April 28, 2022

European Metals Holdings Limited (ASX & AIM: EMH, NASDAQ: EMHXY) (“European Metals” or the “Company”) is pleased to provide an update on its activities during the three-month period ending 31 March 2022 highlighting the continued progress in the development of the globally significant Cinovec Lithium/Tin Project (“the Project” or “Cinovec”) in the Czech Republic.

During the reporting period, the Company made two very significant announcements.

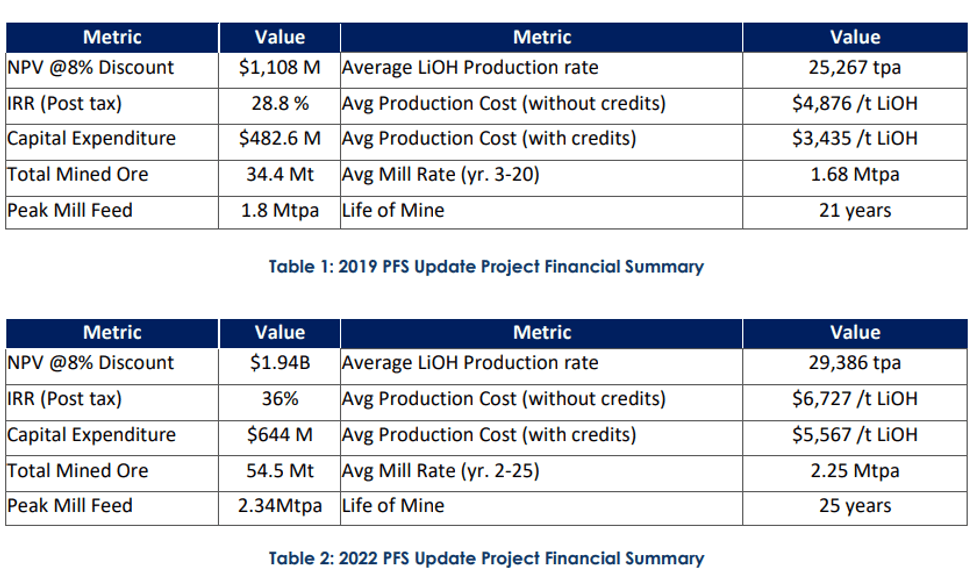

The first of these was an update to the 2019 Preliminary Feasibility Study, highlighting significant increases in the key financial parameters of the Project, an increase in overall lithium production, and further enhancements to the ESG credentials. The 2022 PFS Update shows an NPV8 of US$1.938B (post tax); an up-front capital cost of US$644M; and an increase in the overall annual production of battery-grade lithium hydroxide to 29,386 tpa. In addition, the post-tax IRR has increased to 36.3% (refer to the Company’s ASX release dated 19 January 2022) (PFS Update delivers outstanding results).

Secondly, the Company successfully completed a capital raising of approximately AUD 14.4 million and welcomed Ellerston Capital, a leading Sydney-based fund manager, and another institutional fund to the register. (refer to the Company’s ASX release dated 19 January 2022) (Successful Placing to raise AUD14.4M)

The quarter was marked by continued strong progress by the Company towards finalisation of the Definitive Feasibility Study (“DFS”) together with ongoing discussions with potential offtakers for the products of the Project. From a macro perspective, prices for the Project’s two key products, lithium hydroxide and tin, continued to increase significantly with lithium hydroxide prices exceeding USD 70,000/tonne and tin exceeding USD45,000/tonne during the period. These prices compare very favourably to the prices that were used in the 2022 PFS Update being USD17,000 for lithium hydroxide and USD24,000 for tin.

The timeline for the completion of the DFS is currently under review. Whilst the work on the DFS is proceeding very well, there have been delays in the DFS process caused in part by COVID-19 issues in laboratories, the dramatic upturn in the workload of laboratories and therefore reduction in laboratory availability due to increase in demand in the lithium space, and logistical issues in the industry caused by the Ukrainian situation. The Company is currently reviewing the project timelines and will advise the market when it has completed this review. It is not expected that this will delay the critical path of the Project, as during this time the Company will be in the process of finalising permitting matters.

Post the reporting period, the Company appointed David Koch as the new CFO and Company Secretary.

PFS UPDATE DELIVERS OUTSTANDING RESULTS

As announced on 19 January 2022, the 2019 PFS Update for the Cinovec Project has been updated to demonstrate the effect of changes in the mining process to incorporate the use of paste backfill, which results in an increase in annual production, together with changes in lithium and by-product prices to reflect current and expected market conditions.

The effect of the use of the paste backfill option was to enable the mining schedule to increase the mine life to 25 years whilst increasing the amount of ore mined to 2.25mtpa, thereby increasing the amount of lithium hydroxide produced each year from 25,267 tonnes to 29,386 tonnes.

The use of approximately 54% of the plant tailings for backfill will result in a far smaller environmental impact, with much smaller dry stack tailings storage required, further enhancing the already strong ESG credentials of the Project.

NPV8 (post tax) increases from US$1.108B to US$1.938B, an increase of 74.9%

The 2022 PFS Update highlights the very strong increase in value which results from the increase in the price of battery-grade lithium hydroxide when combined with the use of backfill, and an increase in the overall production of battery-grade lithium hydroxide to 29,386 tpa. The 2022 PFS Update shows a NPV of US$1.938B (post tax, 8%) and an up-front capital cost of US$644M.

Click here for the full ASX Release

This article includes content from European Metals Holdings Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMH:AU

The Conversation (0)

22 March 2022

European Metals

Developing Europe’s Largest Hard Rock Lithium Deposit

Developing Europe’s Largest Hard Rock Lithium Deposit Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00