October 05, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) advises that the Abra mine has generated positive operating cash flows for the quarter ended 30 September 2023 (the “Quarter”) and has achieved new quarter production highs as the mine continues to ramp-up. Subject to September end of month reconciliation the following key operation highlights and significant milestones were achieved.

HIGHLIGHTS

- Three lead concentrate shipments totalling ~22kt were completed, more than doubling revenue from the previous quarter to ~A$45 million and generating positive operating cash flows.

- New quarterly mining and production records:

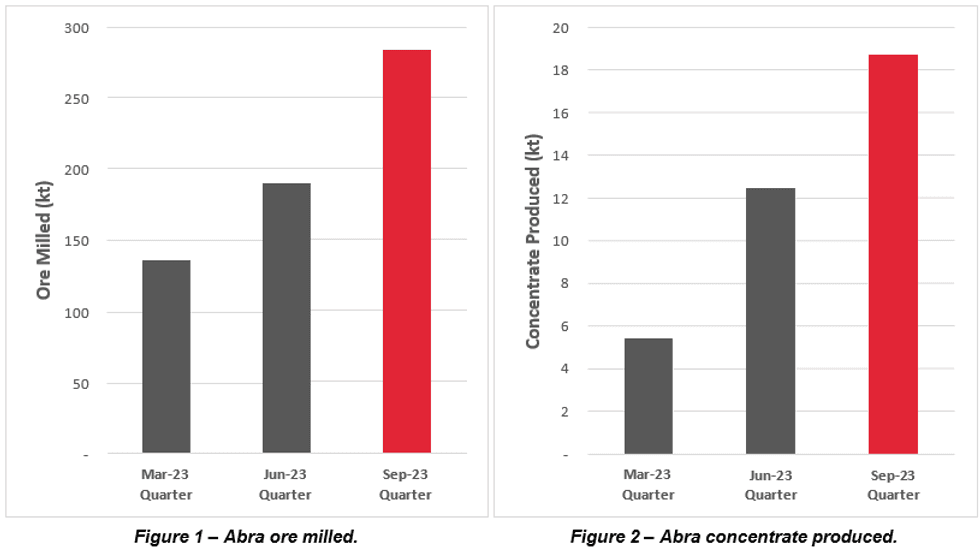

- Total ore milled of ~283kt (~49% increase from previous quarter);

- Lead concentrate production of ~19kt (~50% increase from previous quarter);

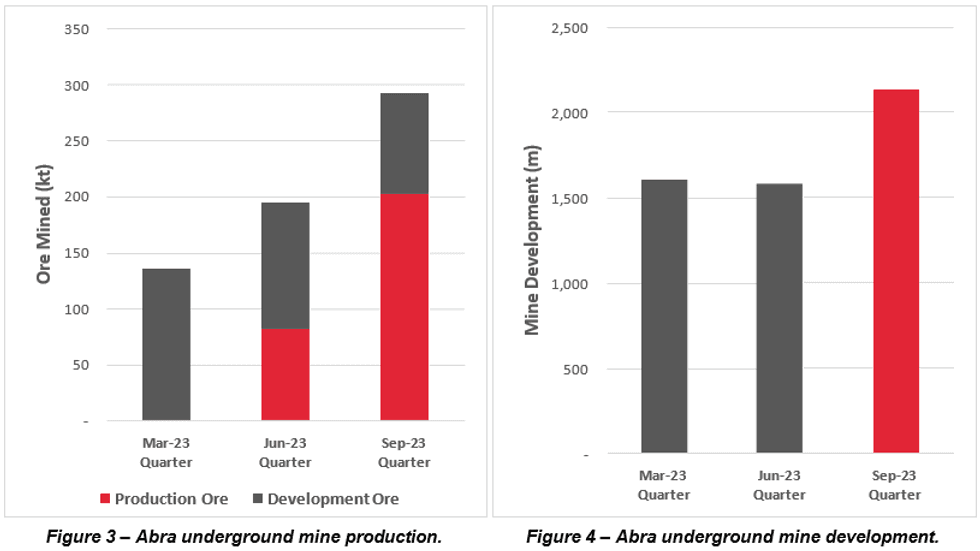

- Total ore mined of ~292kt (~50% increase from previous quarter), with underground stope production of ~202kt;

- Mining of first core vein stope commenced and paste-fill plant commissioned; and

- Underground development of ~2,100m, including a new monthly record of ~800m in September.

- Lead grade continues to improve as new work areas are established and the ratio of stoping ore to development ore continues to increase.

- The official Abra mine opening ceremony was held on 13 September 2023. The mine was officially opened by the President of Toho Zinc (Mr. Masahito Ito) and the Galena/Abra Chairman (Mr. Adrian Byass).

Managing Director, Tony James commented, “The Abra mine was able to achieve new quarterly production highs as we continue to move through the ramp-up process. During this time, we continued to improve the mine’s production levels as we endeavour to become more consistent with our mining and processing. The result was positive operating cash flows for the Quarter.

The mine delivered 202kt of stope ore for the Quarter. Operational and technical issues associated with mining two stopes in September and the commissioning of the paste-fill plant generated stope production delays which were resolved. The plant processed 283kt of stoping and development ore during the Quarter. Ore processed was ~5% less than target due to 13 days of non-processing time over the Quarter, mainly associated with some unplanned and planned maintenance work. Unplanned maintenance included conveyor replacement following rockbolt damage and a primary crusher blockage. Planned maintenance included the mine’s first shutdown for various maintenance activities including the first mill reline.

Achieving higher development rates in the mine of 2,100m (target 2,000m) is significant as it enables us to continue to open new work areas which will allow access to multiple higher-grade stoping blocks. With this, we expect grades to continue to improve as mining progresses and we are very pleased with the strong correlation between the stope grades and the processing reconciliation for the stopes. In steady-state, stoping is expected to account for 80% of the feed stocks which allows the mine to be less reliant on the generally lower grade ore development which is associated with the ramp-up period of operations.

The Abra team continues to be resilient and busy during the mine’s ramp-up and it’s nice to see everyone being rewarded with the continuous improvement we are achieving. We look forward to taking the next ramp-up step in the December quarter, which should see Abra reaching close to its full potential.”

Figures 5-11 (below) show recent photographs of the Abra mine.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00