(TheNewswire)

August 20, 2025, TORONTO, ON TheNewswire - Star Royalties Ltd. (" Star Royalties ", or the " Company ") (TSXV: STRR,OTC:STRFF, OTCQX: STRFF) today reported its financial results for the quarter ended June 30, 2025. All amounts are in U.S. dollars, unless otherwise indicated.

Q2 2025 Financial and Corporate Highlights

-

Quarterly revenues of $96,594 represented a decrease from the prior-year period due to less materials being sold at the Keysbrook Mine ( Keysbrook "). Keysbrook's performance this quarter was directionally in line with the operator's budget, however, the Company anticipates sales volumes to increase in the second half of this year.

-

Management's previously announced cost-savings initiatives resulted in a 34% reduction in total expenses compared to the prior-year period.

-

Minera Alamos Inc. ( Minera Alamos ") (TSXV: MAI, OTCQX: MAIFF) announced the acquisition of a producing gold mine in Nevada, resulting in a de-risked and funded pathway to accelerate the Copperstone Gold Project ( Copperstone ") into production in late 2026.

-

Gold Mountain Mining Corp. ( Gold Mountain ") (TSX: GMTN, OTCQB: GMTNF, FRA: 5XFA) suspended regular operations at the Elk Gold Project ( Elk Gold ") to prioritize updating and optimizing to its resource model. In late July, Gold Mountain consented to an appointment of a receiver following the receipt of demand letters from its creditors.

-

Despite Elk Gold-related uncertainty, the Company's outlook for its mining royalty portfolio has improved considerably driven by Copperstone's de-risking developments and the sustained increase in the gold price to above $3,300/oz.

Summary of Annual Financial Results

| Quarter ended | Quarter ended | ||||

| June 30, 2025 | June 30, 2024 | ||||

| Revenue | $ 96,594 | $ 266,306 | |||

| Net (loss) income | (825,791) | (567,350) | |||

| Basic and diluted (loss) earnings per share | (0.01) | (0.01) | |||

| Cash flow from operating activities | (419,052) | (253,271) | |||

| Cash flow from investing activities | 170,274 | - | |||

| Cash flow from financing activities | - | - | |||

For complete details, please refer to the Condensed Interim Consolidated Financial Statements and associated Management Discussion and Analysis for the three months ended June 30, 2025, available on SEDAR+ at sedarplus.c a or on the Company's website at starroyalties.com .

Alex Pernin, Chief Executive Officer of Star Royalties, commented: "As we approach our upcoming Annual General Meeting on August 29, we are encouraged by Copperstone's recent de-risking events. Minera Alamos' acquisition of a producing mine in Nevada will allow it to fund the construction and development of Copperstone from internally generated cash flows, reinforcing Copperstone's top priority in Minera Alamos' development pipeline. Despite the uncertainty of Gold Mountain's recent announcements, we will be closely following Elk Gold's developments and look forward to receiving updates regarding the potential for new ownership that could ultimately realize the asset's true value. At Keysbrook, the second quarter's operating results contained considerable amounts of materials that were produced but not yet sold. We expect these materials to be reflected in subsequent royalty payments."

"From a financial strength standpoint, we find ourselves in a sustained gold price environment of over $3,300/oz, with our balance sheet's current assets being largely unchanged since the beginning of the year at approximately $3.2 million. Our ongoing cost-saving initiatives, alongside our investment holding of approximately 8 million Minera Alamos shares, leave us well positioned until we begin to receive meaningful gold stream revenues from Copperstone's production in late 2026."

Significant Portfolio Updates

Mining Royalty Portfolio Updates

Keysbrook

Second quarter 2025 royalty income from Keysbrook was $96,594, a decrease from $266,306 in the prior-year period due to less materials being sold than produced in the most recent quarter. Royalty income from Keysbrook was $249,428 during the first six months of 2025 and the Company anticipates higher volumes of materials to be sold in the second half of the year. As previously reported, Keysbrook's operator is actively undergoing approval processes to extend Keysbrook's Life-of-Mine (" LOM "). These LOM extensions are currently being reviewed by various Australian federal, state and shire authorities. The Company estimates these efforts would result in Keysbrook having a LOM extension to 2029, with a potential further LOM extension into the 2030's subject to additional landowner access approvals.

Copperstone

On May 1, 2025, Minera Alamos announced the appointment of Kevin Small, P.Eng., as EVP Operations as part of its plan to rapidly advance engineering for its Copperstone restart. Mr. Small is a mining engineer with 35 years in the industry who has extensive experience with the development and operation of underground mining projects, and has already been actively involved in the engineering work underway for Copperstone.

On June 4, 2025, Minera Alamos provided an update on its development plans for Copperstone. Minera Alamos continued to advance its planned restart of mining operations at Copperstone for 2026, marked by the submission of an amended Mine Plan of Operations in compliance with federal regulations. The update stated that final approval is anticipated by year-end 2025, allowing for a "fast-track" restart alongside permitted site development activities and the relocation of process plant equipment to reduce capital costs. Engineering efforts have been accelerated, with a comprehensive technical study being prepared to highlight development progress, assess increased processing capacity, and support resource expansion through ongoing metallurgical evaluations.

