(TheNewswire)

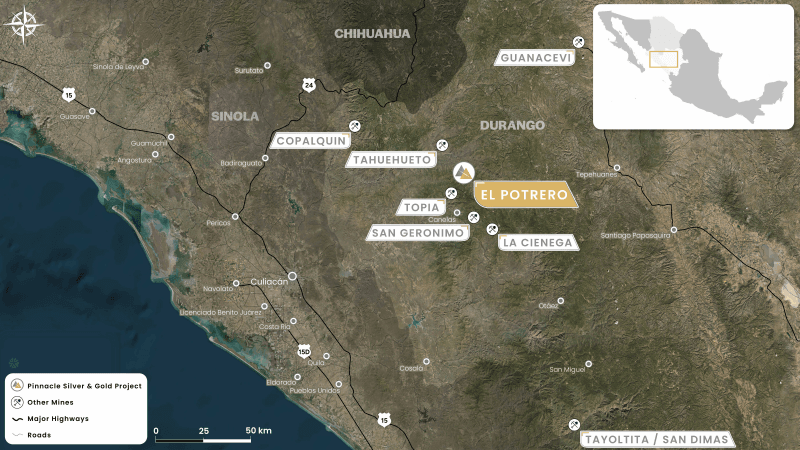

VANCOUVER, BRITISH COLUMBIA TheNewswire - June 25, 2025 (TSXV: PINN, OTC: NRGOF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to provide an update on the high-grade Potrero gold-silver property in Durango, Mexico (see Figure 1). While surface and underground mapping and sampling continues, a recent site visit was conducted for consultants to assess the condition of the processing plant and provide guidance on potential permitting procedures.

"We continue to make excellent progress in moving the Potrero Project forward," stated Robert Archer, Pinnacle's President & CEO. "I joined our consultants in a comprehensive site review last week that provided valuable guidance for permitting and a plant re-build and we are encouraged on both fronts. In parallel, our geological team is making significant strides in their interpretation of the gold-silver mineralizing system at El Potrero and we are commencing plans for an underground drilling program in addition to surface drilling. To date, we have taken in excess of 600 rock samples from underground and surface, with the latest batch in the SGS lab in Durango, and are starting to get a good understanding of the geology that will be critical in the planning stages going forward."

Geological Program

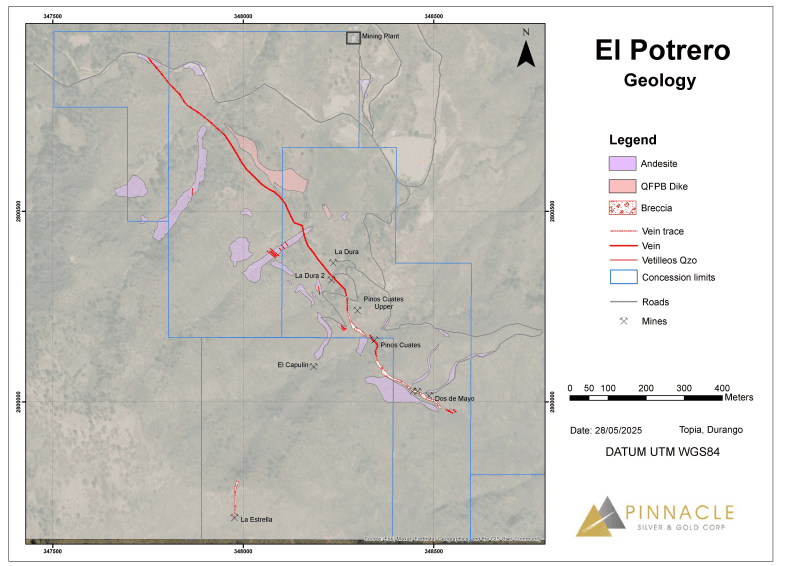

A review was conducted with the geological team whereby the importance of a quartz-feldspar (+/- biotite) porphyry dyke is being recognized as it follows the same structure that hosts the mineralized quartz breccia vein system (see Figure 2). These types of dykes, and their potential association with rhyolite domes, are commonly associated with epithermal systems.

The dyke is pre-mineral as evidenced by the presence of quartz veinlets and associated weak gold-silver values within. It may have provided a competency contrast with the host andesitic volcanics and/or opened up the structure for the injection of mineralizing fluids. As such, the presence of the dyke appears to be an important component in localizing gold-silver mineralization within the breccia and may well become a critical exploration feature.

In particular, it was observed that some of the underground workings are entirely within the dyke and the presence of potentially mineralized vein breccia, presumably in the wall of the workings, needs to be drill-tested. The possibility of doing this via an underground drilling program is currently being assessed as it could be faster and cheaper than a surface drill program.

