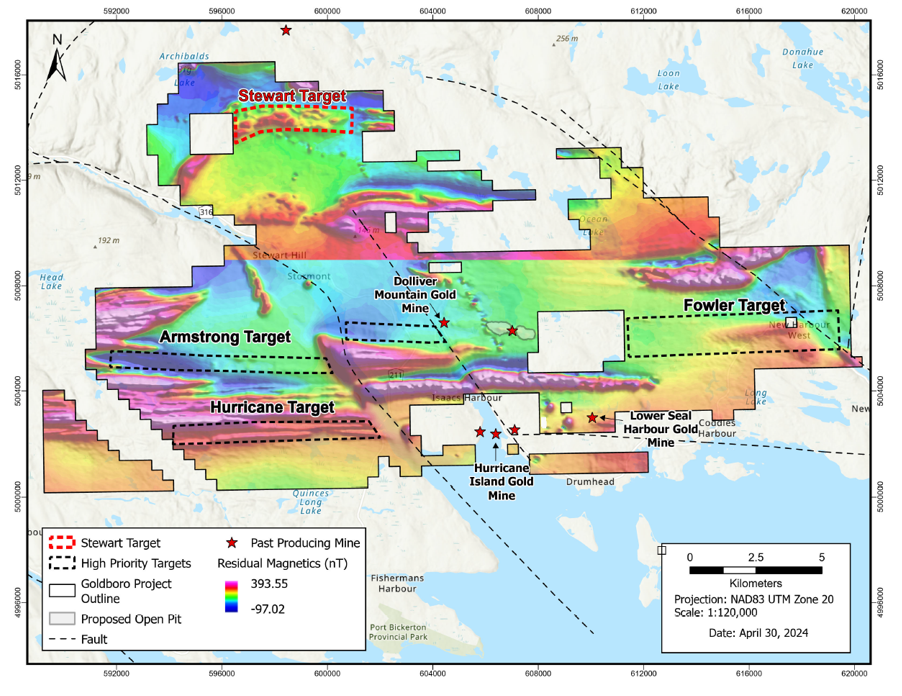

Signal Gold Inc. ("Signal Gold" or the "Company") (TSX:SGNL)(OTCQX:SGNLF) is pleased to announce that it has commenced exploration work at the Stewart target approximately 10 kilometres northwest of the Goldboro Deposit and planned mine and mill infrastructure at the Goldboro Project in Nova Scotia, Canada ("Goldboro", or the "Project") (Exhibit A). Recently staked by the Company, the area has quickly become a high priority growth target within its extensive exploration land package of approximately 27,200 hectares (~272 km2) in the historic Goldboro Gold District