Subsequent to the reporting period, on August 7, 2025, Minera Alamos announced the acquisition of several mining assets from Equinox Gold Corp. (TSX: EQX, NYSE: EQX) for a total consideration of $115 million. The assets include the producing Pan Gold Mine (" Pan "), Gold Rock Project and Illipah Project, all located in Nevada, USA. In connection with the acquisition, Minera Alamos also announced a bought deal private placement financing for gross proceeds of approximately C$135 million, including a fully-subscribed overallotment portion.

Minera Alamos expects that the closing of the acquisition, anticipated during the fourth quarter of 2025, will establish it as a growing precious metals producer with immediate production and cash flow from its Pan and Santana Gold Mine assets. It further disclosed that the funding for the construction of Copperstone, previously contemplated as being externally financed, will now be sourced from a combination of Pan's operating cash flow and a potential gold pre-pay arrangement linked to a portion of Pan's production in 2026 and 2027.

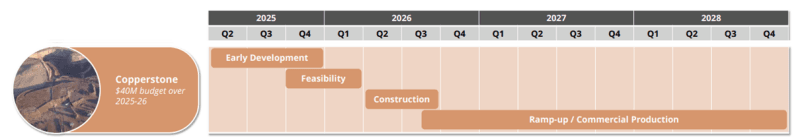

Furthermore, Minera Alamos outlined an updated construction and development timeline for Copperstone, shown below in Figure 1. Copperstone remains the first-in-line development asset in the Minera Alamos project pipeline and Mineral Alamos plans to publish a Feasibility Study on Copperstone in the first quarter of 2026.

Figure 1: Copperstone development timeline and milestones

Source: www.mineraalamos.com

Minera Alamos also identified significant potential to expand the currently defined indicated and inferred resources at Copperstone. The priorities of its upcoming exploration program are:

-

Conduct definition drilling on the projection of the lower mineral zone toward the surface, below the sand cover;

-

Test the potential for down-deep extension of the two main mineral zones through exploration drill holes;

-

Mapping, geochemistry, and geophysics to identify other mineralized centers below gravels and basalts.

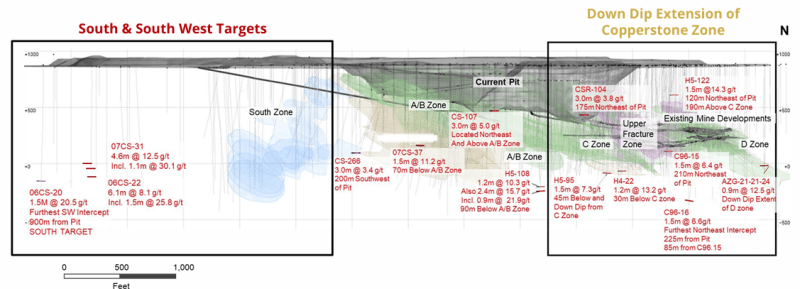

At the South-West Zone, the exploration program will target a historic cluster of high-grade intercepts for accretion of an additional resource, while at the Copperstone Zone, the program will target the downdip extension to confirm if mineralization extends at depth. A long-section of both zones is shown below in Figure 2.

Figure 2: Long-section of exploration zones at Copperstone

Source: www.mineraalamos.com

Elk Gold

On May 12, 2025, Gold Mountain provided an operational update on Elk Gold, which explained that low production results for the preceding several quarters were attributable to substantially reduced operational activities. Gold Mountain's internal review of its Elk Gold Technical Report included a complete relogging of all core data and Gold Mountain anticipated that relogging will be completed in late 2025, with production operations to be reduced substantially until a new mine plan, NI 43-101 compliant mineral resource estimate, and technical report are issued.

On June 18, 2025, Gold Mountain announced a temporary suspension of all regular operations at Elk Gold to prioritize resource development and updates to its resource models. Gold Mountain outlined a cessation period to the British Columbia Ministry of Mines of up to 12 months, during which Elk Gold will be on care and maintenance. Key personnel will continue to manage compliance and oversee the site throughout the shutdown. Following an internal review, Gold Mountain had identified that 65% of all core was available to be relogged, with completion targeted by October 2025. These efforts are expected to support an updated Preliminary Economic Assessment and NI 43-101 Technical Report.

Subsequent to the reporting period, on July 31, 2025, Gold Mountain announced that its Board of Directors had consented to the appointment of a receiver following the receipt of demand letters from its creditor. The Company is currently evaluating the potential impact of this development on the Company's royalty receivables and the valuation of its Elk Gold royalty interest.

