Portofino Resources INC. (TSXV: POR) (OTCQB: PFFOF) (FSE: POTA) ("Portofino" or the "Company") announces that it has submitted detailed proposals through a public tender process in Salta, Argentina, for two contiguous lithium concessions, sub-areas III and IV, within the highly coveted, Arizaro Salar (see Figure 1). The tender submission deadline has now lapsed, and while the Company's success in the process is not guaranteed, the initial, (official) feedback suggests that the Company's financial proposals are extremely competitive with other major lithium participants. Additional aspects of the tender submissions, including community impact, sustainability and communityregional benefits, are also being assessed by officials and results are anticipated to be announced in the second half of September.

Figure 1: REMSa IX, Sub-Area III and IV

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/3751/178113_figure1.jpg

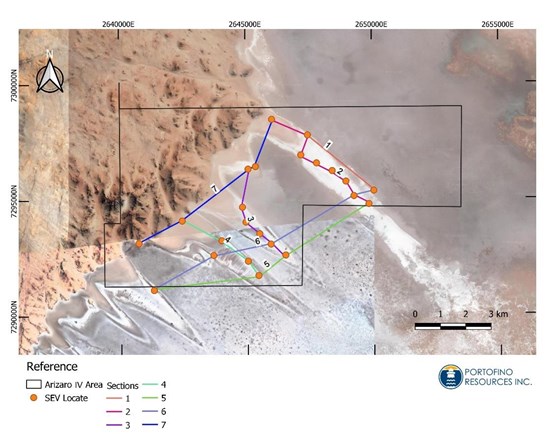

In conjunction with the state-owned resource company in Salta, the Company previously carried out extensive geological due diligence on one of the two concession areas, referred to as Arizaro IV. Initial surface exploration work on this 8,445-hectare block has revealed a thick overburden (crust), however, samples at surface still assayed as high as 100 milligrams per litre ("mg/l") lithium, which is consistent with surface results of other groups exploring this mature salar. Additional exploration activity included:

- 40 +surface brine samples collected and analysed;

- 35 trenches reaching shallow water tables using excavation equipment;

- 69,000 metres ("m") of geophysical surveying utilizing Vertical Electric Soundings ("VES") technology revealing aquifer depths up to 1,000m; and

- Low resistivity horizons being identified and interpreted as brine targets potentially containing large concentrations of lithium (see Figure 2).

Figure 2: Arizaro Project Distribution of resistive sections

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/3751/178113_bed7d85854e9aaf4_001full.jpg

The VES results with the largest thickness in the low resistivity layer are anticipated to be the highest prospective areas of interest and are located to the east and south. The explored area shares geological characteristics with other areas in the same salt flat where brines with high lithium content have been detected at depth. Adjacent properties within the Arizaro salar, have been drilled to depths of more than 500 m, yielding prospective levels of 300 m to 400 m with >500 mg/L lithium.

David Tafel, CEO of Portofino, commented: "Our legal, operations, and geological teams have presented two very thorough, well researched and competitive Arizaro Salar partnership proposals and we remain confident our efforts will be rewarded. Concurrent to our Arizaro proposal submissions, and pursuant to the recent news on the Yergo Lithium Project (POR News Release 14-AUG-2023), the team has commenced preparation of an amended drill permit in anticipation of closing the concession buyout mid-September."

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person ("QP") as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP has not completed sufficient work to verify the historic information on the properties in Argentina and neighbouring companies.

About Portofino Resources Inc.

Portofino is a Vancouver-based Canadian company focused on exploring and developing mineral resource projects in the Americas. Portofino has an opportunity to earn a majority interest in several lithium projects in Salta, Argentina and up to 100% of the (2932 hectare) Yergo Lithium property in Catamarca. The properties are situated in the heart of the world-renowned Argentine Lithium Triangle and in close proximity to multiple world-class lithium projects. The Company also has the right to earn 100% interest in three northwestern Ontario, Canada lithium projects: Allison Lake North, Greenheart Lake and McNamara Lake.

Portofino's South of Otter and Bruce Lake projects are in the historic gold mining district of Red Lake, Ontario, Canada proximal to the Dixie gold project discovered by Great Bear Resources and now owned by Kinross Gold Corp. In addition, Portofino holds three other northwestern Ontario gold projects; the Gold Creek property located immediately south of the historic Shebandowan mine, as well as the Sapawe West and Melema West properties located in the rapidly developing Atikokan gold mining camp.

ON BEHALF OF THE BOARD

"David G. Tafel"

Chief Executive Officer

For Further Information Contact:

David Tafel CEO,

Director 604-683-1991

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking statements" within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking statements. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein include, but are not limited to, statements regarding the Company's future business plans. Forward-looking information in this news release is based on certain assumptions and expected future events, namely the growth and development of the Company's business as currently anticipated. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements. Readers are cautioned that the foregoing list is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement and reflect the Company's expectations as of the date hereof and are subject to change thereafter. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, estimates or opinions, future events or results or otherwise or to explain any material difference between subsequent actual events and such forward-looking information, except as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/178113