November 20, 2023

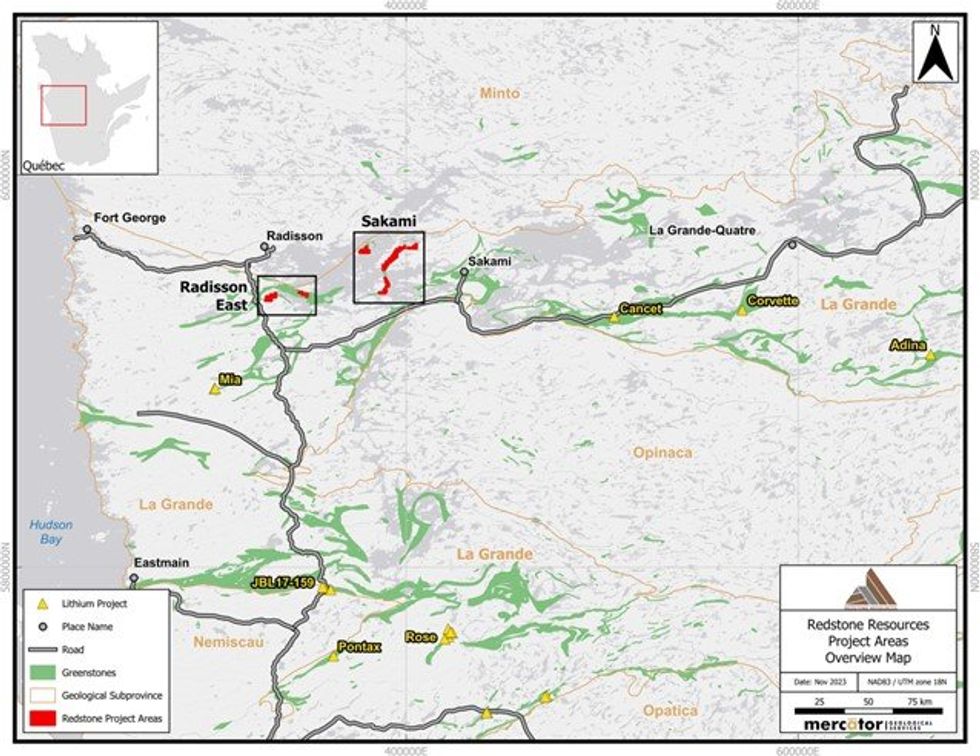

Redstone Resources Limited (ASX: RDS) (Redstone or the Company) is pleased to announce the results of recently completed prospectivity analysis, which has identified a significant number of high priority Lithium‐Caesium‐Tantalum (LCT) pegmatite target areas on the Radisson East Lithium Project and Sakami Lithium Project (collectively the Projects) in James Bay, Québec, Canada.

HIGHLIGHTS

- Prospectivity analysis completed by Mercator Geological Services has generated:

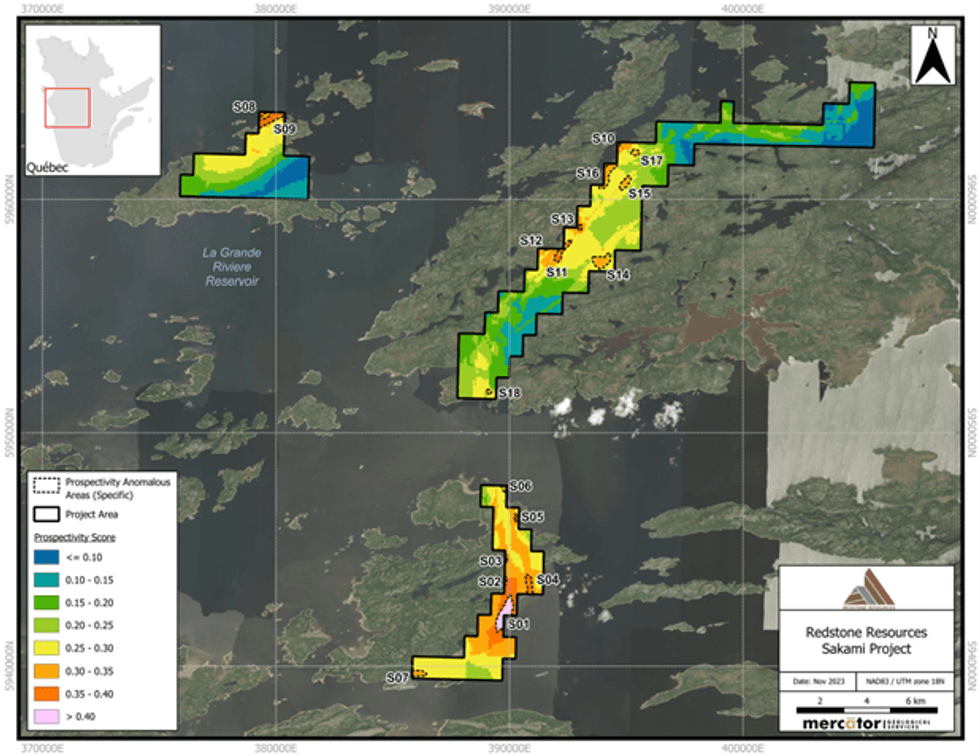

- eighteen (18) Lithium‐Caesium‐Tantalum (LCT) pegmatite target areas across the Sakami Lithium Project; and

- six (6) LCT pegmatite target locations across the Radisson East Lithium Project.

