September, this should pave the way for a very strong period of news flow activity for Nordic as we work towards an updated MRE by the end of this year.”

Drilling update

Visual intersections logged throughout the current drilling program have highlighted the potential to expand the current MRE, while also enhancing Nordic’s geological knowledge in order to vector to interpreted high-grade zones*.

* In relation to the disclosure of visual mineralisation, the Company cautions that visual estimates of sulphide and oxide material abundance should never be considered a proxy or substitute for laboratory analysis. Laboratory assay results are required to determine the widths and grade of the visible mineralisation reported in preliminary geological logging. The Company will update the market when laboratory analytical results become available.

Additionally, the mineralised ultramafic packages have often been correlated to distinct ground- based gravity and/or magnetic anomalies, expanding the ultramafic footprint and also providing a robust tool to map ultramafic units throughout the Pulju Project, in litho-stratigraphically prospective areas.

Furthermore, through the use of partial leach assays, the Company has been actively developing an understanding of nickel deportment throughout the system, allowing the exploration team to vector into the more prospective nickel sulphide zones, assign geochemical markers and utilise these packages to guide targeting and drill planning.

A particularly exciting recent visual observation was logged in the basal section of step-out drill- hole HOT026. Importantly, HOT026 was designed to assess the continuity of mineralised ultramafic material intersected in the north-eastern portions of the Hotinvaara Prospect area towards the south directly along the 2km long Hotinsaajo magnetic feature (Figure 1). Geological logging of this hole has provided very encouraging indications that both the mineralisation, and importantly, the conditions required for re-mobilisation of massive sulphides, continues to the south.

Click here for the full ASX Release

This article includes content from Nordic Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NNL:AU

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

28 May 2025

Total Finland Gold Resources Increase to 961,800oz AuEq

Nordic Resources (NNL:AU) has announced Total Finland Gold Resources Increase to 961,800oz AuEqDownload the PDF here. Keep Reading...

25 May 2025

A$3.5M Institutional Placement and New Chairman Appointed

Nordic Resources (NNL:AU) has announced A$3.5M Institutional Placement and New Chairman AppointedDownload the PDF here. Keep Reading...

21 May 2025

Trading Halt

Nordic Resources (NNL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

11 May 2025

Excellent Gold Intersections Verified at Kiimala Project

Nordic Resources (NNL:AU) has announced Excellent Gold Intersections Verified at Kiimala ProjectDownload the PDF here. Keep Reading...

23 April 2025

Quarterly Activities Report & Appendix 5B

Nordic Resources (NNL:AU) has announced Quarterly Activities Report & Appendix 5BDownload the PDF here. Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00