October 27, 2025

Steadright Critical Minerals Inc. (CSE: SCM) (“Steadright” or the “Company”) is pleased to report that contractor drilling companies are being considered to confirm high historical values in the historic mine site known as the Goundafa Mine. Interest from drilling companies has been received and are currently being reviewed for Historic Polymetallic Copper-Lead-Zinc-Silver-Gold Goundafa Mine in Morocco, which identifies conceptual resources up to 6.62 million tons with grades of 2.1% Zn, 1.8% Pb and 1.5 - 2.1% Copper and up to 3.5 g/t gold in select zones.

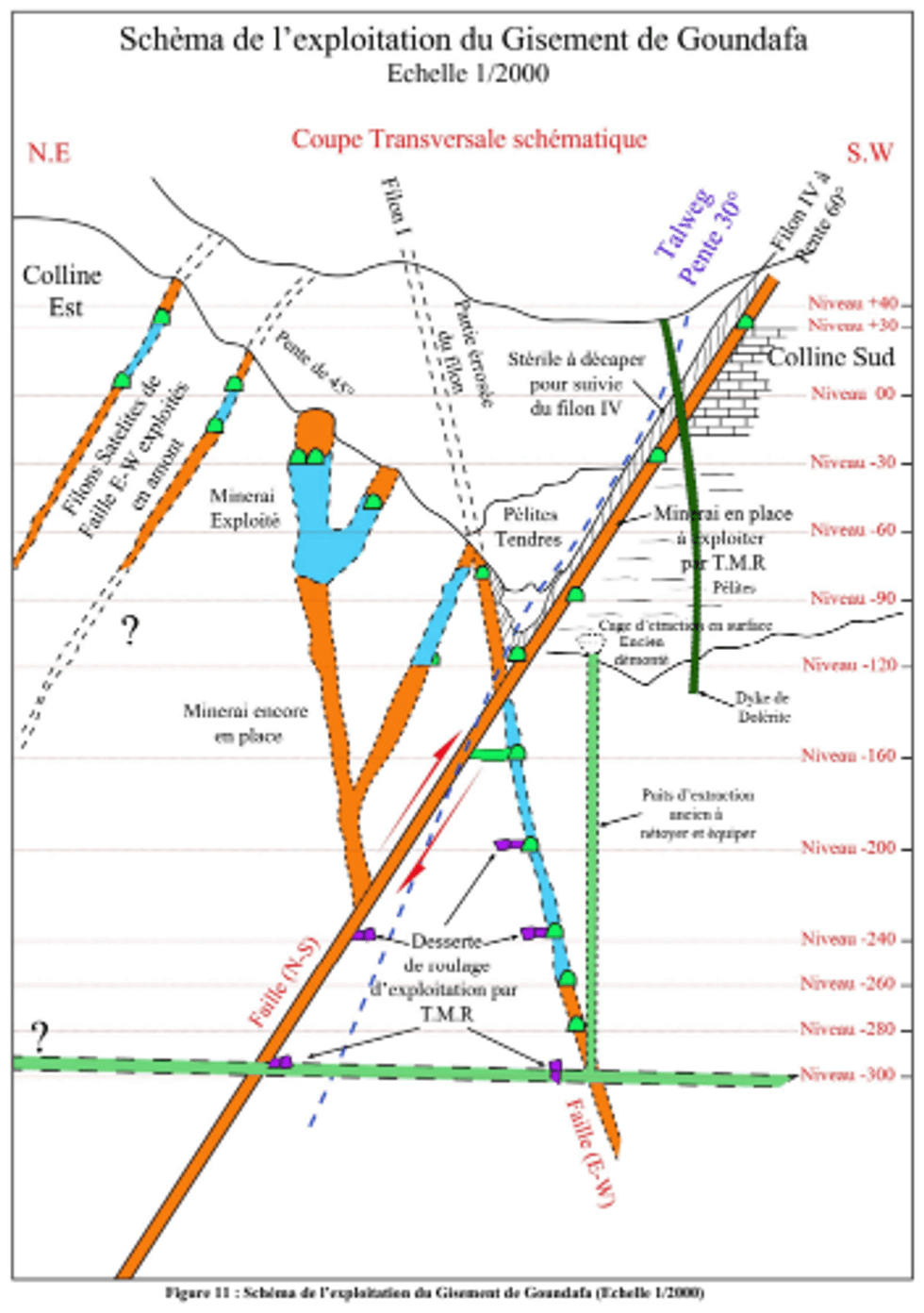

Steadright intends to explore the Goundafa Mine starting in December 2025 and early 2026, using a phased targeted drilling approach. The initial phase, consisting of surface mapping (geological, structural) and drilling, would be utilized to verify current hypotheses of potential resources in Vein 1 adjacent to the historic mining areas and extensions of these zones laterally and at depth. Vein I was mined from 1926 to 1956, historically producing a reported 320k tons of material exceeding 10% grades and 400g/t silver.

Drilling would focus on providing a near-term resource estimate within close proximity of the mine access points that could be available for early production. Based on review of historic mine plans and reports, mining was conducted using drifting methods to mine the ore and vertical openings (raises/shafts) to move the mineralized material to surface for local processing. Many of these openings are potentially available with minimal effort and cost. The goal would be to confirm historic resources estimates and to formulate a 43-101 on the project.

A second phase would include both mapping and drilling but also include geophysics to assist in delineation of Vein I, Vein IV and Vein II bis along interpreted extensions both laterally and at depth also. This phase of drilling would allow for intermediate to wide spaced drilling for resource expansion further afield on surface, and underground based on results from prior mapping and geophysics.

Note: A 2022 geological report (non-NI 43-101 compliant), “Rapport Technique et Financier sur la Concession Minière de Goundafa – Commune d’Ijoukak, Province d’El Haouz, Maroc”, authored by Omar Guillou and prepared for CMS, the concession holder, states:

- “The current estimate is limited to the 600 vertical meters through accessible workings; are within a vertical interval of approximately 600 meters, between the surface and the deepest accessible workings.”

