January 12, 2024

Australia-based QX Resources (ASX:QXR) offers investors exposure to this rapidly expanding market for lithium-ion batteries with an indicative development plan involving drilling, sampling and test work starting with two permitted drill holes over the main part of the surface lithium anomaly, planned for November-December 2023. QXR aims to identify lithium-bearing brine aquifers at depth, which is anticipated to lead to detailed drilling toward an initial resource by mid-2024. QXR has sufficient financial muscle to carry out the drilling and other work, especially with the recent AU$3 million raise via a private placement and access to an additional AU$3 million under an at-the-market (ATM) facility.

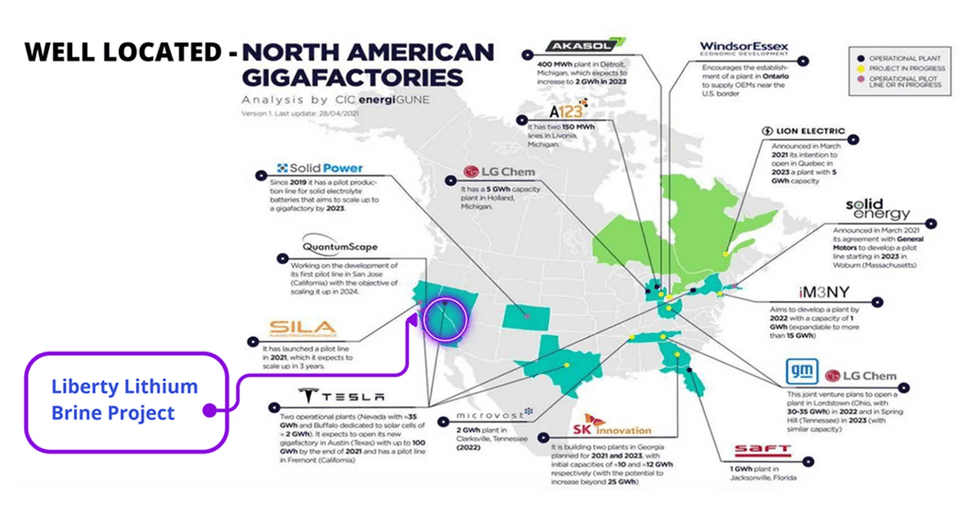

QXR has entered into a binding agreement with vendor ID Lithium LLC (IGL) to acquire a 75 percent interest in the Liberty Lithium Brine Project in California. Separately, QXR has agreed to purchase a small package of leases adjacent to Liberty Lithium to consolidate the area, requiring payment of US$100,000 cash and QXR shares of the same value to the third-party leaseholder.

QXR will undertake a diamond drill program with two permitted drill holes totaling 1,000 metres, along with downhole sampling and geophysics, targeted at the centre of the surface lithium anomaly. Drilling is expected to begin in November-December 2023. Bulk volumes of lithium brines will be submitted for testwork with various DLE providers. The aim is to identify lithium-bearing brine aquifers at depth, which is anticipated to lead to an initial resource by mid-2024.

Company Highlights

- QX Resources is an Australia-based company focused on the exploration and development of battery minerals, with a huge lithium brine project in the US, hard rock lithium assets in a prime location in Western Australia (WA), copper-molybdenum-gold assets in Queensland and a strategic investment in nickel sulphides in Sweden.

- Liberty Lithium Brine Project, located in California, is considered analogous to Albemarle's Silver Peak deposit and is one of the largest single lithium brine projects in the USA with contiguous claims over 102 square kilometres.

- The potentially large-scale lithium brine project located in the US is of significant importance, as participants in the electric vehicle value chain are aggressively seeking to secure domestic battery minerals supply to balance potential supply-side risks to the energy transition.

- QXR aims to commence drilling of the Liberty Lithium Project and has secured A$3 million in funding along with access to an additional A$3 million under an at-the-market facility. The target is to publish an initial resource on the project by mid-2024.

- Additionally, the fundraise also offers flexibility to ramp up exploration activities across its Pilbara lithium hard rock project which are also very exciting prospects. It has four lithium hard rock projects in the Pilbara Province spanning 350 square kilometres and in proximity to some of Australia’s largest lithium deposits and mines.

- The company's other assets include the copper-gold-molybdenum project in Queensland and a 39-percent stake in Bayrock Resources, which owns a portfolio of battery metals projects in Sweden.

This QX Resources profile is part of a paid investor education campaign.*

Click here to connect with QX Resources (ASX:QXR) to receive an Investor Presentation

QXR:AU

The Conversation (0)

30 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

QX Resources (QXR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00