Radisson Mining Resources Inc. (TSXV: RDS) (OTCQB: RMRDF) ("Radisson" or the "Company") is pleased to announce an expansion and extension of its current drill exploration program at its 100%-owned O'Brien Gold Project ("O'Brien" or the "Project") located in the Abitibi region of Québec. This program expansion follows the recent completion of Radisson's successful C$12 million financing and ongoing drilling that is demonstrating significant gold mineralization below the historic mine workings and the Project's current Mineral Resources.

Exploration priorities will be as follows:

- An additional 30,000 to 40,000 metres of drilling. Approximately 18,000 metres of the new drilling will be completed in 2025 on top of the already budgeted 22,000-metre 2025 program. The balance of the new drilling will be completed in 2026. A fourth rig will be added to the Project in June;

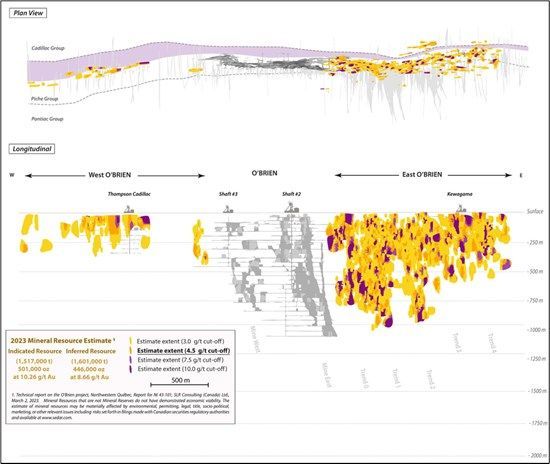

- Expansion of the successful strategy of drilling beneath the historic O'Brien mine and the East O'Brien area of new Mineral Resources, to a depth of up to 2 kilometres (Figure 1);

- Continuance of the successful strategy of pilot holes and multiple wedges to give clusters of intercepts within the favourable Piché formation with an objective of achieving a drill-hole density appropriate, at a minimum, for a future Inferred Mineral Resource;

- Stepping back and looking at broader exploration opportunities, including separate deep exploratory holes beneath the historic Thompson-Cadillac mine located west of the O'Brien mine. This will be the first drilling conducted at Thompson-Cadillac since 2020 and its first deep drilling ever.

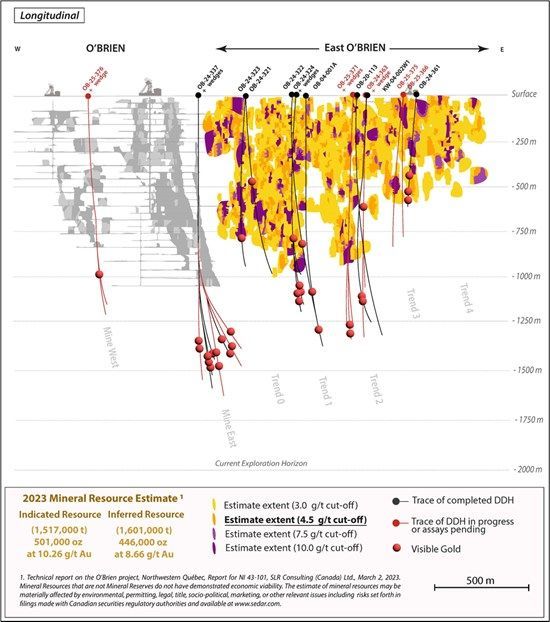

Matt Manson, President & CEO, commented: "Since late last year, we have been achieving consistent success with our "proof-of-concept" strategy of drilling below the existing Mineral Resources at the O'Brien Gold Project with large step-outs. In particular, we are excited by what is developing with our drilling below the historic O'Brien mine workings, where multiple drill-holes have intersected high-grade gold within a large zone of multiple veins with good continuity. In Figure 2 we highlight the amount of coarse visible gold currently being logged in this drilling, both within holes with published assay results and those for which assay results are still pending. At this moment, we are in the process of greatly increasing the known scope of gold mineralization at O'Brien with each new hole. We believe an exploration target of between 3 and 4 million ounces is a reasonable objective for the Project should the style of mineralization we are seeing continue to our exploration horizon of 2,000 metres depth."

Matt Manson continued: "Consequently, we are announcing today a considerably expanded effort to target these new areas of mineralization with additional deep drilling. In this news release we provide a discussion of the techniques we are using: pilot holes, wedges and directional drilling; and we provide a discussion of the context of our exploration: that O'Brien should not be considered a bespoke curiosity with impressive but localised high-grade gold, but is instead a broader system of mineralization with significant scale potential."

Figure 1: The O'Brien Gold Project, from Thompson-Cadillac/West O'Brien in the west through the O'Brien Mine to East O'Brien in long section and plan view, with current Mineral Resources.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/252866_9e86395304e23bd7_002full.jpg

Drilling Context: O'Brien Mineral Resources, Cut-offs and Future Mineral Resources

The 2023 NI 43-101 compliant Mineral Resource Estimate ("MRE") for the O'Brien Gold Project ("Technical Report on the O'Brien Project, Northwestern Québec, Canada" effective March 2, 2023) comprises 0.50 million ounces of Indicated Mineral Resources (1.52 million tonnes at 10.26 g/t Au), and 0.45 million ounces of Inferred Mineral Resources (1.60 million tonnes at 8.66 g/t Au). This estimate utilizes a 4.5 g/t Au bottom cut-off, at US$1,600 per oz Au with a C$:US$ exchange of 1.25, and 85% metallurgical recovery, amongst other assumptions. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Historic production at the O'Brien Mine between 1926 and 1957 is estimated at 0.59 million ounces from 1.2 million tonnes at 15.25 g/t Au.

