Highlights:

- Revenue for the second quarter of 2025 was $23.0 million and $50.9 million for the six months ended June 30, 2025 – an increase of $8.9 million or 21% from 2024-H1.

- Net income was $1.6 million in the second quarter and $4.8 million for the six months ended June 30, 2025 - compared to a loss of $0.6 million in 2024-H1.

- EBITDA (1) for the quarter was $9.1 million and $21.5 million for the six months ended June 30, 2025 – an increase of $7.9 million or 59% compared to 2024-H1.

- EBITDA (1) per share was $0.10 in the second quarter and $0.23 for the six months ended June 30, 2025 – an increase of $0.08 per share or 53% compared to 2024-H1.

- Soma sold 5,200 AuEq ounces in the second quarter and 12,043 ounces in the six months ended June 30, 2025 , compared to 14,233 ounces in 2024-H1.

- The average realized cash margin per gold ounce sold (1) was US$1,598 in the second quarter and US$1,628 for the six months ended June 30, 2025 – an increase of $669 or 70% compared to 2024-H1.

- The Company made payments of $3.5 million against its long-term debt in the six months ended June 30, 2025 and converted another $10.0 million of the loan to equity subsequent to the period end.

Soma Gold Corp. (TSXV: SOMA,OTC:SMAGF) (WKN: A2P4DU) (OTC: SMAGF) (the " Company " or " Soma ") is pleased to announce that the Company's Financial Statements and MD&A for the three and six months ended June 30, 2025 and 2024 have been filed on SEDAR+ and are also available on the Company's website.

Operations Review – Six Months Ended June 30, 2025

- Soma produced 5,377 AuEq ounces in 2025-Q2 and 12,020 ounces in the six months ended June 30, 2025 (2024-H1 – 13,925 AuEq ounces).

- Income from mining operations was $5.7 million in 2025-Q2 and $15.5 million for the six months ended June 30, 2025 (2024-H1 - $10.0 million ).

- Net income was $1.6 million in 2025-Q2 and $4.8 million for the six months ended June 30, 2025 (2024-H1 was a loss of $0.6 million )

- Net income per share was $0.02 in 2025-Q2 and $0.05 for the six months ended June 30, 2025 (2024-H1 was a loss of $0.01 per share).

- Cordero Operations reported attributable cash costs per ounce of gold sold (1) of US$1,671 in Q2-2025 and US$1,438 for the six months ended June 30, 2025 (2024-H1 - US$1,263 ).

Geoff Hampson , Soma's President and CEO, states, "The first half of 2025 delivered strong results, achieving 91.6% of plan. The second quarter's production numbers were below target due to a combination of lower average-grade ore and mechanical issues at the el Bagre Mill. These issues have now been resolved and are not expected to reoccur, as construction of the new 20X20 leach tank has been completed. The resulting excess capacity will allow the maintenance team to take individual leach tanks offline for preventative maintenance without reducing throughput. This additional capacity is expected to ultimately increase gold production as metallurgical analysis indicates recovery could improve to approximately 90% due to the increased residence time provided by the new tank." Mr. Hampson adds, "The el Limon Mill is now operational and will be ramping up production over the coming months. Ball Mill #1 is currently processing ore and is expected to reach 100 TPD within the next two months. The bull gear for Ball Mill #2 will be installed in October and, once completed, production throughput at the mill will increase to 200 TPD by year-end. Once the el Limon Mill is fully operational and processing higher-grade ore from the recently announced Escondida acquisition, total annual production from both mills is expected to increase to between 9,000 and 12,000 ounces per year."

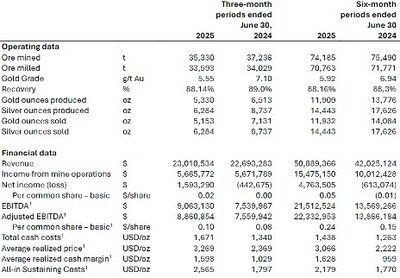

Financial and Operating Highlights for the Three and Six Months Ended June 30, 2025 and 2024

Soma also announces that it has granted an aggregate of 100,000 stock options pursuant to its equity incentive plan to an employee of the Company. The stock options are exercisable at a price of $1 .43 per share and expire three years from the date of grant. In accordance with TSX Venture Exchange policies, these options granted will vest in stages over 12 months, with no more than 25% vesting in any three-month period.

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA,OTC:SMAGF) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia , with a combined milling capacity of 675 TPD. (Permitted for 1,400 TPD). The el Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

"Geoff Hampson"

Chief Executive Officer and President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

| (1) | This news release refers to certain financial measures, such as EBITDA, Adjusted EBITDA, average realized price per ounce of gold sold, and total cash costs per ounce of gold sold which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. These measures may differ from those made by other companies and accordingly may not be directly comparable to such measures as reported by other companies. These measures have been derived from the Company's financial statements because the Company believes that they are of benefit in understanding the Company's results. For a complete explanation of these measures, please refer to Non-IFRS Financial Performance Measures disclosure included in the Company's MD&A for the three and six months ended June 30, 2025 and 2024 which can be accessed at www.sedar.com . |

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management's estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.

SOURCE Soma Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/28/c1048.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/28/c1048.html