Green Star Joint Venture (45.9% interest)

Green Star continues to operate as a joint venture between Star Royalties, Agnico Eagle Mines Limited (" Agnico Eagle ") (NYSE, TSX: AEM), Cenovus Energy Inc. (" Cenovus ") (NYSE, TSX: CVE), and certain members of Star Royalties' and Green Star's management teams and Boards of Directors (collectively, " Management "). The Company retains ownership of approximately 45.9% of Green Star's common shares, Agnico Eagle and Cenovus each own approximately 25.9% of the common shares and the remaining 2.3% is owned by Management.

Green Star Strategy

On April 28, 2025, the Company provided an update on its Green Star strategy, which can be found on the Company's website at News Release (Apr 28, 2025) - Star Royalties . During the past year Green Star observed a shift in carbon market dynamics, with corporate buyers increasingly entering into long-term offtake agreements directly with project developers, thus reducing spot market activity. This presents a significant opportunity for Green Star due to its direct relationships with developers, by enabling it to make strategic investments that are already underpinned by contracted revenue. Furthermore, Green Star is also focused on allocating capital to new investment opportunities in clean technologies.

NativState Improved Forest Management Carbon Offset Portfolio

Green Star owns several gross revenue royalties on a carbon offset-issuing portfolio of Improved Forest Management (" IFM ") projects in the southeastern United States, developed by NativState LLC (" NativState "). NativState is an Arkansas-based forest carbon project developer that aggregates small-to-medium forest landowners into IFM projects under the American Carbon Registry (" ACR "). These royalties are expected to deliver voluntary carbon offsets to Green Star over a 20-year period, with the first approximately 120,000 carbon offsets received from the NativState investment in 2024.

During the second quarter of 2025, Green Star continued to engage with multiple voluntary carbon market intermediaries to monetize already-issued avoidance and removal offsets from Project ACR 783. As of the end of the second quarter, all removal offsets in Green Star's inventory had been sold, along with a small portion of the avoidance offsets. Green Star is currently in advanced discussions with NativState for the sale of the remaining 113,690 units of avoidance offsets and expects to be able to provide an update on the status of the offset sale in the coming weeks.

At the end of July, NativState announced a strategic agreement with TotalEnergies SE (" TotalEnergies ") (NYSE:TTE), whereby TotalEnergies will acquire the carbon credits generated by 13 of NativState's IFM projects in the southeastern United States. The agreement represents a large-scale forest conservation initiative that spans 247,000 acres across four U.S. states, as well as a significant counterparty endorsement of NativState's growing track record of empowering forest landowners to embrace sustainable forestry practices while generating high-integrity, high-demand, certified carbon credits. This investment is a part of TotalEnergies plan to invest US$100 million per year to build a portfolio of projects capable of generating at least 5 million metric tons of CO 2 e of carbon credits per year by 2030.

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

| Alex Pernin, P.Geo. | Dmitry Kushnir, CFA |

| Chief Executive Officer and Director | VP, Investor Relations and Strategy |

| +1 647 494 5001 | +1 647 494 5088 |

About Star Royalties Ltd.

Star Royalties Ltd. is a precious metals and carbon credit royalty and streaming company. The Company's objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders. The Company offers investors exposure to precious metals and carbon credit prices, as well as cleantech and other decarbonization projects through its pure-green joint venture, Green Star Royalties Ltd.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding the Royalties transaction, future market conditions for metals, minerals and carbon offset credits, future capital raising opportunities and commitments, timing with respect to the carbon offset issuances under the NativState projects, demand and growth of the MOBISMART products, timing of the updated ACR protocols with respect to IFM projects. and the future business growth and cash flow of the Company and Green Star. Forward-looking statements are statements that address or discuss activities, events or developments that the Company or Green Star expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties and Green Star to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved.

A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, carbon pricing and carbon tax legislation and regulations, risks inherent to the development of the ESG-related investments and the creation, marketability and sale of carbon offset credits by the parties, the potential value of mandatory and voluntary carbon markets and carbon offset credits, including carbon offsets, the carbon credits to be provided by NativState, risks related to the IFM projects, changes in legislation and policies including affects related to the ACR, risks inherent to royalty companies, title and permitting matters, operation and development risks relating to the parties which develop, market and sell the carbon offset credits from which Green Star will receive royalty payments, changes in crop yields and resulting financial margins regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, economic and geopolitical uncertainty related to tariffs dilution, risk inherent to any capital financing transactions, risks inherent to a possible Green Star go-public transaction, the nature of the governance rights between Star Royalties, Cenovus Energy Inc. and Agnico Eagle Mines Ltd. in the operation and management of Green Star and competition, the ability to raise any additional funds into Green Star. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

Timothy Strong, MIMMM QMR, a Qualified Person under NI 43-101, has reviewed the technical information in this release, which is based on work completed by Minera Alamos on the Copperstone Project. The Company holds a gold stream interest on the Copperstone Project and has relied on this information under Section 9.2 of Form 43-101F1.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2025 TheNewswire - All rights reserved.