- “The conceptual resources DO NOT include “deeper speculative extensions”, and that “ it could extend an additional 800 meters vertically, reaching depths of 1,400 meters below surface

- “The lateral extensions of Veins IV, V and Vi have been identified at surface through trenching and geological surveys. These extensions show structural continuity with the veins exploited at depth, but their potential remains to be confirmed by drilling. They are NOT INCLUDED in the main volumetric estimate of 6.62 Mt , although they represent significant additional potential.”

And furthermore:

- The report identifies conceptual resources up to 6.62 million tons with grades of 2.1% Zn, 1.8% Pb and 1.5-2.1% Copper and up to 3.5 g/t gold in select zones — particularly from underground sampling at Vein II near Gallery L

- 1.7 million tons are directly accessible through the historic multi-level works (as stated in the 1985 BRPM report).

- “Recent XRF-measured grades inside of the mine showed strong potential for significant higher metal grades in some areas, consistent with historic mining.”

The Mining of the Historic Goundafa Mine

The Goundafa Mine was in production from 1923 until 1956. Operations ceased due to political changes following Moroccan independence. This is important to note, as unlike many historic mines, operations did not cease due to economics but rather as a result of a reduction of skilled mining people at the time.

It’s also important to note that access adits and shafts into the mine have been closed for safety purposes and prevention of illegal mining. However, access to the mine can be quickly achieved through the cooperation of the current owners. Intermittent access by the owners has allowed frequent inspection of the mine infrastructure and has determined that access for future mining can be quickly achieved for exploration and future production if and when warranted.

PEA Moving Forward on the TitanBeach Heavy Mineral Sands

Steadright will be meeting the appropriate government officials again in mid-to-late November to lay down plans for both mining and environmental license applications.

Steadright was able to conduct exploration work with their Geologists and Engineers on the heavy mineral sands in September/October and will be returning in November to Southern Morocco to continue with the on-going PEA . The PEA will provide the necessary steps on how to move forward with processing options. The company’s Engineers are reviewing refining schematics for the modular components for the sand processing and the plant configurations are planned to be built in the Province of Tan-Tan, Morocco.

