Saga Metals Corp. (" TSXV: SAGA ") (" FSE: 20H" ) (" SAGA " or the " Company "), a North American exploration company focused on discovering critical minerals, is pleased to announce its plans for a maiden drill program at the Double Mer Uranium project.

Key Highlights for the maiden drill program at the Double Mer Uranium Project:

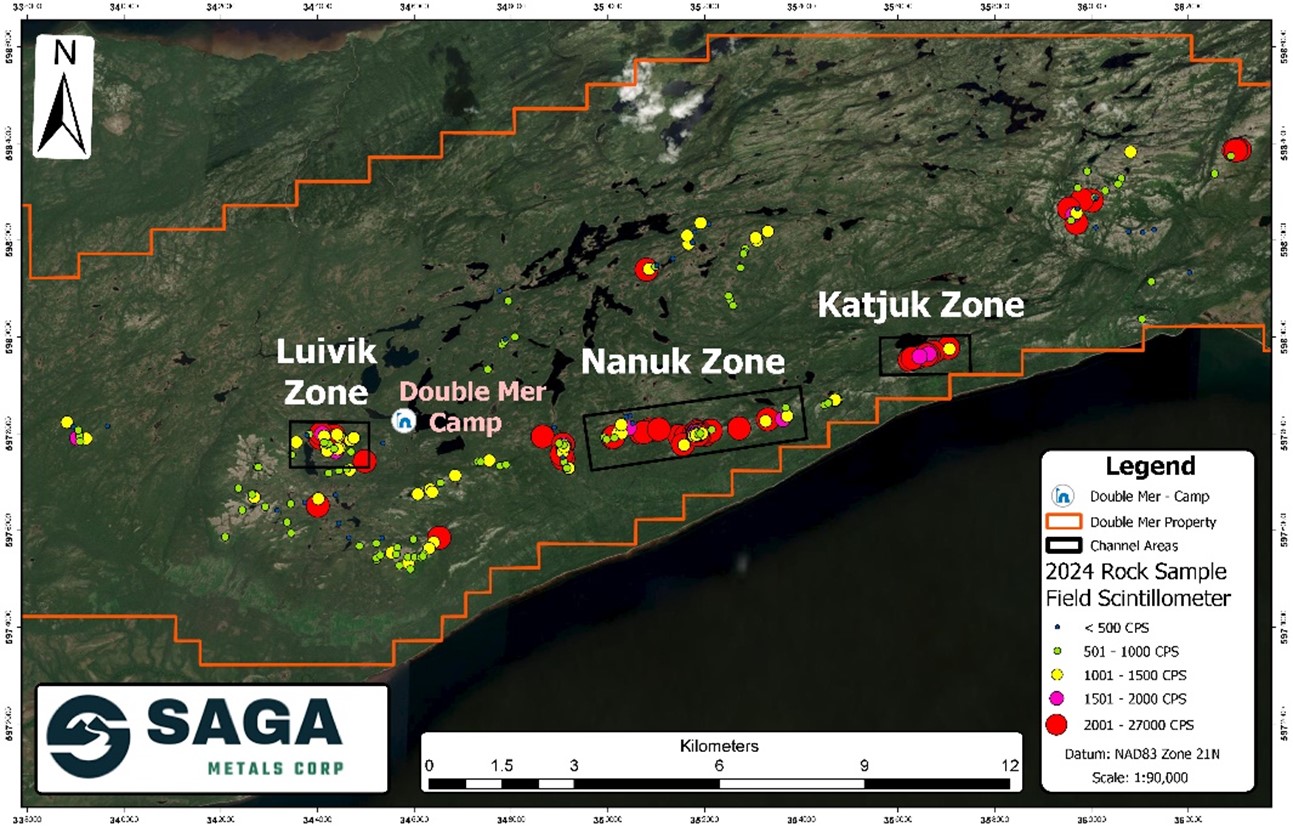

- Maiden Drill Program: SAGA's first drilling initiative at Double Mer will focus on the Luivik zone , the westernmost area of an 18 km uranium trend identified through surface sampling and radiometric surveys. This program will assess the zone's uranium potential, laying the groundwork for further exploration.

- Potential Uranium-Rich Targets: Three primary targets have been identified along the 18 km trend, with Luivik as the first focus. This zone shows promising signs of uranium-bearing pegmatites enriched with smoky quartz and iron carbonate, suggesting secondary fluid enrichment that can be conducive to uranium mineralization.

