July 31, 2024

Neurotech International Limited (ASX: NTI) (“Neurotech” or “the Company”), a clinical-stage biopharmaceutical development company focused predominately on paediatric neurological disorders, today is pleased to report further clinical efficacy and the safety results for all 14 female paediatric patients who have now completed 20 weeks of daily oral treatment with NTI164 under the Company’s one year extension period of the Phase I/II clinical trial investigating the use of NTI164 in Rett Syndrome.

Key Points:

- Further significant clinical improvements observed in Rett Syndrome patients after 20 weeks of daily oral treatment with Neurotech’s broad-spectrum cannabinoid drug therapy NTI164

- Continued clinical improvement at 20 weeks (versus baseline) on four core Rett-domain anchors with 100% of patients (pts) improved (p<0.001) vs. 93% at wk 12 with 57% of pts “very much/much improved” (vs. 36% at wk 12)

- Gold standard RSBQ measure of key Rett symptoms showed an improvement of 24% versus baseline (p<0.001), with no further improvement from week 12 to week 20 (p=0.08)

- No diarrhoea, vomiting/nausea reported from 12 to 20 weeks and no weight loss with all 14 pts who commenced the Phase I/II clinical trial remaining on treatment

- Durable clinical response, coupled with excellent safety provides strong rationale for long term administration of NTI164 for Rett Syndrome patients where new treatments are urgently required

Dr Thomas Duthy, Executive Director of Neurotech International said “We are pleased to see these patients continue to do very well on extended treatment with NTI164, with zero safety events recorded relating to diarrhoea and nausea/vomiting from week 12 to week 20 with zero weight loss recorded. Our safety and efficacy to 20 weeks is trending favourably when compared to the current FDA approved treatment, DAYBUE™ (trofinetide). Rett Syndrome represents an attractive market opportunity for NTI164, with a potential annual market opportunity of approximately US$2.0 billion. We are currently working with our clinical advisors and Professor Ellaway (our newly appointed Chief Medical Officer) on the design of a registration directed Phase III clinical trial.”

A caregiver of a patient in the NTIRTT1 trial commented after 20 weeks of treatment with NTI164 “Increased use of eye gaze technology and increased ability to use the eye gaze accurately when making choices.”

Clinical Improvement Continues on NTI164

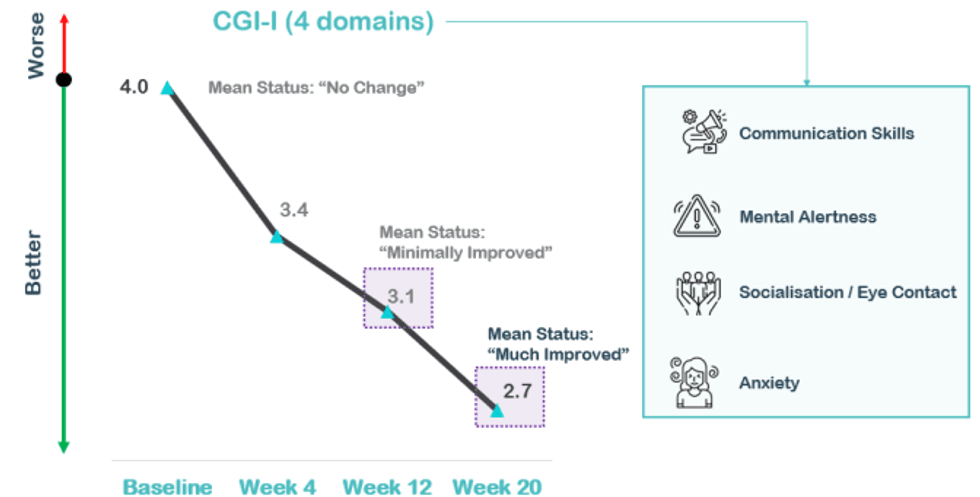

Clinical improvement was assessed by the clinician using the gold standard, Clinical Global Impression - Improvement (CGI-I), which measures how much the patient's illness has improved or worsened relative to a baseline state at the beginning of NTI164 treatment and ranges from 1 – “Very Much Improved” to 7 - “Very Much Worse”. A decrease in CGI-I score indicates improvement. Based on the CGI-I primary endpoint at 12 weeks Neurotech has four core domains of interest – communication skills, mental alertness, socialisation/eye contact and anxiety – which will likely form the basis of the CGI-I measures required for a registration-directed Phase III clinical trial of NTI164 versus placebo.

