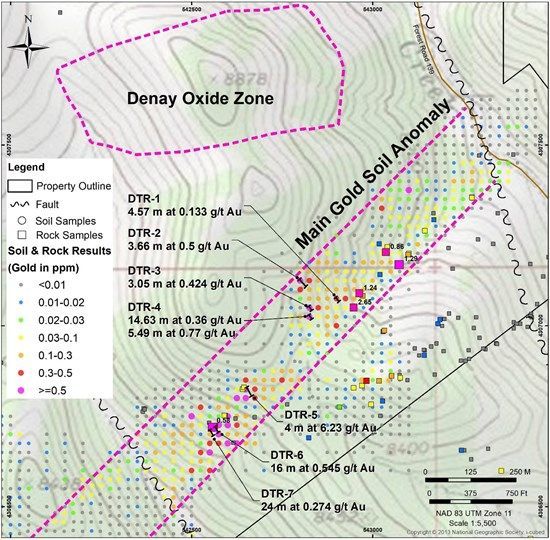

Phenom Resources Corp. (TSXV: PHNM,OTC:PHNMF) (OTCQX: PHNMF) (FSE: 1PY0) ("Phenom" or the "Company") is pleased to report that preliminary prospecting and mapping have identified a new sizable oxidized and altered zone 700 metres long and 300 metres wide at Dobbin. The newly identified zone hosted in Denay Formation limestone is 400 metres northwest of the main gold soil anomaly (see Figure 1). Alteration and pathfinder geochemistry is promising. Rocks within the new zone are moderately oxidized with both limonite and hematite, and moderately to strongly decalcified, locally. Very limited rock chip sample results are available to date, all showing strongly anomalous arsenic values between 140 and 1070 ppm and mercury values between 8 and 20 ppm, typical pathfinders to Carlin-type gold systems. Gold values are weakly anomalous to 31 ppb. Additional rock sample assays are pending. Additional focused prospecting, sampling and mapping are planned to evaluate this new zone. This zone will likely be a candidate for grid soil sampling. The zone may reflect a deeper target than that in the main gold soil anomaly. It clearly indicates a larger system and possibly a greater opportunity at Dobbin.

Figure 1: New Denay Oxide Zone and Hand Trench Results in Main Gold Soil Anomaly

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3372/263050_e11e193234c359e6_001full.jpg

In further news, the Company is pleased to report additional gold assays from chip sampling of mineralized bedrock within the main +2.1 kilometres long (1.3 miles) and 200 meters (660 feet) wide gold soil anomaly at Dobbin. In late June, the company hand-dug seven shallow trenches which exposed bedrock and delivered gold grades and continuity characteristic of a Carlin gold system. The seven initial hand-dug trenches ranged in length from 13 metres to 26 metres and were oriented perpendicular to the indicated trend of the soil anomaly and located over selected elevated gold soil sample sites with the objective of reproducing gold values in bedrock and determining the degree of grade continuity between soil sample sites. Highlights of four trenches are reported in Table 1.

Table 1: Trench Highlights from DTR-01 to DTR-04

| Trench ID | Length (m) | Length (ft) | Averaged grade (g/t Au) |

| DTR-01 | 4.57 | 15 | 0.133 |

| DTR-02a | 1.52 | 5 | 0.532 |

| DTR-02b | 3.66 | 12 | 0.50 |

| including | 1.83 | 6 | 0.73 |

| DTR-03 | 3.05 | 10 | 0.424 |

| DTR-04 | 14.63 | 48 | 0.36 |

| Including | 5.49 | 18 | 0.772 |

| including | 3.66 | 12 | 0.928 |

In each of the seven trenches, including those reported in the July 29, 2025 press release, mineralization was open at one or both end with ending assays between 0.206 and 10.35 g/t Au. The Company plans to extend the lengths of each trench.

In addition, four grab samples taken over a 200-metre length of the main soil gold anomaly east of trench DTR-01 returned values of between 0.858 g/t Au and 2.65 g/t Au.

ON BEHALF OF Phenom Resources Corp.

per: "Paul Cowley"

CEO & President

(604) 340-7711

pcowley@phenomresources.com

www.phenomresources.com

Technical disclosure in this news release has been reviewed and approved by Paul Cowley, a Qualified Person as defined by National Instrument 43-101, director, President and CEO to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263050