- Drilling Planned for Winter 2025: Drilling is scheduled to begin in early 2025, with an initial minimum of 1,500 meters of drilling planned. The program will systematically grid and evaluate the anomalies of the Luivik zone, providing comprehensive data on its uranium potential.

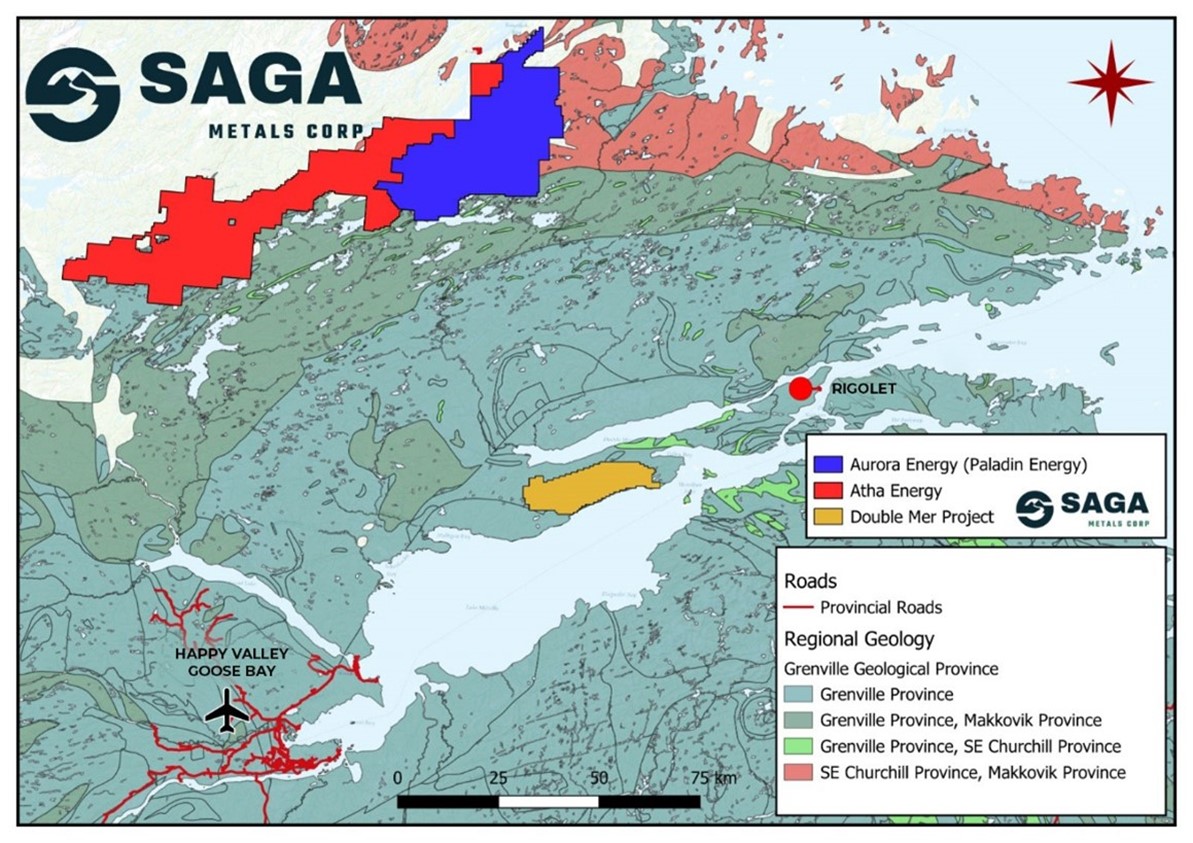

The Double Mer Uranium Project is Saga Metals' flagship project, covering 1,024 claims across 25,600 hectares in eastern-central Labrador, approximately 90 km northeast of Happy Valley-Goose Bay. Leveraging significant historical exploration data, SAGA entered its 2024 field program with a solid foundation, enabling a focused approach to expand known uranium mineralization along an 18 km trend.

Throughout the 2024 field season, SAGA's team compiled and validated key data, which has strengthened confidence in the project's potential. This work has refined the understanding of the target zones, specifically supporting the decision to initiate drilling within the promising Luivik zone .