There was a statistically significant difference (improvement) in CGI-I in these four core domains at 20 weeks versus baseline; with a mean difference of -1.3 (p=<0.001), versus mean difference of -0.9 (p=0.001) at 12 weeks. Overall, the 20 week data showed an improvement of 33% versus baseline (compared to 23% improvement at 12 weeks). Between 12 to 20 weeks, there was an additional CGI-I improvement of -0.4, representing a significant, additional improvement of 13% (p=0.007), which continues the downward trajectory of clinical improvement overall.

At 20 weeks, 100% of patients showed improvement (versus 93% of patients at 12 weeks) with; 57% very much or much improved (versus 36% at week 12) as shown below.

The individual measures of CGI-I in the four core composite measures at 20 weeks all showed continued improvement from 12 weeks: Communication Skills (mean difference -0.2), Mental Alertness (mean difference -0.6), Socialisation/ Eye Contact (mean difference -0.3) and Anxiety (mean difference -0.3).

Rett Syndrome symptoms via RSBQ were stable

The Rett Syndrome Behavioural Questionnaire (RSBQ) consists of 8 domains/subscales that reflect the core features of the disease: General Mood; Breathing Problems; Hand Behaviours; Repetitive Face Movements; Body Rocking and Expressionless Face; Nighttime Behaviours; Fear/Anxiety; and Walking/Standing.

At 20 weeks, patients receiving NTI164 showed a clinically meaningful 24% improvement in total RSBQ score versus baseline (p<0.001). There was no further improvement in RSBQ scores between week 12 and week 20 with RSBQ measures relatively stable (mean difference 2.9, p=0.08). At commencement the average RSBQ total score for the patients was 44.6 compared to 31.2 at 12 weeks and 34.1 at 20 weeks.

Click here for the full ASX Release

This article includes content from Neurotech International Limited licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NTI:AU

The Conversation (0)

11 February

InMed Reports Second Quarter Fiscal 2026 Financial Results and Provides Business Update

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical drug development company focused on developing a pipeline of proprietary small-molecule drug candidates for diseases with high unmet medical needs, today reports financial results for its second quarter of... Keep Reading...

11 February

As GLP-1 Brands Go Prime Time, Regulators Flag Growing Illicit Market

At Super Bowl LX, companies behind blockbuster GLP-1 medications spent tens of millions of dollars to court a mass audience. But as brand-name makers and telehealth platforms race to normalize and expand access, regulators on both sides are warning of a parallel surge in counterfeit, compounded,... Keep Reading...

28 January

Expansion of SVN-015 into Depression Following Positive Preclinical Data

Demonstrates antidepressant-like activity benchmarked against fluoxetine (Prozac®), supporting potential in patients with inadequate SSRI response

Solvonis Therapeutics plc (LSE: SVNS), an emerging biopharmaceutical company developing novel medicines for high-burden central nervous system ("CNS") disorders, announces the expansion of its investigational compound SVN-015 into the treatment of depression, supported by preclinical data... Keep Reading...

20 January

5 Biggest Pharmaceutical ETFs for Investors in 2026

Experienced and novice investors alike may want to consider pharmaceutical exchange-traded funds (ETFs) as a way to gain exposure to the top pharma companies and the pharma market as a whole. Like all ETFs, pharmaceutical ETFs are a good option for those who want to trade a set of assets in the... Keep Reading...

17 December 2025

InMed Announces Results of 2025 Annual General and Special Meeting

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates for diseases with high unmet medical needs, today confirmed that, at its annual general and special meeting of shareholders... Keep Reading...

12 December 2025

InMed Provides Update on BayMedica Commercial Business

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates for diseases with high unmet medical needs, today released the following statement.Recently, H.R. 5371, the "Continuing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00