June 20, 2023

Eclipse Metals Ltd (Eclipse or the Company) (ASX: EPM | FSE: 9EU) is pleased to provide an update on the Company’s mineralogical determinations and percussion drilling program for its Grønnedal prospect within the Ivigtût multi-commodity project in SW Greenland.

- Encouraging mineralogical determinations from Grønnedal

- Composite ferro-carbonate mineral containing elevated medium to heavy REE

- Grønnedal Pr+Nd account for 55% of the measured 4REE (La+Ce+Pr+Nd)

- On-going assessment of material found over a wide area in Grønnedal

- Located within the Ivigtût multi-commodity project in SW Greenland

- Assays from drilling at Ivigtût project are expected this quarter

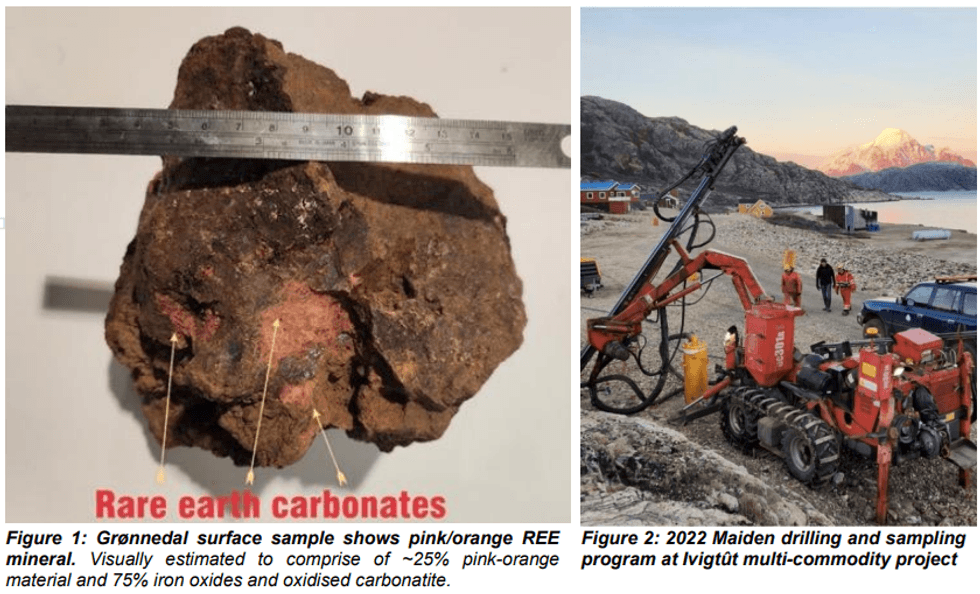

Ongoing mineralogical assessment of pink-orange mineralised material found over a wide area (1.5 km x 3 km) in Grønnedal, including scanning electron microscope (SEM) examination at CSIRO, has identified composite ferro-carbonate minerals containing elevated medium to heavy REE.

Cautionary Statement

Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Executive Chairman Carl Popal commented: “These initial results at Grønnedal are of great significance for Eclipse and follow up the sampling of drill core from the Ivigtût pit which also confirmed the presence of REE mineralisation. The REE prospectivity at both Ivigtût and Grønnedal aligns with our strategy of becoming a leading supplier of metals and minerals used in the green energy industry. Eclipse will continue to actively explore the historic Ivigtût pit and the nearby Grønnedal prospect during 2023.”

Previous ambiguous mineralogical determination attempts could not name the pink/orange coloured minerals containing these REEs with anomalous Pr, Nd and Dy content. Precise mineralogical identification is essential in processing REE and is an important step in prefeasibility studies.

The pink-orange coloured minerals were first submitted by Eclipse for mineralogical determinations in 2021, which initial assessment determined that there is a possible combination of several minerals. During 2022, an XRD assessment was conducted by the St Andrews University School of Earth Science which identified possible bastnasite and proposed further thorough assessment to identify the precise composite nature of the minerals (ASX release 1 November 2022).

Previous laboratory and pXRF assay results from Grønnedal rock chip samples using polished thin sections (ASX release 17 November 2021) and now Scanning Electron Microscopy (SEM) have confirmed the presence of rare earth minerals in three of the four rock samples examined at CSIRO. SEM/EDS (SEM with Energy Dispersive X-ray Spectroscopy) analysis of one sample returned chemistry corresponding to the rare earth minerals Parisite and Ancylite. These two minerals were distinguished by the difference in CaO values showing a composite mineral structure containing REEs with elevated Pr, Nd and Dy values.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00