Regional map of the Double Mer Uranium Project in Labrador, Canada

SAGA sees the Double Mer Uranium Project as a promising addition to the significant uranium projects already established in Labrador's Central Mineral Belt (CMB) , including Paladin Energy's Michelin and Atha Energy's CMB discovery. With encouraging surface samples and geophysical data, SAGA believes Double Mer could offer comparable large-tonnage potential.

To advance from discovery toward resource definition, SAGA is launching a focused 1,500 to 2,500-meter drill program in the Luivik zone , aiming to confirm uranium concentrations and take initial steps in delineating the zone's uranium resources. This strategic drilling marks a critical step in positioning Double Mer as a significant project in the Labrador uranium landscape.

"We are incredibly excited to be starting the preparations for our maiden drill program, a key milestone for the company. The Luivik zone target is incredibly compelling and is born from our efforts over this past field season," stated Michael Garagan, CGO & Director of Saga Metals Corp. "We submitted our drilling permits early autumn in anticipation and now, with the recent closing of the second tranche from our IPO prospectus, SAGA can start to put plans in motion. The Luivik zone looks to contain a late-stage fluid enrichment to the already emplaced uraniferous pegmatites and conveniently is located proximal to our camp making for a logistically practical initial drill program in the winter months. This pragmatic approach gives our team high confidence in the Luivik zone, while our strategy will continue to develop additional tier one targets throughout the Nanuk and Katjuk zones heading into the spring. Our goal at Double Mer has always been to confirm the continuation of large tonnage reserves already proven to exist in Labrador."

The Double Mer Uranium property and its three zones as defined by the 2024 field season.