Steadright’s CEO, Matt Lewis: “Steadright’s North Star is the thesis that we can best serve our shareholders by acquiring assets which have clearly achievable near-term production - and then moving to the revenue stage as quickly as possible. I am very pleased with our execution so far and think we are on target to hit our goals. We strongly commend our Moroccan team and all the levels of government helping make this possible.”

Qualified Person

Mr. Robert Palkovits, P. Geo, VP Exploration for Steadright, who is a qualified person (“QP”) under the National Instrument 43-101 – Standards of Disclosure of Mineral Projects has reviewed and approved the scientific and technical information in this press release. WITH NOTICE TO THE READER THAT ALL INFORMATION REQUIRES VERIFICATION.

ABOUT STREADRIGHT CRITICAL MINERALS INC.

Steadright Critical Minerals Inc. is a mineral exploration company established in 2019. Steadright has been focused in 2025 on finding exploration projects that can be brought into production within the critical mineral space focused in Morocco. Steadright currently has mineral exploration claims known as the RAM project near Port Cartier, Quebec within the Côte-Nord Region, which is accessible by route 138. The RAM project is comprised of over 11,000 acres and is located on an Anorthositic complex that is in a highly prospective geological unit and historically been under-explored for Ni, Cu, Co and precious metals.

ON BEHALF OF THE BOARD OF DIRECTORS

For further information, please contact:

Matt Lewis

CEO & Director

Steadright Critical Minerals Inc.

Email: enquires@steadright.ca

Tel: 1-905-410-0587

Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors which may cause the actual results, level of activity, performance or achievements of Steadright to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: there is no certainty that the ongoing programs will result in significant or successful exploration and development of Steadright’s properties; uncertainty as to the actual results of exploration and development or operational activities; uncertainty as to the availability and terms of future financing on acceptable terms; uncertainty as to timely availability of permits and other governmental approvals; general business, economic, competitive, political and social uncertainties; capital market conditions and market prices for securities, junior market securities and mining exploration company securities; commodity prices; the actual results of current exploration and development or operational activities; competition; changes in project parameters as plans continue to be refined; accidents and other risks inherent in the mining industry; lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation or income tax legislation, affecting Steadright; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the " U.S. Securities Act ") or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SCM:CC

The Conversation (0)

4h

ReeXploration Commences Exploration Drilling at Eureka Uranium Target

First drill testing of a large-scale Rossing-style uranium target, along trend of Namibia's giant uranium depositsReeXploration Inc. (TSXV: REE) (FSE: K2I0) ("ReeXploration" or the "Company") is pleased to announce the launch of a fully funded uranium drilling program at the Eureka Project in... Keep Reading...

05 February

Brazil's Serra Verde Offers US Minority Stake in Expanded DFC Loan Deal

Brazilian rare earth producer Serra Verde Group has reportedly offered the United States an option to take a minority stake in the company as part of a newly expanded financing package, according to Bloomberg.The move comes as Serra Verde finalized a US$565 million loan with the US International... Keep Reading...

04 February

"No Realer Thing Than Critical Minerals" — US Proposes Price Floors, Preferential Trade Zone

The US Department of State held its first Critical Minerals Ministerial on Wednesday (February 4), drawing together officials from more than 50 countries in Washington, DC. The initiative is geared at challenging China's dominance in critical minerals supply chains, and comes just two days after... Keep Reading...

03 February

Japan Advances Rare Earths Ambitions with World's First Seabed Trial

Japan announced that it has successfully retrieved mineral-rich seabed sediment from nearly 6,000 meters below the ocean's surface near the remote island of Minamitorishima.Officials say the technical milestone could help reduce the country’s dependence on China.The work was carried out by... Keep Reading...

03 February

Trump Unveils Plan for US$12 Billion Critical Minerals Stockpile

US President Donald Trump is preparing to launch a US$12 billion strategic stockpile of critical minerals aimed at accelerating the administration’s efforts to reduce US dependence on China for key raw materials.Called Project Vault, the initiative will combine up to US$10 billion in long-term... Keep Reading...

28 January

Rare Earths 2040 Outlook: Australia’s Place in the Ex-China Market

Adamas Intelligence has published a report on the global mine-to-magnet supply chain, outlining historical production, consumption and prices of rare earth oxides.The company called this its most comprehensive annual report to date, specifically looking into the split between the China and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00