April 28, 2022

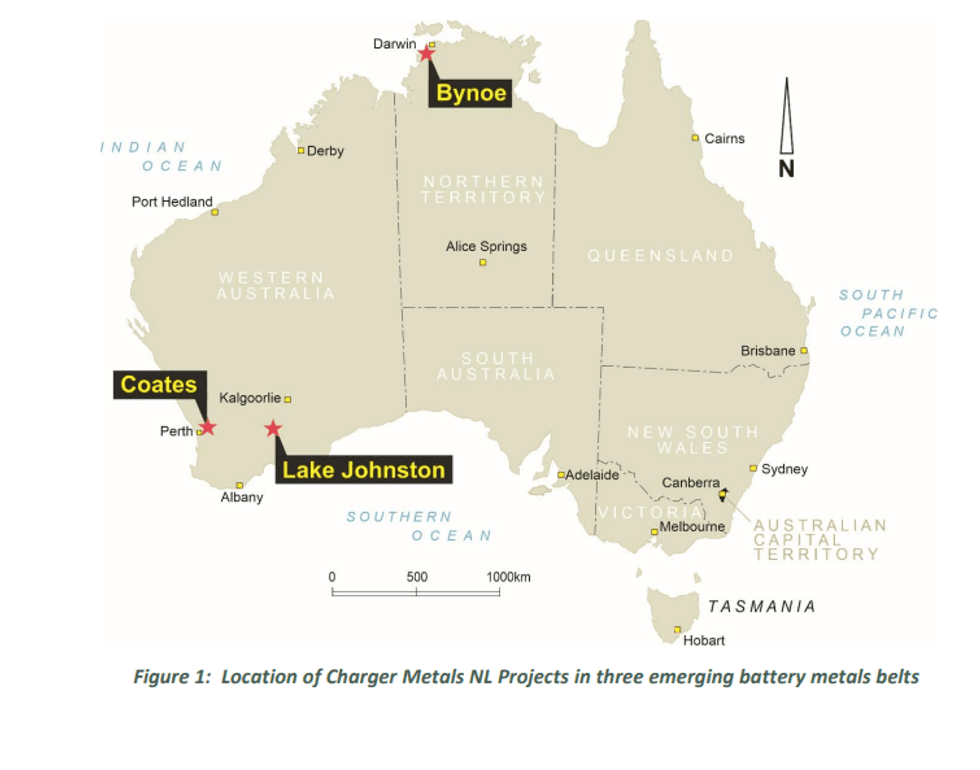

Battery metals explorer Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) is pleased to provide the following update on its activities for its third quarter since listing.

HIGHLIGHTS

Bynoe Lithium Project, Northern Territory

- Permit applications for the maiden drill program at Bynoe lodged for assessment earlier this year. Drilling will commence once these are approved.

- Charger’s geochemistry and field mapping highlight two large LCT1 pegmatite zones, which extend for 8 km at Megabucks and 3.5 km at 7-Up. These form the basis for Charger’s forthcoming drilling program.

- When geochemistry and aeromagnetic data is viewed in conjunction with publicly available drilling results from Core Lithium Ltd (ASX: CXO) and other earlier explorers, the trend direction of lithium-mineralised LCT pegmatites may extend from CXO’s adjacent Finniss Lithium Project into the Company’s Bynoe Project.

Coates Ni-Cu-Co-PGE Project, Western Australia

- A POW2 application for the maiden drill program at Coates lodged for assessment earlier this year, and drilling will commence when approved by DMIRS3.

- Final geophysical report for a FLTEM4 survey has refined conductor targets which could include massive sulphides related to nickel, copper or possibly VMS-related mineralisation.

- Key Landowner agreement executed, providing access to priority drill targets.

- Five diamond core drill holes initially planned to test conductor targets for economic mineralisation, with contingency for additional holes as needed.

Lake Johnston Lithium Project, Western Australia

- Widespread soil geochemical sampling program, which totalled over 7,000 samples, completed at the Mt Day and Medcalf Prospects.

- Samples submitted for pXRF5 analysis by a commercial contractor using a proprietary lithium index algorithm, ahead of conventional chemical analysis. This will expedite field mapping and drill hole targeting.

- The linear extent of the sampling at Mt Day and Medcalf Prospects is 23 km and 9 km respectively.

Corporate

At the end of the March quarter, the Company held cash reserves of $3.90m. The Company has 50.96 million fully paid ordinary shares on issue and an undiluted market capitalisation of approximately $36 million.

The top 20 shareholders hold approximately 61.3% of the issued shares.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00