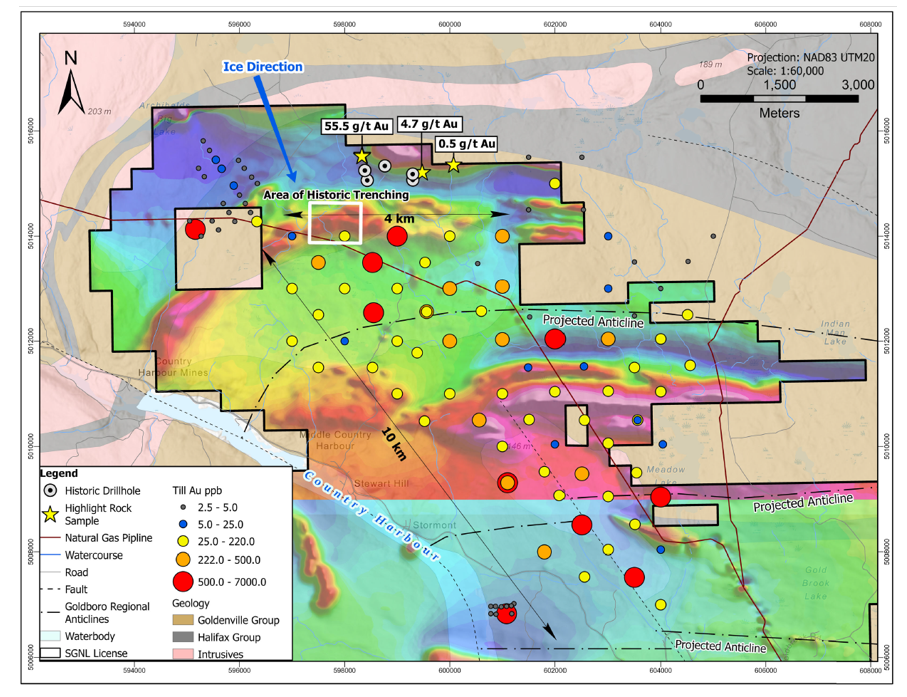

The Stewart target comprises a 10 by 4-kilometre area of combined gold, antimony, and tungsten till anomalies that is centered on two large granite intrusives that, along with adjacent sedimentary rocks, have potential to host poly-metallic skarn mineralization (Exhibit A). Information from the recently completed airborne geophysical survey has outlined a 4-kilometre-long zone of highly magnetic rocks at the terminus of the till anomaly that forms a compelling exploration target (Exhibit B). Additionally, initial prospecting has located numerous quartz-vein boulders throughout the target area, as well as historic undocumented trenches that require follow-up exploration. Historic samples taken within the target region demonstrate gold in till values ranging from 0 to 7,000 parts per billion ("ppb") gold, with 20 of these samples assaying above 220 ppb gold within the target area. Using this information, the Company is planning a program of geological mapping and prospecting, soil and till geochemistry, as well as targeted ground geophysical surveys to identify specific drill targets.

"We are excited to begin exploration at the Company's recently staked property north of the Goldboro Deposit, known as the Stewart target, which has become one of our most compelling growth targets after completing data compilation and a regional airborne geophysical survey. The strong tenor of gold anomalies over a large area and coincident antimony and tungsten anomalies from till sampling, combined with the presence of gold-bearing quartz boulders assaying up to 55.5 g/t gold, underscores the potential of the Stewart target area to host orogenic gold deposits and polymetallic skarn mineralization. With this program at the Stewart target, we look forward to identifying specific drill targets with the ultimate goal of making a new discovery in the Goldboro Gold District."

~ Kevin Bullock, President and CEO, Signal Gold Inc.