- Targets are identified in areas where favourable lithology, mineralisation, structure and geochemistry for LCT pegmatites occur together.

- The highest priority targets on the Sakami Lithium Project (S01 through S04) occur towards the boundary between the La Grande and Opinaca sub‐province, in an area where amphibolite is truncated by faulting; and are associated with low level geochemical anomalism that is found with LCT pegmatites (see Figure 2).

- The highest priority targets on the Radisson East Project (RE01 and RE02), occur within an amphibolite and an area of low‐level geochemical anomalism found with LCT pegmatites (see Figure 3).

- Radisson East and Sakami Projects have a combined area of 90km2 and cover more than 40 km of the Yasinski Group greenstone belt. Greenstone belts in the James Bay area host a number of pegmatite occurrences including Q2 Metals Corp.’s Mia Lithium Deposit within the Yasinski greenstone belt.

- Planning is now underway to follow up the generated targets at both the Sakami and Radisson East Projects.

- An initial field programme will include field mapping, outcrop sampling and geochemical sampling over the most prospective target areas.

Redstone retained Mercator Geological Services Limited (Mercator) to complete their proprietary prospectivity analysis method on Sakami and Radisson East Projects, identifying eighteen (18) target areas and six (6) target areas respectively on the Projects.

The Sakami Lithium Project (68 km2) consists of three claim blocks within the La Grande sub‐province situated approximately 14 km north of the boundary between the La Grande and Opinaca sub‐ provinces, in a similar geological setting as the Corvette (Patriot Battery Metals), Cancet (Winsome Resources Ltd.) and Adina Lithium Deposits (Winsome Resources Ltd.) lithium deposits, which all occur 10 to 20 km north of the boundary (Figure 1).

The Radisson East Lithium Project (22 km2) consists of two claim blocks, both within the La Grande sub‐province and 55 kilometres to the northeast of Q2 Metals Corp.’s Mia Lithium project (Figure 1).

The primary purpose of this prospectivity analysis was to identify priority lithium targets within the Projects to guide further exploration. The prospectivity model used was designed on the LCT (lithium‐ cesium‐tantalum) pegmatite deposit model of Černy & Ercit (2005)1, and review of data from the known lithium deposits in the area. The final version of the prospectivity map consisted of 79 input layers of data sourced from the Government of Québec’s Geomining Information System (SIGÉOM) that were used to calculate the prospectivity weightings. The model was designed to highlight the best lithium targets where favourable structure, lithology, mineralisation, and LCT pegmatites geochemistry occur.

SAKAMI LITHIUM PROJECT

The prospectivity analysis has generated eighteen (18) target areas that are prospective for LCT pegmatites across the Sakami Lithium Project, (Figure 2).

The two easternmost claim blocks follow a north‐south trend of elevated prospectivity scores, and the northwestern‐most claim block is highlighted by an elevated prospectivity score along its northern boundary (Figure 2). The north‐south trend of prospectivity appears to be associated with amphibolite and paragneiss units along north‐northeast‐trending faults.

The highest priority targets on the Sakami Lithium Project are targets S01 through S04 to the south end of the Project towards the La Grande‐Opinaca sub‐province boundary. These high priority targets occur in an area where a north to south trending amphibolite unit is truncated by east to west faulting and an increase in low level geochemical anomalism that is associated with LCT pegmatites occurs in the direction of the La Grande‐Opinaca regional geological boundary.

Targets S08 and S09 (Figure 2), lying towards the La Grande‐Minto geological boundary in the northeastern most claim block, appears to be associated with favourable lithology and structure that is commonly associated with LCT pegmatites in the James Bay area.

Click here for the full ASX Release

This article includes content from Redstone Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RDS:AU

Sign up to get your FREE

Redstone Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 May 2025

Redstone Resources

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

25 November 2025

Diamond Drilling Discovers New Tollu Copper Mineralisation

Redstone Resources (RDS:AU) has announced Diamond Drilling Discovers New Tollu Copper MineralisationDownload the PDF here. Keep Reading...

16 September 2025

Redstone Drilling at Tollu Intersects 10m at 1.37% Cu

Redstone Resources (RDS:AU) has announced Redstone Drilling at Tollu Intersects 10m at 1.37% CuDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

03 July 2025

Deep Diamond Drillhole Completed at West Musgrave Cu Project

Redstone Resources (RDS:AU) has announced Deep Diamond Drillhole Completed at West Musgrave Cu ProjectDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Redstone Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00