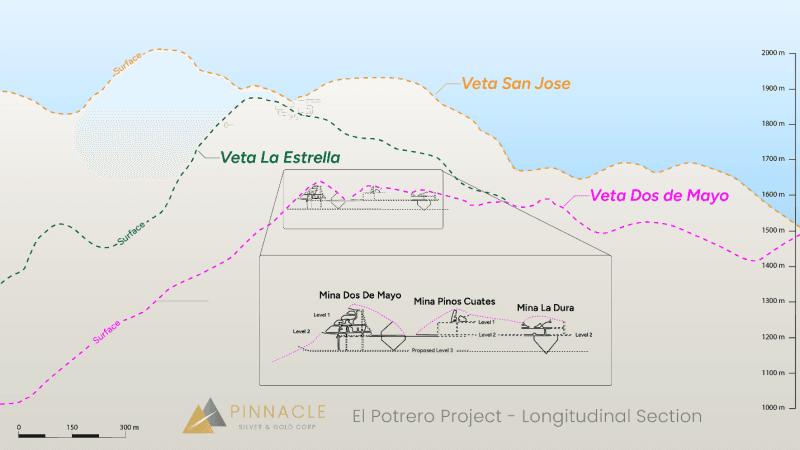

Follow-up sampling is being conducted in the areas of high-grade gold-silver mineralization that has been identified to date, including the upper level of the historic Pinos Cuates mine (see Figure 3) where composite channel samples returned up 19.4 grams per tonne gold (g/t Au) and 266 grams per tonne silver (g/t Ag) over 4.1 m etres, with individual samples returning up to 37.3 g/t Au and 346 g/t Ag ( see Pinnacle news release of June 2, 2025 ).

Figure 1: Regional location map of the Potrero Project, Durango, Mexico

Additional channel sampling is also being conducted in areas that were previously restricted by accessibility that has now been improved by the installation of metal ladders. First pass sampling of the Dos de Mayo mine is complete, with 167 samples taken and submitted to the SGS lab in Durango. Underground mapping and sampling will now progress to the easternmost La Dura and La Dura 2 workings, where fine-grained visible gold and ginguro (grey-black bands of electrum and silver sulphides) were observed on the site visit.

Surface prospecting, mapping and sampling along the main Dos de Mayo vein system is continuing, with cleaning and sampling of historical trenches being conducted in areas of interest such as the old pit with vein material containing visible gold and ginguro that assayed 13.2 g/t Au and 2,280 g/t Ag and 5.2 g/t Au and 745 g/t Ag in two grab samples (see Pinnacle news release of June 2, 2025 ).

A program of combined underground and surface diamond drilling is being devised in order to systematically test the Dos de Mayo vein system. Underground drilling would consist of short (10-20 metres), closely spaced (10-15 metres) holes drilled into the walls of the underground workings and would be designed to test the width, continuity and grade of the breccia vein. Results would be used to guide future mine development. Surface holes would be more widely spaced (potentially 50 metres) and would be designed to give a more complete cross-section through the 500 metre mine area as well as test the continuity of the vein structure and mineralization along strike of the historic mines. Further details will be provided in due course.

Figure 2: Preliminary geology of the Potrero Project showing vein projections and historic mines

Figure 3: Longitudinal section, looking southwest, of underground workings at the Potrero Project.

Plant Assessment

With access roads to the project and the area around the plant having been completely cleaned up, an inspection was conducted by a plant consultant to assess the approximate cost and schedule to get it ready for production again. While a final report will be submitted to the company within approximately 3-4 weeks, it was determined that the basic infrastructure (framework, excavation and civil pads) appears to be sound, thereby significantly reducing both costs and time to get it production-ready. As such, future costs required will be focused on specific equipment such as new/refurbished crushers, ball mill, pumps, leaching and solution recovery equipment, and the Merrill Crowe circuit, etc. This will ensure required plant capacity and reliability during operation.

Metallurgical testing will also be undertaken and once all the equipment has been sized and a new flowsheet designed, water balance and connected power requirements will be determined that will, in turn, provide the basis for permitting and discussions with the Comision Federal de Electricidad - the federal electrical commission. The existing power line comes to within about three kilometres of the plant, but a new or upgraded substation may need to be established to provide sufficient power to the site. Potential areas for a dry-stack tailings storage facility were also examined as a means of water recovery and conservation.

Further details will be provided as the assessment progresses.

Permitting

A permit consultant was taken to the project to initiate a site review for the purpose of permitting near-term diamond drilling, mid-term mine development and site preparation, and future production. As anticipated, the Company was advised that the previous disturbance of the site by historic activity will significantly speed up and simplify the permitting process. Guidelines on the requirements for baseline studies, to include extensive photos, soil and water samples, etc. were discussed and a compilation of this material has already been initiated. A more formal proposal from the consultant will be submitted to the Company within the next two weeks, whereby the permitting process can get underway.

