May 10, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to announce a JORC (2012) Mineral Resource Estimate (MRE) for the Supreme Gold Project in Reefton, New Zealand.

Highlights

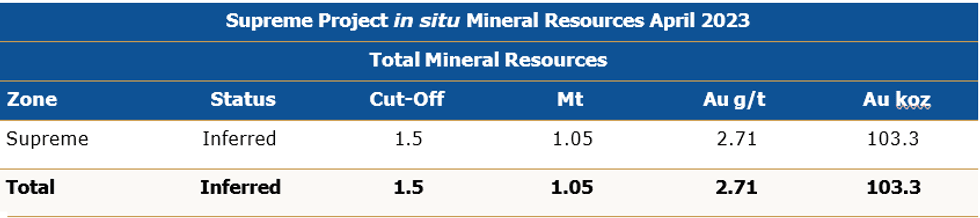

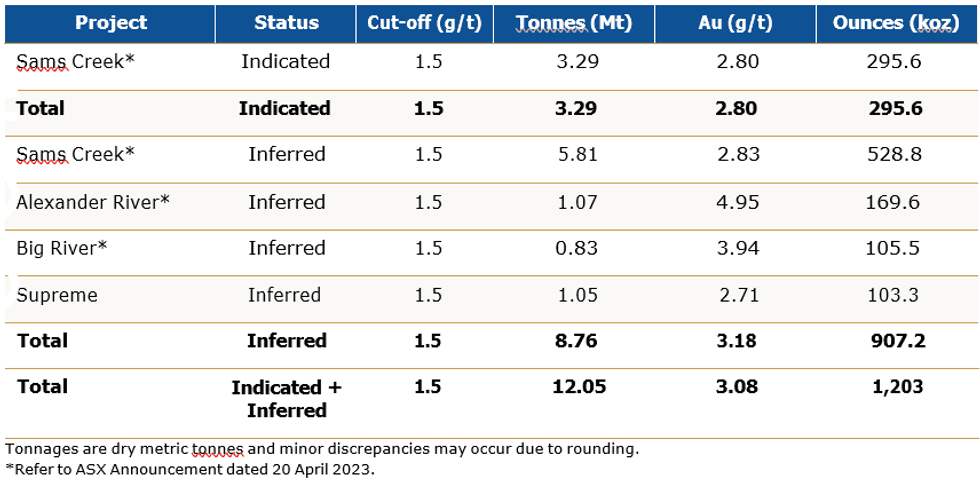

- Mineral Resource Estimate (MRE) at Siren’s Supreme prospect of 103koz at 2.7g/t Au at a 1.5g/t cut-off.

- Supreme lies within the recently acquired Cumberland tenement along the main structural corridor that hosts all the larger mines in the Reefton Goldfield, and links through Globe Progress to Siren’s very promising Auld Creek Au-Sb prospect.

- Mineralisation is a similar style to the historical Globe-Progress mine that produced 1.1Moz @ 6g/t Au.

- The MRE based on historical data down to only 200m depth with significant intersections including:

- 14.0m @ 3.5g/t Au;

- 14.0m @ 3.2g/t Au;

- 29.0m @ 2.6g/t Au;

- 10.0m at 3.5g/t Au, and

- 9.5m @ 4.1g/t Au.

- The Supreme deposit remains open at depth, with significant potential for increased gold resources from additional exploration drilling.

- Siren’s Global Mineral Resource now stands at 1.2Moz at 3.1g/t Au (100% basis).

Background

The Cumberland permit comprises the northern and southern areas of the previous Globe Progress mining permit, as shown in Figure 1. The Cumberland permit joins Siren’s Big River, Golden Point and Reefton South permits and abuts the Federation Mining permit, where they are currently developing the Snowy River underground mine to extract around 700koz of gold below the historic Blackwater mine.

Gold bearing reefs in the Cumberland project area were first discovered at Supreme in 1872 and mining proceeded from then until 1923 when Sir Francis Drake mine closed. Relative to the rest of the Reefton Goldfield, the historical Cumberland mines were undercapitalised, with a total production of 44,626 oz of gold from 97,993 tonnes of ore at an average grade of 14.2 g/t Au.

The mineralisation in the Cumberland permit extends for 3kms south of the Globe Progress mine and is open to the west (under cover) and south (Figure 2). This area lies along the main structural corridor that hosts all the larger mines in the Reefton Goldfield and links to Siren’s very promising Auld Creek Au-Sb prospect. The gold and antimony mineralisation extends for 10kms from Auld Creek south into the Globe Progress Mine, including the Globe Deeps area below the open pit, through Souvenir, Supreme and Big River. A total of 77 drillholes for a total of 10,933m have been completed.

Supreme’s gold mineralisation is a similar style to the Globe-Progress deposit, with high-grade quartz breccia, pug and disseminated sulphides. The Supreme prospect contains three sub-parallel mineralised shoots that have been traced down dip for approximately 200m and are open at depth (Figure 3). The shoots plunge moderately to the SE, with an average thickness of approximately 12m. Significant intersections include 10m @ 3.5g/t Au and 14m @ 3.5g/t Au (RDD013), 14m @ 3.2g/t Au (RDD017), 29m @ 2.6g/t Au (RDD018), 9.5m @ 2.3g/t Au (RDD021) and 9.5m @ 4.1g/t Au (RDD025).

The Gallant prospect contains a shear hosted, 1m-5m thick quartz vein, that extends for over 300m and dips steeply east and west. Diamond hole GLA001 was drilled to the west and appears to have drilled obliquely down a steeply west dipping reef. The hole intersected a 27m mineralised zone dominated by a quartz reef with visible gold and disseminated arsenopyrite mineralisation in the hangingwall. The true thickness of the mineralised zone is unclear but estimated to be around 5m. The average down- hole grade of the mineralised zone was 27m @ 74.9g/t Au, which includes 1m @ 1,911g/t Au. Detailed soil sampling and trenching will be utilised in Quarter 2 to try and expose the Galant Reef to determine its orientation and true thickness.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00