Exploration and Geological Details of Newly Acquired Licenses

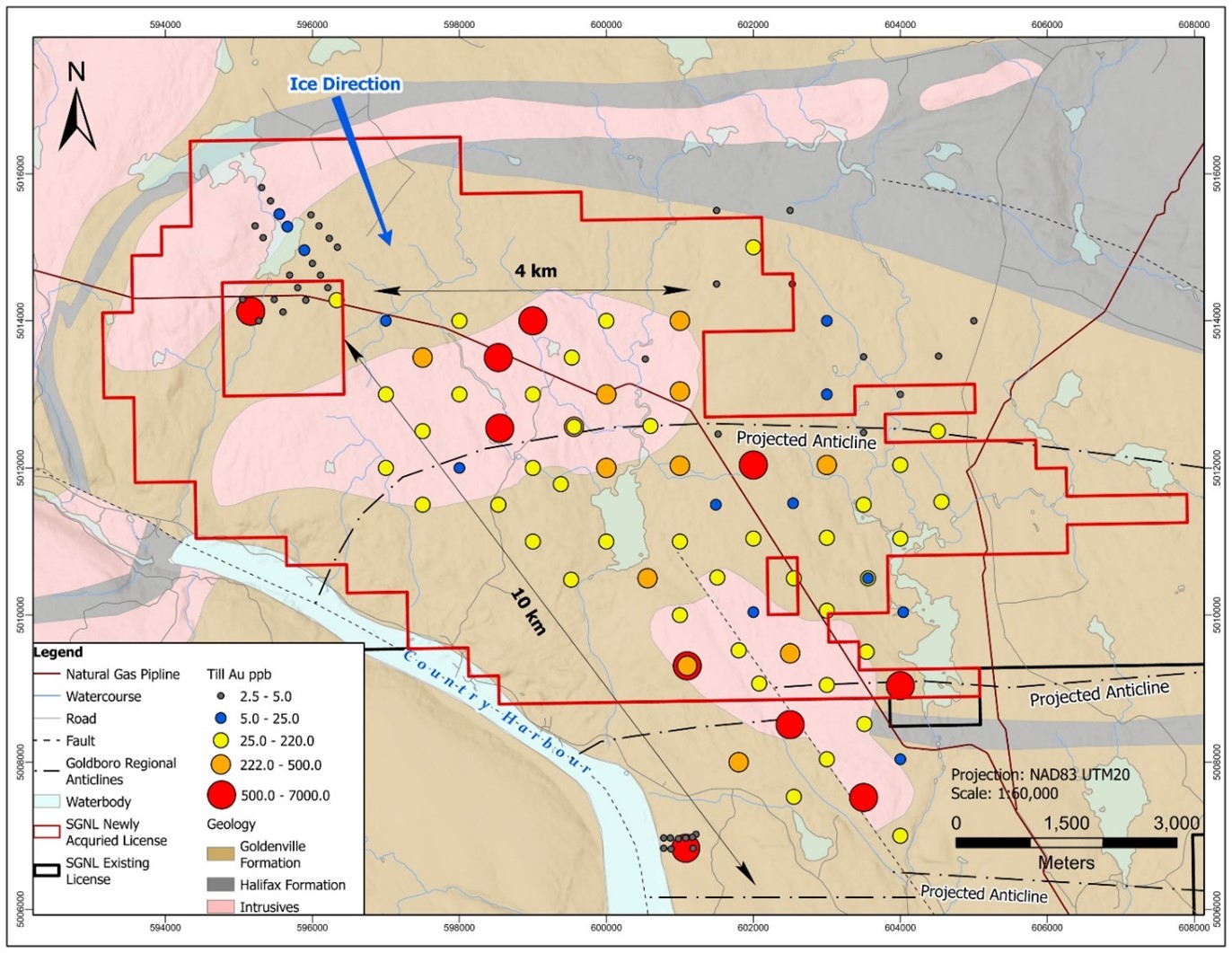

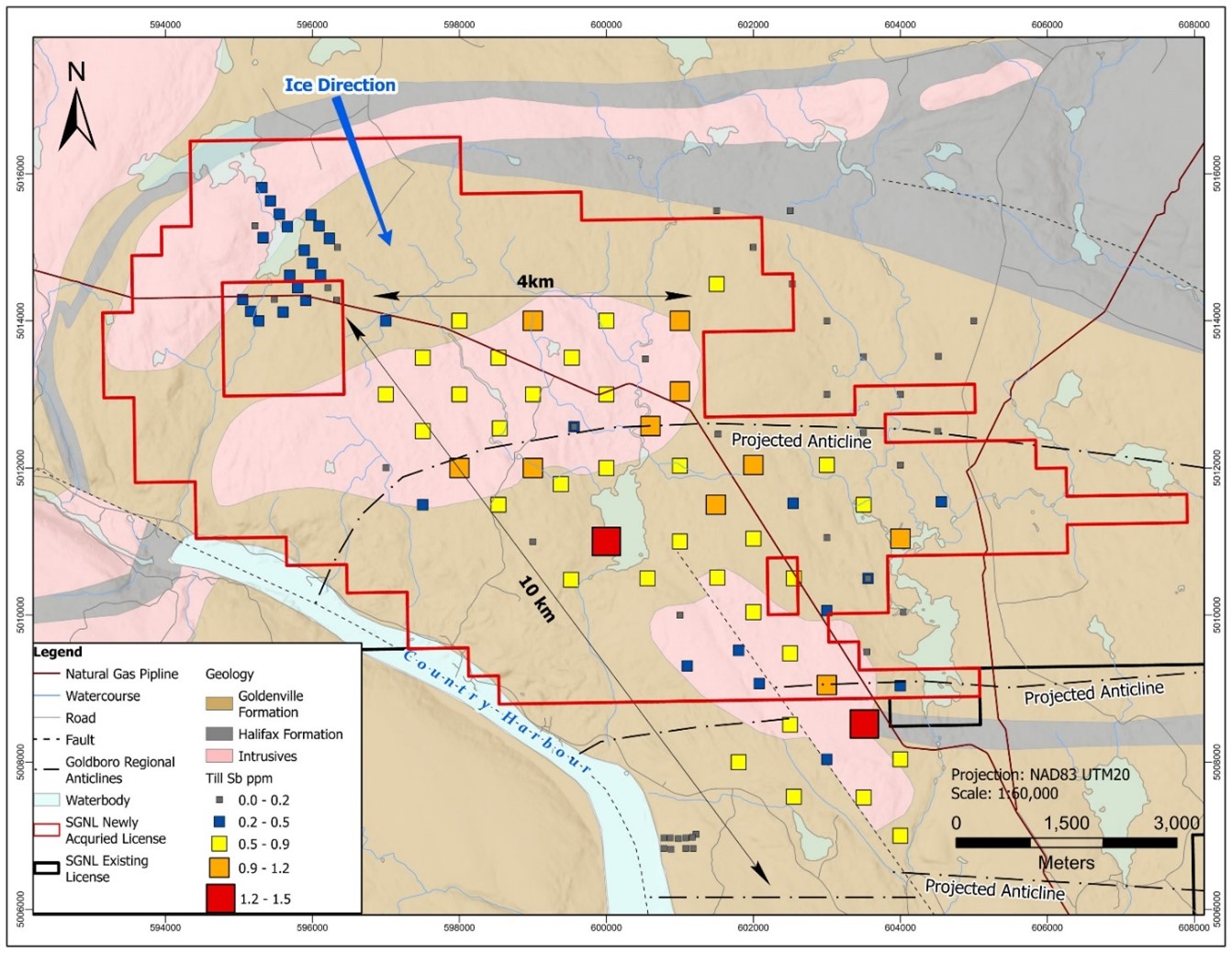

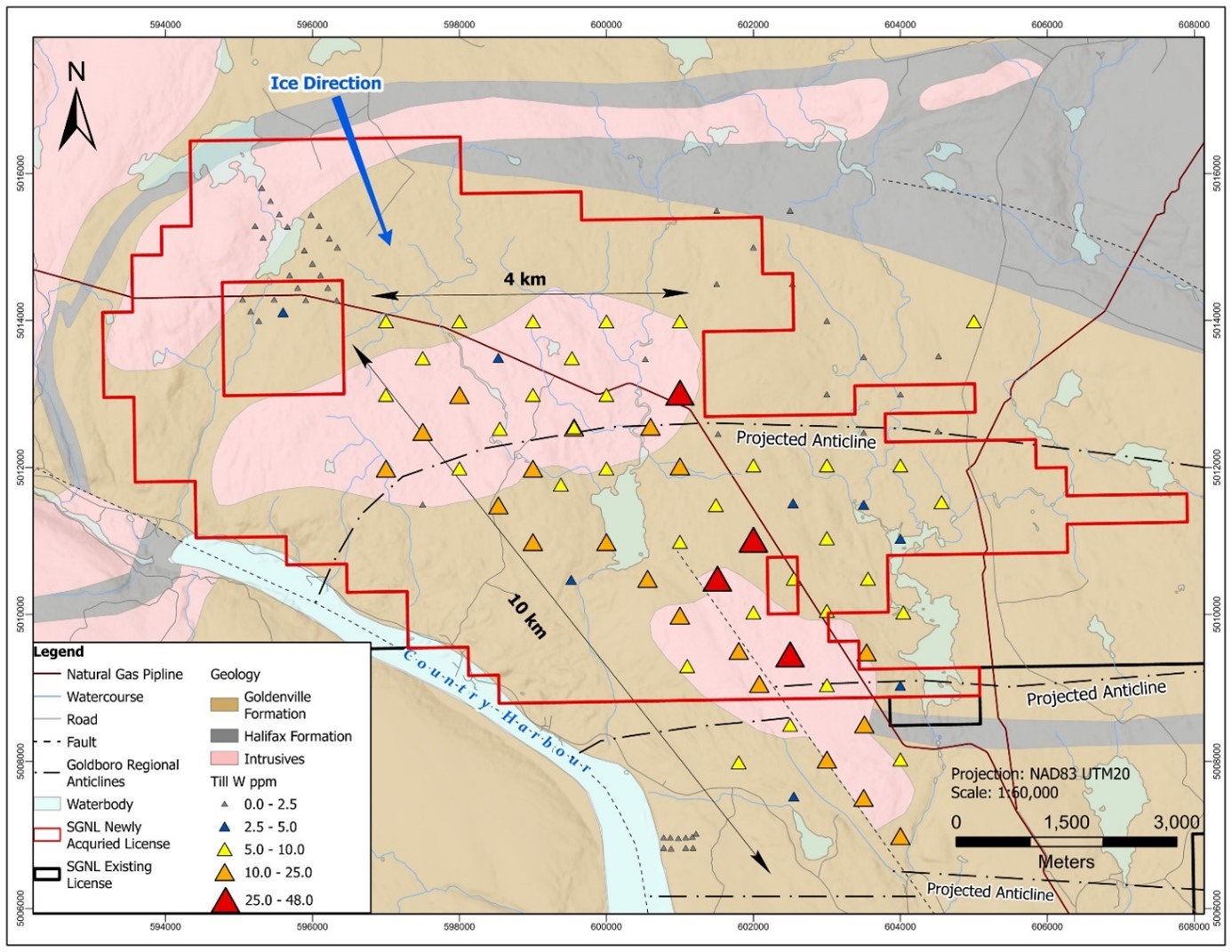

The Stewart target covers an area of historic till sampling from 1986-1988 by Seabright Resources Inc. which defined a combined gold, antimony, and tungsten till anomaly over a 10 by 4-kilometre area. Of the 497 historic samples taken within the region, gold in till values ranged from 0 to 7000 ppb gold, with 24 of these samples assaying above 220 ppb gold (95th percentile) of which 20 samples lie within the target area (Exhibits C). Tungsten values range from 0 to 48 ppm, with 26 of these samples assaying above 10 ppm tungsten (95th percentile) of which 18 samples lie within the target area (Exhibits D). Antimony values range from 0 to 3 ppm, with 23 of these samples assaying above 0.9 ppm tungsten (95th percentile) of which 11 samples lie within the Project area (Exhibits E).

