/NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES/

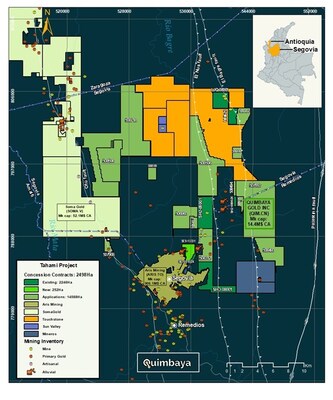

Quimbaya Gold Inc. ("Quimbaya Gold" or the "Company") (CSE: QIM) (OTCQB: QIMGF) is pleased to announce the signing of a definitive agreement for the acquisition of an additional mining property with gold and silver exploration potential, encompassing approximately 252 hectares. The new secured title is SE9-13331 (252.7 Ha), referred to as the "Concession Contract,", is continuous northeast of Aris Mining's Segovia operation which significantly expands Quimbaya Gold's foothold in the burgeoning mining landscape of Segovia, situated northeast of Medellín, the regional capital of the Department of Antioquia, Colombia .

"We are thrilled to announce the signing of the definitive agreement for this significant mining property, which not only enhances our gold and silver exploration potential but also solidifies our presence in the highly prospective Segovia mining district. This strategic expansion underscores our commitment to advancing our exploration activities and creating value for our shareholders. The new Concession Contract, located contiguous to Aris Mining's renowned Segovia operation, positions Quimbaya Gold favorably in one of Colombia's most prolific mining regions. We are excited about the opportunities this acquisition brings and look forward to the positive impact it will have on our growth trajectory", comments Alexandre P. Boivin, CEO of Quimbaya Gold.

The concession SE9-13331 covers 252.7 ha and is located immediately NE of the Aris Segovia Au-Ag project, and hence shares most of its geological features in terms of lithology, alteration, structure and mineralization styles. Accordingly, the geology of concession SE9-13331 is dominated by igneous rocks of intermediate composition, comprising medium to coarse grained locally pegmatitic biotite and hornblende-bearing granodiorites and tonalitiques incorporating minor pulses of dioritic and monzogranitic composition, all assigned to the Jurassic Segovia Batholith, the dominant wall rock to productive Au quartz vein mineralization in the area. In the northern parts of the concession, the Segovia Batholith is covered by a strongly tectonized volcano-sedimentary succession of Cretaceous age, with nature of contact largely undefined. A strong magnetic anomaly locates towards central-southern parts of the concession is used as evidence to postulate that a stock of possible mafic (i.e., gabbroic) composition intrudes the Segovia Batholith. A set of NNE striking dikes of andesitic composition crosscut the intrusive rocks and also the volcano-sedimentary sequence above described.

On structural grounds, analysis of surface and underground structural data along with appropriate geomorphological and imagery analysis allow the definition of various structural trends with some of them exerting a first-order control on the emplacement of Au-bearing quartz veining. The presence of various sets of structures is conceived as a product of various deformation pulses, varying from compressional to extensional. A first set of structures exhibit a NNE strike and dips moderately ESE, and herein interpreted as WNW verging thrusts faults which exerted a primary control on the precipitation of productive structures such as Sandra K and Vera, as that characterized as vein-faults, with features proper of orogenic Au deposits with wall rock altered to quartz-sericite (± pyrite). Thin vein-faults mapped on NW parts of concession SE9-13331 are included on this set and structural model suggests that they are paralleling but are overlying NE extensions of Sandra K and possibly Vera veins which are located on deeper levels of structural block on concession SE9-13331 (see below). A second set of structures have a dominant NE strike and dip steeply to NW, which are crosscutting set 1 of structures and exhibit reverse-dextral kinematics and interpreted as branching out from the K fault mapped on the Segovia Project and characterized as a SE verging thrust. A third set of structures incorporates normal faults and herein grouped as Cianurada and Cianurada 2 types. Former type has dominant NE strikes and dips steeply SE and includes the San Nicolas Fault, whereas Cianurada 2-type strike NW and dips NE. These extensional structures exerted a control on the Z shaped riverbed of the Cianurada creek and, in turn, delimit a rhomb-shaped structural block on concession SE9-13331. A set of NNW striking veins known as Douglas type are interpreted as formed under an extensional regime.

As compensation for the Concession Contract, the Company will be paying a total amount of USD $205,000. The payment schedule is as follows: Payment 1 of USD $50,000 at the signing of the purchase agreement; Payment 2 of USD $75,000 before 31 May 2024 ; and Payment 3 made at twelve months after signing for USD $80,000 . The vendor of the Concession Contract will retain a 3% Net Smelter Return.

Qualified Person

Francois Goulet , M.Sc., P.Geo, a "qualified person" as defined by National Instrument 43-101 - Standards for Disclosure of Mineral Projects , has reviewed the news release and assumes responsibility for scientific and technical disclosure contained herein.

TAHAMI PROJECT

About Quimbaya Gold

Quimbaya aims to consolidate gold reserves through the exploration and acquisition of mining properties in Antioquia, Colombia . Managed by an experienced team in the mining sector, Quimbaya Gold is focused on three projects in the regions of Segovia (the Tahami project), Puerto Berrio (the Berrio Project), and Abejorral (the Maitamac Project), all located in the Antioquia Province, Colombia.

follow on X @apboivin1987

follow on X @solarip

follow on X @quimbayagoldinc

follow on LinkedIn @quimbayagold

Cautionary Statements

Certain statements contained in this press release constitute "forward-looking information" as that term is defined in applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. In particular, this news release contains forward-looking information in relation to potential completion of acquiring the Concession Contracts, including Quimbaya's potential business upon the completion of the acquisitions, the potential conditions and satisfaction of those conditions for the completion of the acquisitions and the issuance of compensation shares and cash. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". Forward-looking information by its nature is based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Quimbaya to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These assumptions include, but are not limited to: the satisfaction of any conditions to the acquisitions set forth in the definitive agreements including, without limitation, the acceptance of the proposed acquisition by the CSE and typical closing conditions; and the receipt of all required approvals for the acquisitions, including CSE acceptance, any board approvals or third party consents. Although Quimbaya's management believes that the assumptions made and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Readers are cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of Quimbaya as of the date of this news release and, accordingly, is subject to change after such date. Except as required by law, Quimbaya does not expect to update forward-looking statements and information continually as conditions change.

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE Quimbaya Gold Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/June2024/17/c1374.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/June2024/17/c1374.html