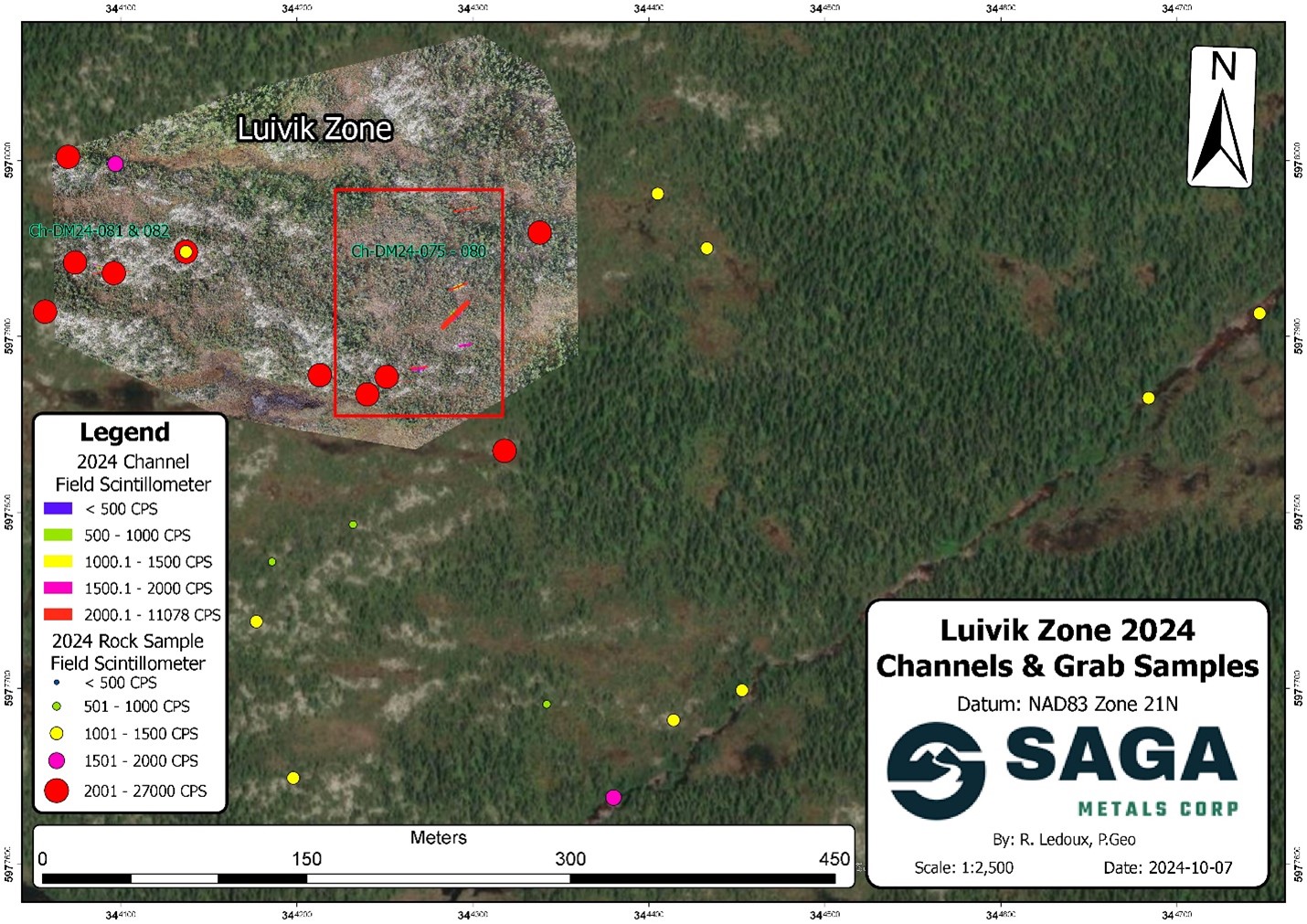

The Luivik zone has been prioritized for drilling due to its anomalous uranium (U3O8%) geochemistry, along with clear signs of alteration and fluid enrichment. This zone exhibits Iron phase IOCG (Iron Oxide Copper Gold) fluid characteristics, such as high concentrations of smoky quartz and iron carbonate staining, which are indicators of late fluid flow. This characteristic will be carefully monitored as it can have the potential to enrich uraniferous units and mark the highest-grade intercepts. Consistent CPS (counts per second) readings further highlight the Luivik zone's significant uranium potential, making it a top target for exploration.

The zone's favorable mineralogy is complemented by logistical advantages. Located just one kilometer from Double Mer's main camp, the Luivik zone offers easy access for drilling teams, with snowmobile trails in place to support active drilling operations, ensuring both practical and cost-effective program execution.