The area, including the zone of anomalous historic tills, is underlain by sedimentary rocks of the Goldenville Group, the same rocks hosting the nearby Goldboro Deposit, that have been intruded by Devonian granites of the South Mountain Batholith (East Branch and Southern Plutons). Rocks have been deformed by upright folding and faulting that make it a favourable environment to host orogenic gold deposits. In additional, the presence of younger granites provides a permissible environment for polymetallic skarn mineralization (Au, Ag, Sb, W, Sn, Mo, Pb, Zn), similar to the East Kemptville (Nova Scotia), Mount Pleasant, Lake George and Sisson Brook deposits (New Brunswick).

The 10 by 4-kilometre gold, antimony, tungsten glacial till anomaly trends southeast and is sub-parallel to the main glacial transport direction. The northern extent of the anomaly coincides with the northern contact between a granite intrusion and the host Goldenville Group sedimentary rocks delineated by an east-west trending magnetic high. This forms a favourable target for follow-up exploration with a known east-west trend along strike length of approximately 4 kilometres (Exhibits C, D, E).

Exhibit A. The location of high priority exploration targets at the Goldboro Project including the Stewart Target located northwest of the Goldboro Deposit.

Exhibit B. Airborne magnetic high trend underlying the Stewart Target with adjacent gold-bearing till and rock samples.

Exhibit C. A plan map showing the 10 by 4-kilometre glacial till gold anomaly on the newly acquired claims and underlying geology. The till anomaly trends parallel to the major southeast directed glacial ice direction and its northern termination is coincident with the northern edge of a granite intrusion showing a target area of approximately 4 kilometres in length.

Exhibit D. A plan map showing the 10 by 4-kilometre glacial till antimony anomaly on the newly acquired claims and underlying geology. The till anomaly trends parallel to the major southeast directed glacial ice direction and its northern termination is coincident with the northern edge of a granite intrusion showing a target area of approximately 4 kilometres in length.

Exhibit E. A plan map showing the 10 by 4-kilometre glacial till tungsten anomaly on the newly acquired claims and underlying geology. The till anomaly trends parallel to the major southeast directed glacial ice direction and its northern termination is coincident with the northern edge of a granite intrusion showing a target area of approximately 4 kilometres in length.

Historic till samples referred to in this news release were obtained from digital data made public by the Nova Scotia Department of Natural Resources and Renewables entitled "DP ME 134, Version 2, 2006. Compilation of Seabright Resources Inc. Till and Soil Geochemical Data by the Nova Scotia Department of Natural Resources over the Meguma Terrane, Nova Scotia, 1986-1989". The Qualified Person has not completed sufficient work to verify these results.

Rock samples and drill hole data were compiled from historic assessment reports made available from the Nova Scotia Department of Natural Resources and Renewables online NovaScan Database. The Qualified Person has not completed sufficient work to verify these results.

This news release has been reviewed and approved by Paul McNeill, P.Geo., VP Exploration with Signal Gold Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

ABOUT SIGNAL GOLD

Signal Gold is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study which demonstrates an approximately 11-year open pit life of mine ("LOM") with average gold production of 100,000 ounces per annum and an average diluted grade of 2.26 grams per tonne gold. (Please see the ‘NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia' on January 11, 2022, for further details). On August 3, 2022, the Goldboro Project received its environmental assessment approval from the Nova Scotia Minister of Environment and Climate Change, a significant regulatory milestone, and the Company has now submitted all key permits including the Industrial Approval, Fisheries Act Authorization and Schedule II Amendment, and the Mining and Crown Land Leases. The Goldboro Project has significant potential for further Mineral Resource expansion, particularly towards the west along strike and at depth, and the Company has consolidated 25,600 hectares (~256 km2) of prospective exploration land in the Goldboro Gold District.

FOR ADDITIONAL INFORMATION CONTACT:

Signal Gold Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@signalgold.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Signal Gold Inc.

View the original press release on accesswire.com