March 22, 2023

Results indicate exceptionally high phosphate bioavailability, highlighting the opportunity to produce organic fertilisers for agricultural applications

Australian sustainable rare earths company RareX Limited (ASX: REE) (RareX or the Company) is pleased to advise that recent testwork on samples from the Cummins Range Rare Earths & Phosphate Project in WA has confirmed the potential to produce phosphate Direct Shipping Ore (DSO) and phosphate mineral concentrate, with both products showing strong potential as direct-application agricultural fertiliser.

Results from initial phosphorous bioavailability tests on DSO and phosphate mineral concentrate – both of which are anticipated co-products with rare earths from Cummins Range – show the material possesses very high bioavailability, that is two-to-five times better than what has been classified as high-bioavailable rock phosphate by industry standard.

This unlocks a variety of development scenarios for the Cummins Range Project, including:

- A DSO product could be produced initially, meaning very low levels of processing and capital would be required to develop a readily saleable and marketable phosphate product line that is in demand in the fertiliser trade.

- A premium-grade phosphate concentrate product could also be produced from the Cummins Range deposit for direct-application fertiliser. Previous testwork has already demonstrated a simple beneficiation flowsheet and low reagent consumptions1, suggesting low capital and operating costs. In addition, the beneficiation circuit for phosphate concentrate production could be integrated as part of the rare earth beneficiation process in the longer-term, supporting enhanced project development.

Direct-application fertilisers are classified as organic as they do not require chemical reaction with sulphuric acid to make the phosphate derivative products. In addition, they often have favourable properties for plants’ uptake. Direct-application phosphates, where the natural mineral form remains unadulterated, can be produced at a discount while also trading at a premium to processed phosphates.

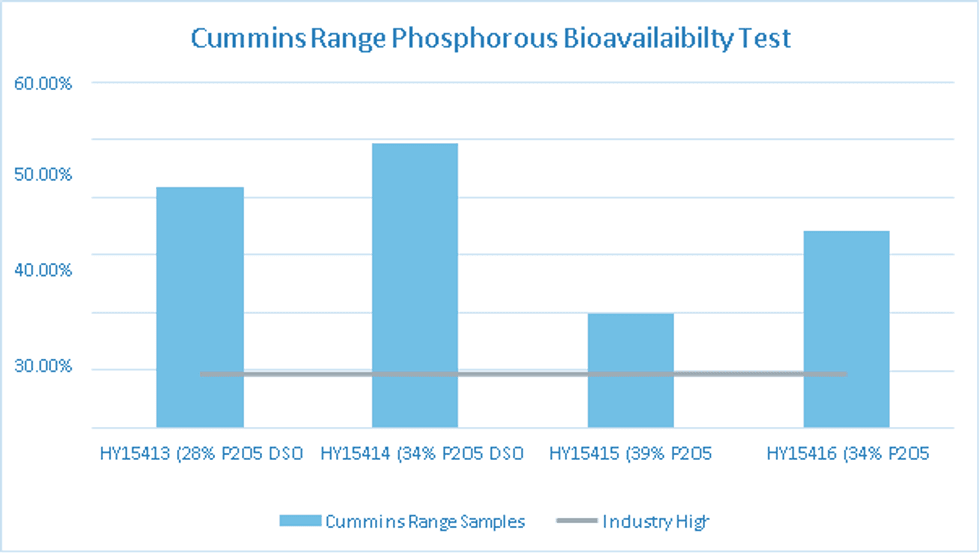

The testwork undertaken to assess the phosphorous bioavailability of the Cummins Range mineralisation was a 2% citric acid test, which is an industry standard bioavailability assessment. The tests simulated the soil conditions and were performed on four resource samples – two DSO samples and two phosphate float concentrate samples.

The results of the tests are shown in Figure 1 with comparison to industry standard. As illustrated, the phosphorous dissolutions of all samples are shown to be multiples of what is typically considered high by industry standards (>9.4% P2O5 dissolution in 2% citric acid).

This is an outstanding result which suggests the Cummins Range material will be ideal for use as direct- application fertiliser.

It should also be noted that all potentially deleterious elements (fluorine, cadmium, uranium and chlorine) have come back within normal specifications, and no further deleterious elements are present.

RareX Managing Director, Jeremy Robinson, said: “This is a standout result for the Cummins Range Rare Earths & Phosphate Project as it delivers outstanding flexibility for the Project’s development – with the potential to commence with an ultra-low capital, high-margin starter project producing organic direct- application phosphate fertiliser, before moving into a longer-term rare earths and phosphate concentrate project. The best comparison for the starter project would be to a DSO iron ore operation – it would literally be dig-and-ship. Direct fertiliser deposits are globally scarce, making Cummins Range a rare development.”

Tests on the phosphate co-product are being undertaken in parallel with rare earth metallurgical testwork programs, which are also delivering promising results. An update on the rare earth metallurgy will be made in due course.

Click here for the full ASX Release

This article includes content from RareX, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

REE:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00