July 18, 2025

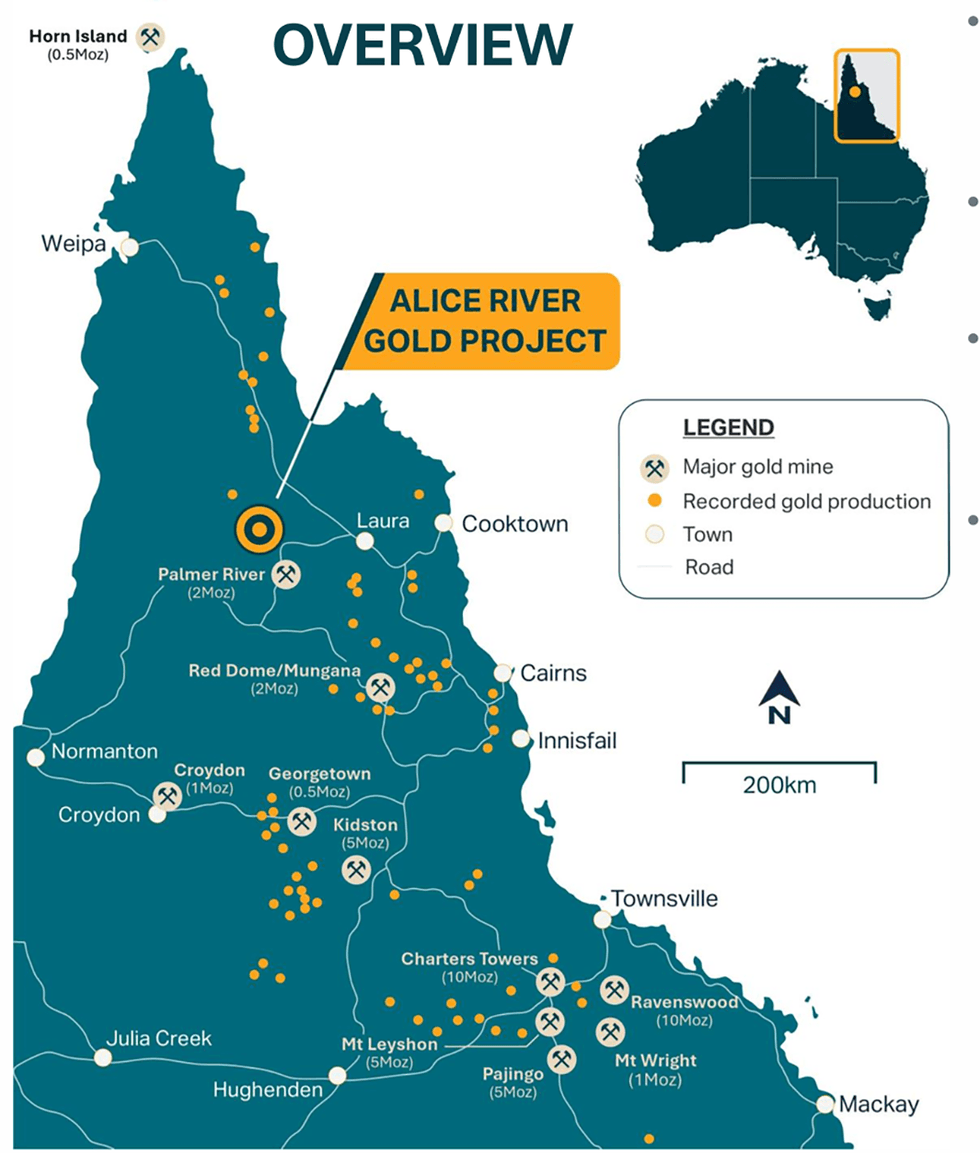

Pacgold (ASX:PGO) is an Australian gold exploration company advancing the high-potential Alice River Gold Project in Northern Queensland. Led by a technically driven and experienced team with proven success across exploration, resource development, and capital markets, Pacgold is applying a systematic, discovery-focused approach to unlock the project’s value.

The company holds a dominant 377 sq km land package, including eight mining leases, along the highly prospective Alice River Fault Zone (ARFZ) — a major structural corridor interpreted to host an intrusion-related gold system analogous to globally significant deposits such as Fort Knox (USA) and Hemi (WA).

The Alice River Gold Project is a large-scale, greenstone-hosted gold system located in Northern Queensland, centered along the regionally significant Alice River Fault Zone (ARFZ). The project covers 377 sq km of contiguous tenure, including eight granted mining leases.

Pacgold controls over 30 km of strike length along the ARFZ — a major crustal-scale structure that has only recently been the focus of systematic exploration using modern techniques, offering significant untapped discovery potential.

Company Highlights

- District-scale Discovery Potential: Pacgold controls more than 377 sq km of tenure and more than 30 km of strike length across the Alice River Fault Zone (ARFZ), a fertile, underexplored structural corridor in Northern Queensland.

- Maiden Resource: In May 2025, the company published a 474,000 oz gold mineral resource estimate (MRE), covering just five percent of the total strike, confirming high-grade mineralization and strong potential for expansion.

- Aggressive Exploration Strategy: More than 10,000 metres of RC drilling campaign is underway, complemented by air-core and diamond programs, aimed at growing the Central Zone resource and testing multiple regional targets.

- Attractive Valuation Entry: With a market capitalization of just ~AU$10 million and an EV of AU$8.5 million (as of Q1 2025), Pacgold provides a low-cost entry into a potentially Tier 1 gold system.

- Experienced Leadership: The board includes proven mine developers and discovery geologists with prior success at Chalice, AngloGold Ashanti, BHP and Sibanye-Stillwater.

This Pacgold profile is part of a paid investor education campaign.*

Click here to connect with Pacgold (ASX:PGO) to receive an Investor Presentation

PGO:AU

Sign up to get your FREE

Pacgold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

Pacgold

Advancing Tier-1 exploration at Alice River in Northern Queensland and leveraging near-term gold production at White Dam in South Australia

Advancing Tier-1 exploration at Alice River in Northern Queensland and leveraging near-term gold production at White Dam in South Australia Keep Reading...

24 February

Profit Share Agreement on Wadnaminga Project

Pacgold (PGO:AU) has announced Profit Share Agreement on Wadnaminga ProjectDownload the PDF here. Keep Reading...

22 February

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Pacgold (PGO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Further High Grade Antimony Results from St George Drilling

Pacgold (PGO:AU) has announced Further High Grade Antimony Results from St George DrillingDownload the PDF here. Keep Reading...

06 January

Imminent Gold Production and Cashflow from White Dam Project

Pacgold (PGO:AU) has announced Imminent Gold Production and Cashflow from White Dam ProjectDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Pacgold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00