November 22, 2022

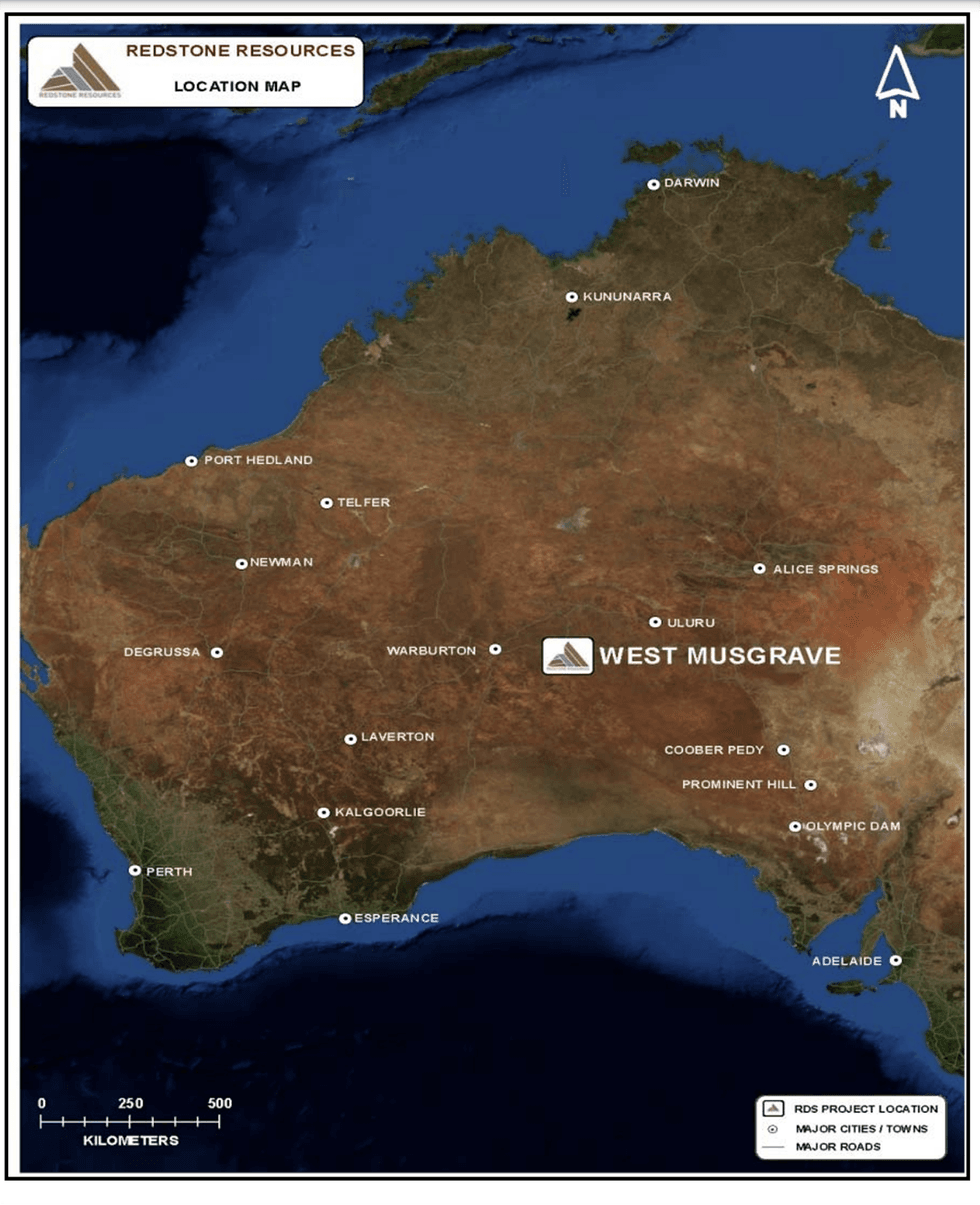

Redstone Resources (ASX:RDS) explores its 100-percent-owned highly prospective West Musgrave Project located proximal to OZ Minerals’ world-class Nebo-Babel nickel-copper-PGE sulphide deposit and Succoth copper (nickel, palladium) deposit, and Nico Resources’ Wingellina nickel-cobalt project. Redstone also has other pending tenement applications prospective for nickel and copper in the same region.

The unique Musgrave terrain has already drawn the interest of notable miners, such as OZ Minerals. OZ Minerals is progressing the development of its recently acquired Nebo-Babel nickel-copper-PGE sulphide deposit, which has been estimated to have a resource of 390 million tonnes grading 0.33 percent copper and 0.30 percent nickel, for 1.2 million tonnes of contained nickel metal and 1.3 million tonnes of contained copper metal (Mea + Ind + Inf – 2012 JORC). OZ Minerals was recently granted final regulatory approval to begin construction of the Nebo-Babel mine. Other discoveries and deposits in the area, such as the Wingellina nickel-cobalt deposit, indicate the potential of the West Musgrave region to become a significant base metal jurisdiction.

An experienced management team leads Redstone with decades of experience in the mineral resources sector, with expertise in mineral exploration, mining operations and corporate finance.

Company Highlights

- Redstone is an Australia-based mineral exploration company exploring highly prospective properties for copper and nickel in the West Musgrave region of Western Australia.

- The West Musgrave region has already drawn the interest of significant miners who have made significant discoveries, including the world-class Nebo-Babel nickel-copper-PGE sulphide deposit and the Wingellina nickel-cobalt deposit.

- Redstone’s projects are in close proximity to these existing projects, indicating the potential of the company’s tenure.

- The company owns 100 percent of the West Musgrave Project, which includes the Tollu Copper vein deposit.

- It has the right geological and structural setting for large magmatic nickel-copper sulphide deposits, VHMS deposits and other large intrusive related hydrothermal systems

- The Tollu Copper vein deposit is proof of a significant hydrothermal system on the project area.

- A strong management team leads the company with decades of experience in the resources sector.

This Redstone Resources profile is part of a paid investor education campaign.*

Click here to connect with Redstone Resources (ASX:RDS) to receive an Investor Presentation

RDS:AU

The Conversation (0)

14 May 2025

Redstone Resources

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

25 November 2025

Diamond Drilling Discovers New Tollu Copper Mineralisation

Redstone Resources (RDS:AU) has announced Diamond Drilling Discovers New Tollu Copper MineralisationDownload the PDF here. Keep Reading...

16 September 2025

Redstone Drilling at Tollu Intersects 10m at 1.37% Cu

Redstone Resources (RDS:AU) has announced Redstone Drilling at Tollu Intersects 10m at 1.37% CuDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

03 July 2025

Deep Diamond Drillhole Completed at West Musgrave Cu Project

Redstone Resources (RDS:AU) has announced Deep Diamond Drillhole Completed at West Musgrave Cu ProjectDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00