June 06, 2022

Tempus Resources Ltd (“Tempus” or the “Company”) (ASX: TMR, TSX.V: TMRR, OTCQB: TMRFF) is pleased to announce the results from the Phase 2 sampling program at the Valle del Tigre Project (VdT) located in south-eastern Ecuador. The Phase 2 program was a larger scale follow-up to the initial reconnaissance work conducted during February 2021 where areas with anomalous gold and copper were discovered (see Tempus announcement dated 25 March 2021).

HIGHLIGHTS

- Soil geochemistry sampling results reconfirm the presence of copper and gold mineralization at Valle del Tigre – highlighting two zones of anomalous copper and gold values within the 5 km2 survey area

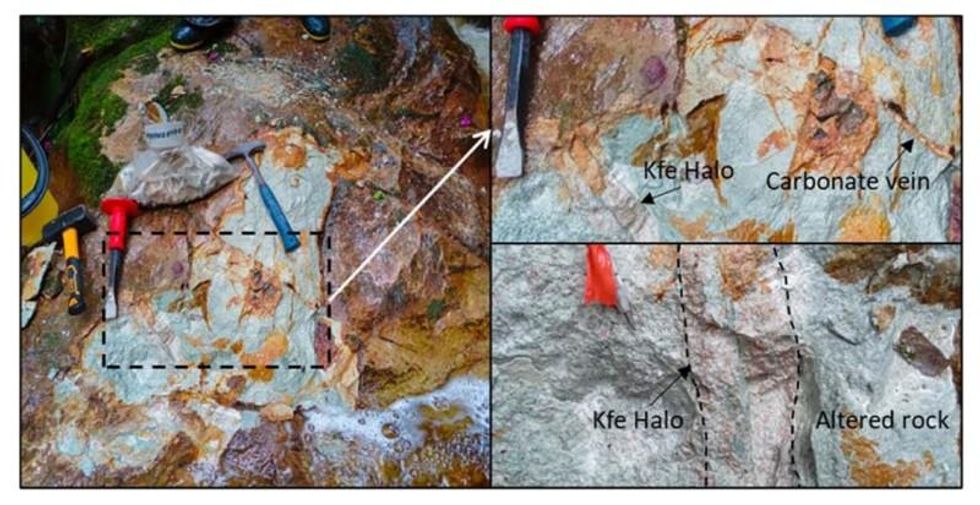

- Copper-bearing minerals, chalcopyrite and bornite observed within the survey area, as well the presence of sericite and potassic alteration

- Anomalous copper and gold results correlate with 3 km geophysical anomaly “footprint” of target mineralisation zone identified in previous ZTEM fly over survey

Results from the Phase 2 sampling program reconfirm the presence of gold and copper mineralization at Valle del Tigre and show a direct correlation with the geophysical anomalies generated by the airborne geophysical survey (ZTEM) work that Tempus conducted on the project in 2019.

Tempus President & CEO, Jason Bahnsen commented “The results of our Phase 2 exploration program at Valle del Tigre highlight the potential of the project for both copper and gold mineralisation. The MMI soil geochemistry results have identified two strongly anomalous areas within the overall 3km geophysical footprint that we will target for further exploration work. The Vdt project is centrally located in a major copper porphyry mineralisation trend that hosts several major copper deposits.”

The Phase 2 exploration program included a Mobile Metals Ion (MMI) geochemistry soil sampling survey over an area of approximately 5 square kilometres in addition to rock and stream sediment samples. In total 505 MMI soil samples were collected, together with 53 rock samples and 48 stream sediment samples.

In 2019, Tempus conducted a ZTEM, Magnetics and Radiometrics helicopter-borne geophysical survey over the VdT license area (see Tempus announcement dated 15 December 2019). The airborne geophysics defined two east-west trending magnetic highs which are transected by a strong northeast trending ZTEM anomaly that extends for over 3 km in length. At other regional copper porphyry projects including, Panantza, Mirador and Warintza, the copper mineralization occurs in east trending zones with a similar orientation to the two magnetic anomalies that occur at VdT.

The Phase 2, MMI soil, rock and stream sediment sample results have identified two anomalous areas that display good coincidence for copper, gold, molybdenum and bismuth (see Figure 2 and Figure 3). Chalcopyrite and bornite plus sericite and potassic alteration was observed within the sample area.

Tempus is currently completing further analysis and review of the geochemical and geophysical results with regard to next steps towards refining target locations for a future drill program.

Valle del Tigre is centrally located in a newly emerging copper porphyry belt that includes the El Hito and Santa Barbara deposits to the south (Lumina Gold) and Mirador, Panantza and Warintza deposits to the northeast (Figure 1).

There are strong geological similarities between VdT and Warintza and Mirador with the Hollin Formation unconformably overlying the Misahualli Formation which is underlain by the older Zamora Batholith (see Figure 2). Copper mineralization in the northern part of the copper district is associated with a younger intrusive phase of the Zamora Batholith which has been dated as upper Jurassic in age.

QA/QC

All samples were collected by Tempus Resources under the supervision of Mr. Sonny Bernales (CPG, QP) who maintained chain of custody until delivery of the samples to SGS Laboratories in Lima, Peru for preparation and analysis. SGS’s facility in Lima, Peru is accredited to the ISO 9001 standard for assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria.

The Phase 2 exploration program was conducted between 30 January 2022 to 23 February 2022. In total 505 MMI soil samples were collected, together with 53 rock samples and 48 stream sediment samples.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TMR:AU

The Conversation (0)

25 February 2021

Tempus Resources

Exploration in Established Gold Trends in Canada and Ecuador

Exploration in Established Gold Trends in Canada and Ecuador Keep Reading...

2h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

15h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

18h

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00