October 22, 2023

Heavy Rare Earths Limited (“HRE” or “the Company”) is pleased to report a sizeable Exploration Target at its 100 per cent-owned Cowalinya rare earth project in the Norseman- Esperance region of Western Australia.

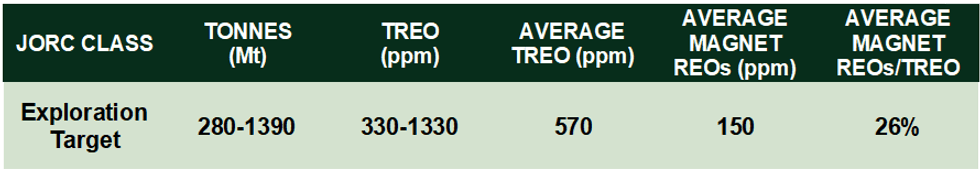

- Conservative Exploration Target estimated for Cowalinya: 280 to 1390 million tonnes @ 330 to 1330 ppm TREO

- Exploration Target excludes recently announced Mineral Resources of 159 million tonnes @ 870 ppm TREO

- Collectively, Mineral Resources and Exploration Target occupy 45% of HRE’s total land position at Cowalinya

- Scale of rare earths inventory at Cowalinya indicates potential to underpin a long-life development

- Opportunities for straightforward conversion of Exploration Target to additional Mineral Resources via modest programs of shallow drilling

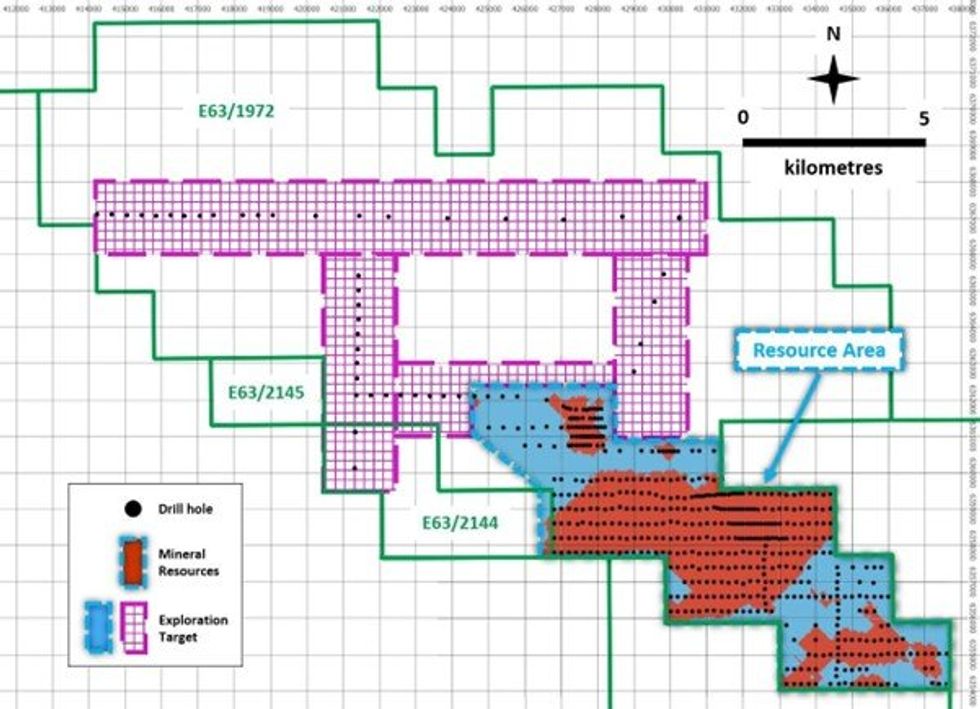

The Exploration Target is summarised in Table 1 below and shown in Figure 1. Most of the Exploration Target lies immediately to the north-west of the project’s Inferred Mineral Resources which are estimated to be 159 million tonnes @ 870 ppm TREO using a 400 ppm TREO-CeO2 grade cut-off (refer to ASX announcement 3 October 2023). The potential quantity and grade of the Exploration Target is conceptual in nature, and there has been insufficient exploration completed by HRE on parts of its Cowalinya tenement package to estimate Mineral Resources. Furthermore, it is uncertain if further exploration will result in defining additional Mineral Resources at Cowalinya.

HRE Executive Director, Richard Brescianini, said, “Taken together with our recently announced 159 million tonnes of Inferred Resources, today’s result of up to 1.4 billion tonnes in an Exploration Target at Cowalinya delivers a clear statement on the potential of our land holdings to host sufficient rare earths to underpin a long-life development. Of course, further drilling is necessary to convert any part of the Exploration Target to Mineral Resources, but its execution must not run ahead of one of our key downstream metallurgical work programs, the production and customer qualification of a mixed rare earth carbonate product, scheduled for completion by the end of this year.”

Figure 1 shows the area of HRE’s existing Inferred Resources (red) in the densely-drilled south-east corner of E63/1972. New Exploration Target areas are 1) in the immediately adjacent less densely drilled areas (blue) within the Resource Area (dashed blue border) and 2) further to the north-west within the four pink hatched areas containing single lines of ‘far field’ aircore drill holes (black dots). REE-mineralised intercepts in all holes along the lines clearly demonstrate continuity of the mineralised layers found to the south-east in the Resource Area.

Click here for the full ASX Release

This article includes content from Heavy Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRE:AU

The Conversation (0)

06 September 2022

Heavy Rare Earths

Rare Earth Elements in Western Australia and the Northern Territory

Rare Earth Elements in Western Australia and the Northern Territory Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00