April 12, 2024

Ramp Metals (TSXV:RAMP) specializes in battery and base metals, particularly nickel and lithium with three properties, two situated in Northern Saskatchewan, Canada, and one in Nevada, United States. The company's Rottenstone SW Claims is situated along a geological structure that historically yielded the highest-grade nickel and platinum group elements (PGE) in Canada. Rottenstone exhibits similarities to the Nova-Bollinger nickel-copper mine in Western Australia, which was discovered by Sirius Resources and ultimately sold to IGO Limited for AU$1.8 billion. The Nova-Bollinger mine had an estimated resource of 13.1 million tons (Mt) grading 2 percent nickel, 0.8 percent copper, and 0.07 percent cobalt.

Ramp Metals' fully permitted drill program in 2024 consists of four drilling locations with eight holes. The current drill program is focused on testing two of these targets. The first target is positioned at the anomaly within the center of the claims and falls within the "Rottenstone Eye" structure. The second target is an anomaly located outside the eye structure, approximately 3 kilometers east-southeast from the first location. To date, Ramp has successfully drilled four holes for a total of 1,180 meters.

The striking similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s belief in the potential of the Rottenstone property. Bennett has over three decades of experience in establishing mines, and played a key role in multiple discoveries, such as the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, in addition to the Nova-Bollinger nickel-copper mine. Along with Bennett, Ramp Metals has also appointed leading geologist Scott McLean, a 35-year veteran in the mining industry, as its strategic advisor.

Company Highlights

- Ramp Metals is a battery and base metals exploration company with a focus on exploring high-grade nickel-copper-PGE in Northern Saskatchewan. Ramp intends to uncover the next major discovery essential for driving the green technology movement.

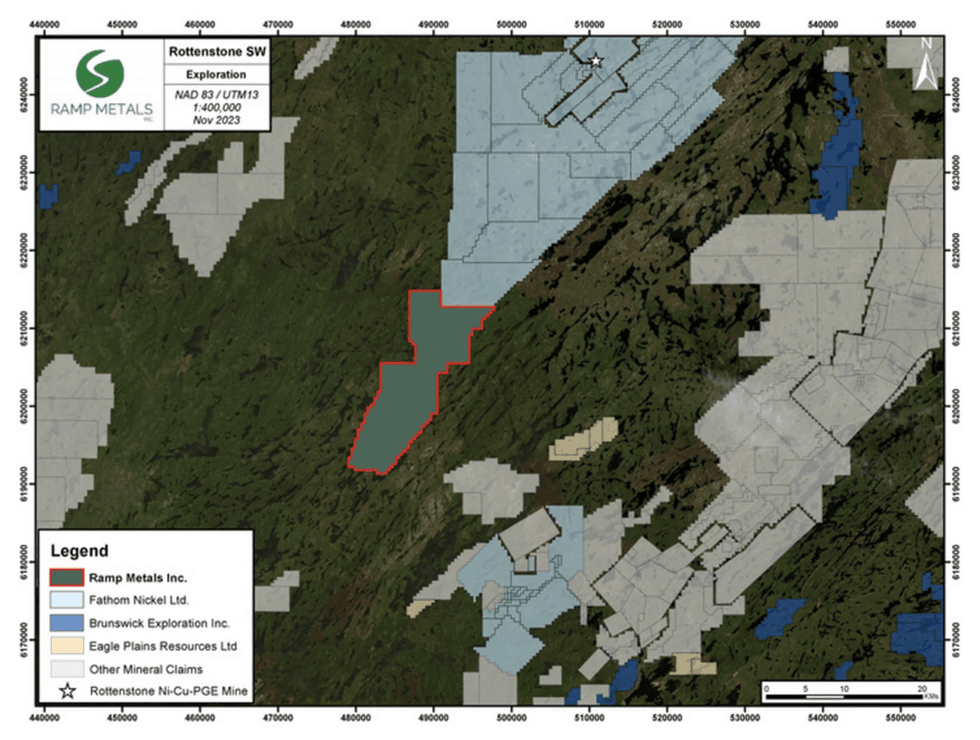

- The company has three properties covering a total area of 20,000 hectares. Of these, two are located in Northern Saskatchewan – Rottenstone SW Claims and Peter Lake Domain (PLD). The third property is located in Nye County, Nevada.

- The company’s flagship project Rottenstone SW property is situated adjacent to a northeast-southwest geological formation connected to the renowned Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-platinum group elements (PGE) and gold ore, with grades averaging 3.28 percent nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

- The geophysical program at Rottenstone highlights striking similarities with the Nova-Bollinger mine in Australia owned by Sirius Resources, which was eventually sold for AU$1.8 billion.

- Dr. Mark Bennett, founder of Sirius Resources who oversaw the development of the Nova-Bollinger mine, is a strategic advisor to Ramp Metals.

This Ramp Metals profile is part of a paid investor education campaign.*

Click here to connect with Ramp Metals (TSXV:RAMP) to receive an Investor Presentation

RAMP:CC

The Conversation (0)

03 November 2024

Ramp Metals

Battery metals exploration company focused on mining assets in Saskatchewan

Battery metals exploration company focused on mining assets in Saskatchewan Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00