May 08, 2023

QGL Becomes Full Participant in Grid Connected Energy Storage Market

The Company is pleased to announce that its joint venture with Sunlands Co., Quantum Sunlands Partnership, has acquired the original equipment manufacture rights (OEM) for Sunlands Co.’s TES Graphite Cells. The name of the joint venture company will be changed to Sunlands Power, recognising its critical role in the delivery of the LDES technology to the market.

Highlights

- Change of name of joint venture (Quantum Sunlands Partnership) to Sunlands Power

- Sunlands Power acquires full OEM rights to manufacture Sunlands Co.’s LDES TES Graphite Cells

- OEM rights extend to TES Graphite Cells made from non-QGL supplied flake graphite

- Agreement effective 1 July 2023

The OEM rights are in addition to those previously granted to Sunlands Power to manufacture the Uley 2 flake graphite-based energy storage media. With the acquisition of the OEM rights, Sunlands Power is now positioned as a strategic full participant in the global LDES market.

Sunlands Power will be directly responsible for the manufacture and delivery to Sunlands Co. of the complete TES Graphite Cell facility. Included within this facility will be all the associated plant and equipment required for the connection to conventional thermal power plants (i.e., steam turbine generator packages). Importantly the OEM rights are not limited to or dependent on the flake graphite being sourced from the Company.

The Company's financial returns from Sunlands Power will be a significant addition to the returns delivered from its Uley 2 Project. Based upon the current market prices for graphite energy storage media and LDES facilities, the combined manufacture and sale of the flake storage media and the TES Graphite Cell facilities will generate revenues far in excess of those derived from the sale of Uley 2 flake to Sunlands Power. The Company will provide further information on the expected financial returns from its Sunlands Power interest upon the completion of the TES Graphite Cell pilot plant.

The capital to establish Sunlands Power's operations will be included within the sustainably linked bond financing currently being progressed by the parties. The Company and Sunlands Co. expect that Sunlands Power will deliver a return to them within the first year of achieving its minimum production capacity of 0.5GW of TES Graphite Cells per annum. This level of LDES requires a minimum 50,000 tonnes of Uley flake graphite based media.

Quantum Graphite director, Michael Wyer, commented that, "our initial arrangement with Sunlands Co. established the exclusive working relationship between the parties. The critical supply of the flake graphite-based energy storage media was the key step in building an end to end supply chain. The grant of OEM rights to Sunlands Power now underpins the Company's participation in the biggest market associated with the grid connected energy markets".

Key Target Market - Retrofitting of Coal Fired Power Stations

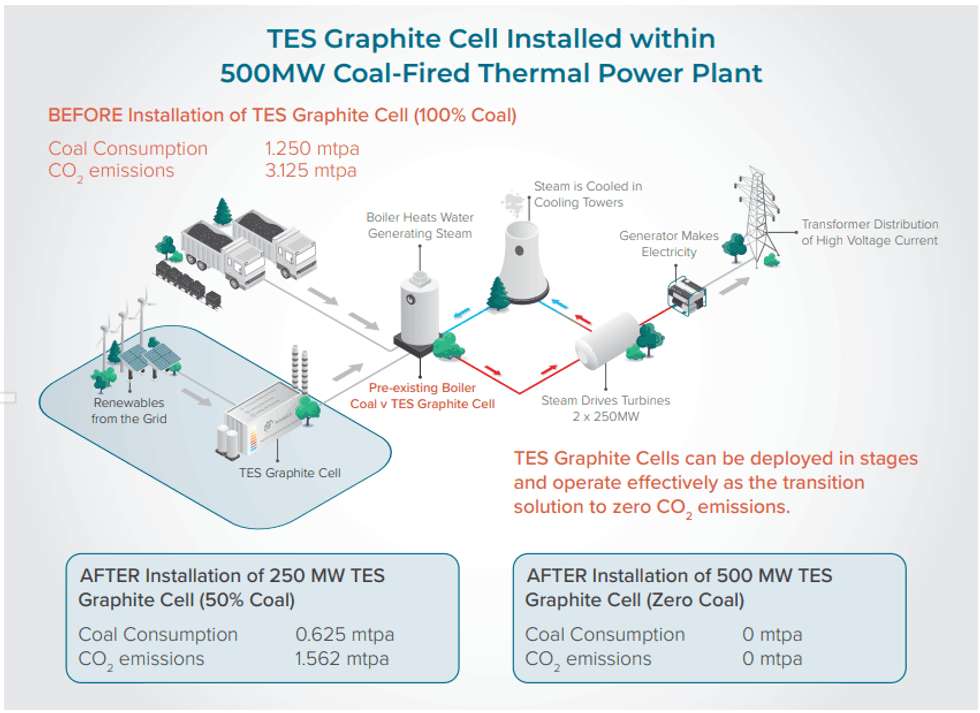

The Sunlands Power TES Graphite Cells are ideally suited to the retrofitting of coal fire power stations. Storing energy from renewables in the form of heat, TES Graphite Cells can retain this heat for weeks at a time and deliver this heat to pre-existing coal boilers to generate steam.

Essential to the generation of electricity from these power stations’ conventional turbine generators is the production of efficient high temperature steam. TES Graphite Cells’ high operating temperatures ensure the reliable, consistent production of high temperature steam to drive the type of utility scale turbines found at large grid scale coal fired power stations.

Deployment of TES Graphite Cells within existing coal fired power stations and their charging from renewables results in the direct reduction of CO2 emissions. In a typical 500MW (bitumus) coal fired thermal power plant, TES Graphite Cells can eliminate more than 3,000,000 tonnes of CO2 emissions per annum.

Cost Competitive Advantages of TES as Preferred Decarbonisation Solution

The Long Duration Energy Storage Council1 has stated that TES is a cost competitive decarbonisation solution today. It acknowledges that TES based LDES solutions are a more cost efficient (steam based) decarbonisation and electrification solution than carbon capture and storage (at existing coal fired power stations) or replacing gas with hydrogen or biomass.

Click here for the full ASX Release

This article includes content from Quantum Graphite, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

27 November 2025

Major JORC Resource & Reserve Upgrade at Orom-Cross

Blencowe Resources Plc (LSE: BRES) is pleased to announce the completion of the updated JORC 2012 Mineral Resource and Ore Reserve Statement ("JORC") for its 100%-owned Orom-Cross Graphite Project in Uganda. This upgrade incorporates all the infill drilling undertaken in 2025 across the Camp... Keep Reading...

06 November 2025

Amitsoq Update - Graphite pilot processing plant

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is pleased to announce that it has signed a purchase agreement with a leading manufacturing company in China for a line of graphite processing mills and has also signed a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00