Figure 2: Pilot hole and wedge clusters in the O'Brien Mine and East O'Brien Areas in the west to and Trend #3 in East O'Brien. Illustrates logged instances of visible gold in both published drill holes and completed drill holes with assays pending.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/252866_9e86395304e23bd7_003full.jpg

In Radisson's view, both the 2023 MRE and the historic mining represent "high-graded" estimates of actual gold content in their respective volumes. In the March 2023 Technical Report for the MRE, sensitivity estimates based on alternate cut-off grades were presented. Using a 3.0 g/t Au cut-off, the Indicated Mineral Resources sensitivity was 0.58 million ounces (2.12 million tonnes at 8.46 g/t Au) and the Inferred Mineral Resource sensitivity was 0.68 million ounces (3.67 million tonnes at 5.79 g/t Au), increases of 15% and 53% respectively in contained ounces over the MRE at a 4.5 g/t Au cut-off grade.

Radisson believes that the O'Brien Project should be evaluated on the basis of a lower cut-off grade, yielding more ounces in more tonnes with greater continuity at lower average grades. Radisson's disclosure of drill results since 2024 has been based on an assumed cut-off grade of 3 g/t Au for intercepts with mineral resource potential, and Figures 1 and 2 graphically illustrate the MRE at multiple cut-offs including 3 g/t Au. With this view, and given the recent successful drilling below the current MRE and the historic mine, Radisson believes the exploration potential of the Project is between 3 and 4 million ounces should the current density of gold mineralization, in ounces per vertical metre, continue to a nominal exploration horizon of 2,000 metres depth.

By the end of the current program, Radisson will have completed an additional 80,000-90,000 metres of new drilling since the publication of the 2023 MRE. At this time the Company will assess the completion of an updated Mineral Resource estimate. To this end, current and future drilling will be designed to attain a drill-hole density appropriate, at a minimum, to an Inferred Mineral Resource.

Drilling Approach: Deep Pilot Hole + Wedge Drilling in O'Brien's Core Area

Radisson's deep drilling program employs a cost-effective and time-efficient strategy that leverages both wedge and directional drilling to generate multiple branches intersecting the prospective Piché Group formation. A full-time directional drilling team is integrated with contract drillers, enhancing precision in targeting and increasing operational flexibility. Drill-hole trajectories are monitored daily to ensure accurate deviation and allow for real-time adjustments. This system provides significant optionality for subsequent branches, enabling Radisson to adapt targets without compromising the integrity of the pilot hole for future exploration.

The O'Brien project has long been known for its occurrence of coarse gold. To address the challenges this presents in sample representativity, where for example, conventional fire assay may under-report grade by missing so-called "nuggets", Radisson has implemented a screen metallics assay method in intervals containing or proximal to visible gold. As part of ongoing efforts to improve assay reliability and scalability, the Company will soon begin testing PhotonAssay technology. This next-generation technique offers a more advanced and comprehensive solution to the coarse gold challenge by enabling rapid, non-destructive analysis of larger sample volumes.

Qualified Person

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Mr. Richard Nieminen, P.Geo, (QC), a geological consultant for Radisson and a Qualified Person for purposes of NI 43-101. Mr. Nieminen is independent of Radisson and the O'Brien Gold Project.

About Radisson Mining

Radisson is a gold exploration company focused on its 100% owned O'Brien Gold Project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Québec. The Bousquet-Cadillac mining camp has produced over 25 million ounces of gold over the last 100 years. The Project hosts the former O'Brien Mine, considered to have been Québec's highest-grade gold producer during its production. Indicated Mineral Resources are estimated at 0.50 million ounces (1.52 million tonnes at 10.26 g/t Au), with additional Inferred Mineral Resources estimated at 0.45 million ounces (1.60 million tonnes at 8.66 g/t Au). Please see the NI 43-101 "Technical Report on the O'Brien Project, Northwestern Québec, Canada" effective March 2, 2023 and other filings made with Canadian securities regulatory authorities available at www.sedar.com for further details and assumptions relating to the O'Brien Gold Project.

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Matt Manson

President and CEO

416.618.5885

mmanson@radissonmining.com

Kristina Pillon

Manager, Investor Relations

604.908.1695

kpillon@radissonmining.com

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. Forward-looking statements including, but are not limited to, statements with respect to the closing of the Offering, the planned and ongoing drilling, the significance of drill results, the ability to continue drilling, the impact of drilling on the definition of any resource, the ability to incorporate new drilling in an updated technical report and resource modelling, the Company's ability to grow the O'Brien project and the ability to convert inferred mineral resources to indicated mineral resources. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements Forward-looking information is based on estimates of management of the Company, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the drill results at O'Brien; the significance of drill results; the ability of drill results to accurately predict mineralization; the ability of any material to be mined in a matter that is economic. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Company believes that this forward-looking information is based on reasonable assumptions, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon. The Company does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law. These statements speak only as of the date of this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/252866