November 12, 2023

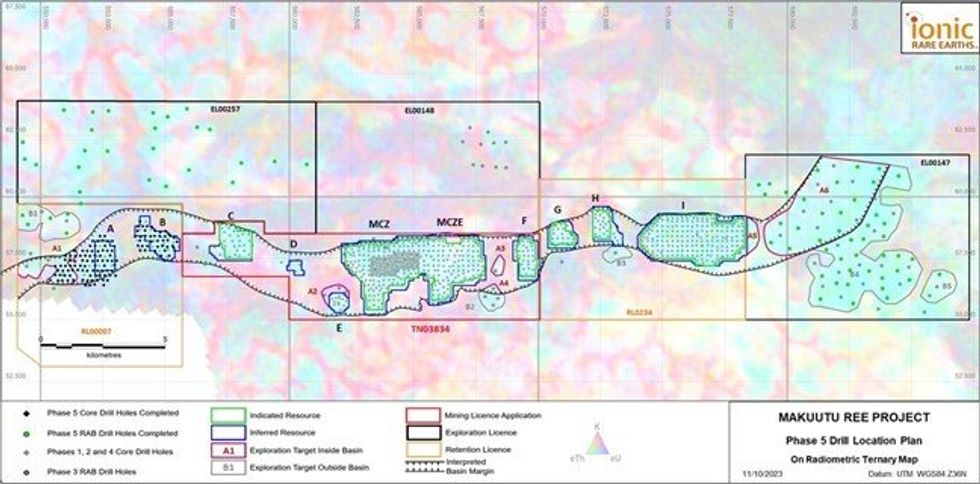

Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) is pleased to advise progress in securing land access agreements for the Mining Licence Application (MLA) for the Stage One development of the Makuutu Rare Earths Project (“Makuutu”) over Retention Licence (RL) 1693 (application TN03834), through local Ugandan operating entity Rwenzori Rare Metals Limited (“RRM”).

- Land access agreements now secured for over 92% of the full 44km2 Mining Licence Application (MLA) for the Stage One development of the Makuutu Project over Retention Licence (RL) 1693 (application TN03834);

- Ugandan Government approved Rwenzori Rare Metals’ land access process on 15th September 2023 and progress indicates completion over the next 10 days;

- Uganda’s Directorate of Geological Survey and Mines (DGSM) agreement verification processes across TN03834 to start this week on site; and

- Makuutu’s basket contains 71% magnet and heavy rare earths content, and is one of the most advanced heavy rare earth projects globally available as a source for new supply chains emerging across Europe, the US, and Asia.

The Ugandan government approved RRM’s proposed process to secure land access agreements on 15th September 2023. Land access agreements have now been secured for 92% of the MLA, comprising Bugweri District (94% completed), Bugiri District (84% completed) and Mayuge District (90% completed). Progress across all three districts is continuing rapidly and the Company expects to secure agreements covering close to 100% of the 44 km2 MLA area in the next ten days. Formal issuance of the Mining Licence can occur once land access has been verified by the DGSM (ASX: 20 October 2023). DGSM representatives will commence field-based activities in the communities to verify land access this week.

The Makuutu Heavy Rare Earths Project has the Government’s full support and is set to become Uganda’s flagship mine (refer also to IXR ASX release on the 11th of September for more detail).

The Company is not aware of any other requirements prior to the award of the Stage 1 mining licence over TN03834.

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

8h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00