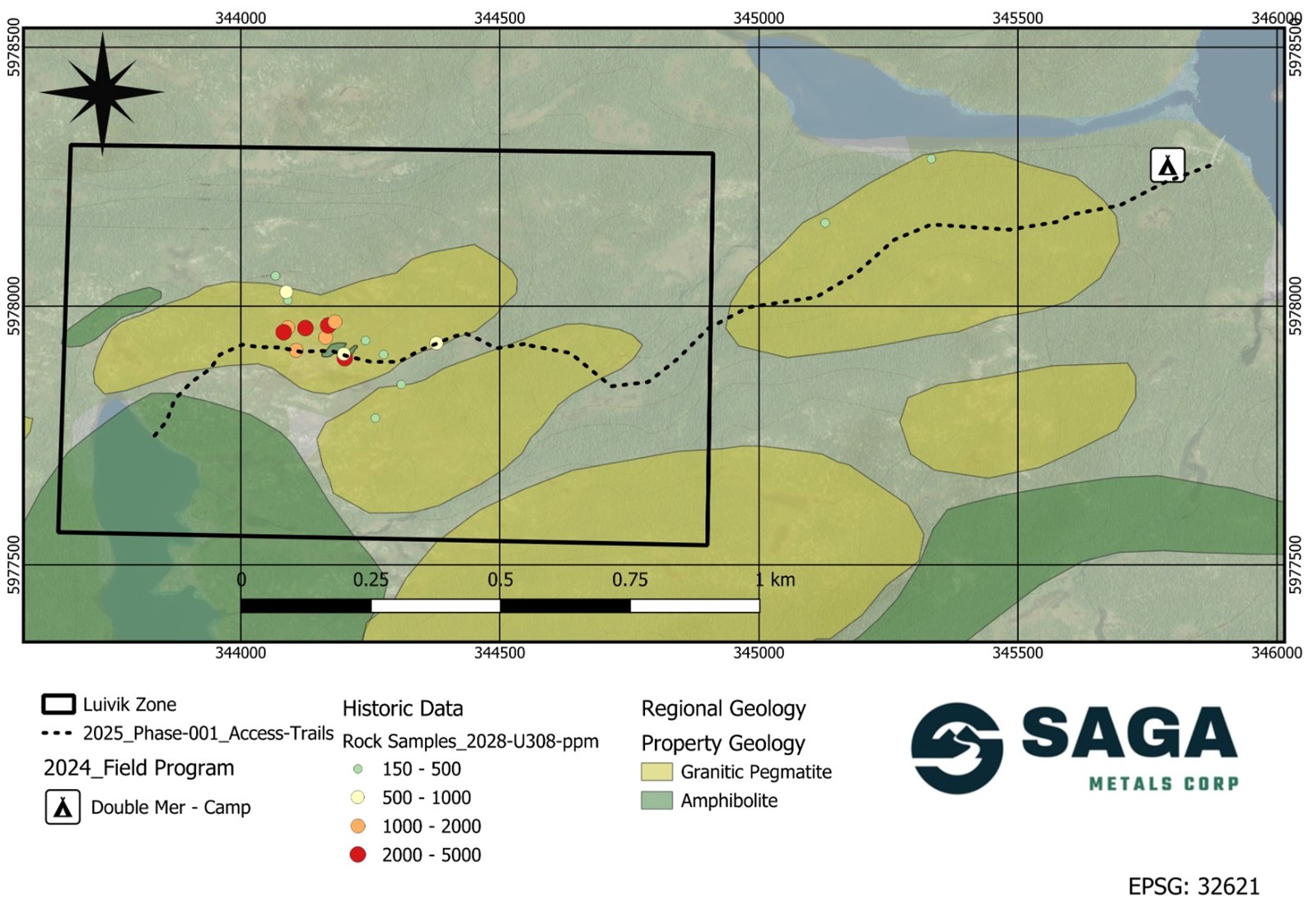

The Luivik zone in the west of the Double Mer Uranium Property. Mapped pegmatites with amphibolite mafic rocks which sit in place with much of the mineralized trends.

The Luivik zone boasts a width of 300 meters between samples with a cut-off of 150 ppm U3O8 and anomalous grades over 1,100 ppm U308 to a high of 3,692 ppm U3O8 in a single sample. The Uranium count radiometrics suggest that the anomalous pegmatites which predominantly hosts the Luivik zone may extend upwards of one km or greater.

Discovered later in the 2024 field season due to well-covered outcrops, the Luivik zone required extensive manual work to expose the bedrock beneath overburden. Unlike the Nanuk and Katjuk zones, which run along ridge lines with exposed outcrop, Luivik's more concealed setting initially limited visibility. However, scintillometer readings pinpointed highly anomalous areas throughout the zone, confirming its strong exploration potential. This discovery underscores Luivik as a promising target for SAGA's upcoming maiden drill program.

Luivik zone with detailed drone imagery inset of channel sample cross section perpendicular over zone expressing both rock and channel sample locations with CPS readings from R-125 Scintillometer

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of critical minerals that support the global transition to green energy. The company's flagship asset, the Double Mer Uranium Project, is located in Labrador, Canada, covering 25,600 hectares. This project features uranium radiometrics that highlight an 18-kilometer east-west trend, with a confirmed 14-kilometer section producing samples as high as 4,281ppm U 3 O 8 and spectrometer readings of 22,000cps.

In addition to its uranium focus, SAGA owns the Legacy Lithium Property in Quebec's Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Lithium.

SAGA also holds secondary exploration assets in Labrador, where the company is focused on the discovery of titanium, vanadium, and iron ore. With a portfolio that spans key minerals crucial to the green energy transition, SAGA is strategically positioned to play an essential role in the clean energy future.

For more information, contact:

Saga Metals Corp.

Investor Relations

Tel: +1 (778) 930-1321

Email: info@sagametals.com

www.sagametals.com

Qualified Persons

Peter Webster, P. Geo., of Mercator Geological Services Limited is a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (" NI 43-101 ") and has reviewed and approved the scientific and technical content of this news release regarding the Double Mer Property.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release. Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipates", "expects", "believes", and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to plans with respect to drilling at its mineral exploration properties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, failure to satisfy closing conditions in respect of the Offering, risks and uncertainties involved in the mineral exploration and development industry, and the risks detailed in the Prospectus and available under the Company's profile at www.sedarplus.ca, and in the continuous disclosure filings made by the Company with securities regulations from time to time. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/64070cd4-dce2-419a-9ace-6b07f02dd90f

https://www.globenewswire.com/NewsRoom/AttachmentNg/56ed0904-8931-4ea8-9d49-4785dc1978a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/e5fbb1d2-5ac9-4ead-a896-2ff8d6c68348

https://www.globenewswire.com/NewsRoom/AttachmentNg/51c4e638-216b-480e-9e31-0bebf6d28705