At a higher level, meetings were held with the Company's corporate and environmental lawyers to discuss the anticipated process of completing and filing permit applications with the authorities in such a way as to minimize any potential delays.

QA/QC

The technical results contained in this news release have been reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). Pinnacle has implemented industry standard practices for sample preparation, security and analysis given the stage of the Project. This has included common industry QA/QC procedures to monitor the quality of the assay database, including inserting certified reference material samples and blank samples into sample batches on a predetermined frequency basis.

The systematic chip channel sampling was completed across exposed mineralized structures using a hammer and maul. The protocol for sample lengths established that they were not longer than two metres or shorter than 0.3 metres. The veins tend to be steeply dipping to vertical, and so these samples are reasonably close to representing the true widths of the structures. Samples were collected along the structural strike or oblique to the main structural trend.

All samples were bagged in pre-numbered plastic bags; each bag had a numbered tag inside and were tied off with adhesive tape and then bulk bagged in rice bags in batches not to exceed 40 kg. They were then numbered, and batch bags were tied off with plastic ties and delivered directly to the SGS laboratory facility in Durango, Mexico for preparation and analysis. The lab is accredited to ISO/IEC 17025:2017. All Samples were delivered in person by the contract geologist who conducted the sampling under the supervision of the QP.

SGS sample preparation code G_PRP89 including weight determination, crushing, drying, splitting, and pulverizing was used following industry best practices where all samples were crushed to 75% less than 2 mm, riffle split off 250 g, pulverized split to >85% passing 75 microns (μm). All samples were analyzed for gold using code GA_FAA30V5 with a Fire Assay determination on 30g samples with an Atomic Absorption Spectography finish. An ICP-OES analysis package (Inductively Coupled Plasma - Optical Emission Spectrometry) including 33 elements and 4-acid digestion was performed (code GE_ICP40Q12) to determine Ag, Zn, Pb, Cu and other elements.

Qualified Person

Mr. Jorge Ortega, P. Geo, a Qualified Person, and independent from Pinnacle, as defined by National Instrument 43-101, and the author of the NI 43-101 Technical Report for the Potrero Project, has reviewed, verified and approved for disclosure the technical information contained in this news release.

About the Potrero Property

El Potrero is located in the prolific Sierra Madre Occidental of western Mexico and lies within 35 kilometres of four operating mines, including the 4,000 tonnes per day (tpd) Ciénega Mine (Fresnillo), the 1,000 tpd Tahuehueto Mine (Luca Mining) and the 250 tpd Topia Mine (Guanajuato Silver).

High-grade gold-silver mineralization occurs in a low sulphidation epithermal breccia vein system hosted within andesites of the Lower Volcanic Series and has three historic mines along a 500 metre strike length. A historic resource based upon underground sampling of those three mines is reported to consist of 45,561 tonnes at 8.0 g/t gold and 186 g/t silver. (These resources are historical in nature and Pinnacle is not treating these estimates as current mineral resources as a qualified person on behalf of Pinnacle has not done sufficient work to classify them as current mineral resources.) The property has been in private hands for almost 40 years and has never been systematically explored by modern methods, leaving significant exploration potential.

A 100 tpd plant on site can be refurbished / rebuilt and historic underground mine workings rehabilitated at relatively low cost in order to achieve near-term production once permits are in place. The property is road accessible with a power line within three kilometres. Surface rights covering the plant and mine area are privately owned (no community issues).

Pinnacle will earn an initial 50% interest immediately upon commencing production. The goal would then be to generate sufficient cash flow with which to further develop the project and increase the Company's ownership to 100% subject to a 2% NSR. If successful, this approach would be less dilutive for shareholders than relying on the equity markets to finance the growth of the Company.

About Pinnacle Silver and Gold Corp.

Pinnacle is focused on district-scale exploration for precious metals in the Americas. The addition of the high-grade Potrero gold-silver project in Mexico's Sierra Madre Belt complements the Company's project portfolio and provides the potential for near-term production . In the prolific Red Lake District of northwestern Ontario, the Company owns a 100% interest in the past-producing, high-grade Argosy Gold Mine and the adjacent North Birch Project with an eight-kilometre-long target horizon . With a seasoned, highly successful management team and quality projects, Pinnacle Silver and Gold is committed to building long -term , sustainable value for shareholders.

Signed: "Robert A. Archer"

President & CEO

For further information contact :

Email: info@pinnaclesilverandgold.com

Tel.: +1 (877) 271-5886 ext. 110

Website: www.pinnaclesilverandgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release .

Copyright (c) 2025 TheNewswire - All rights reserved.