December 04, 2023

Surefire Resources NL (“Surefire” or “the Company”) is delighted to announce the results of the Pre-Feasibility Study (PFS) for the Company’s flagship Victory Bore Project, located close to existing infrastructure with direct transport links to Geraldton Port in Western Australia.

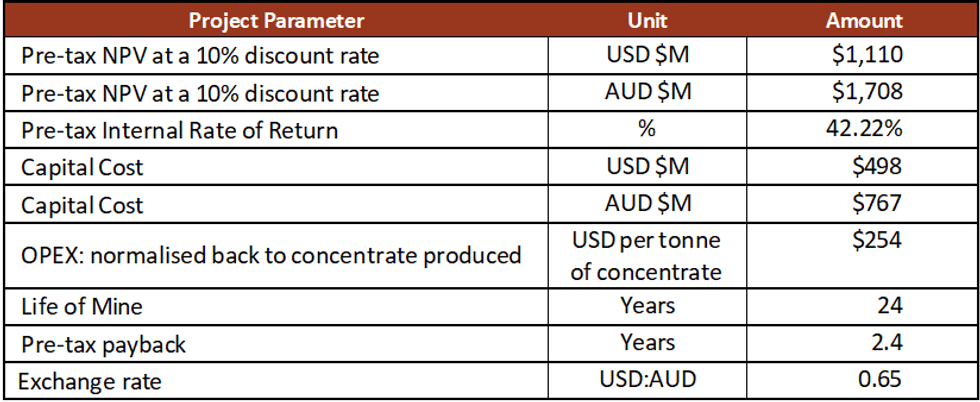

- The Victory Bore Pre-Feasibility Study (PFS) has been completed on time, and on-budget by METS Engineers, Snowden-Optiro and other key specialists. A summary of the financial results are shown in the body of this announcement.

- An updated Mineral Resource of 465 Mt @ 0.30% V2O5, 5.1% TiO2 and 17.7% Fe (Measured, Indicated and Inferred Resources) was reported in accordance with the JORC Code (2012).

- A maiden probable Ore Reserve of 93 Mt @ 0.35% V2O5, 5.2% TiO2 and 19.8% Fe was reported in accordance with the JORC Code (2012).

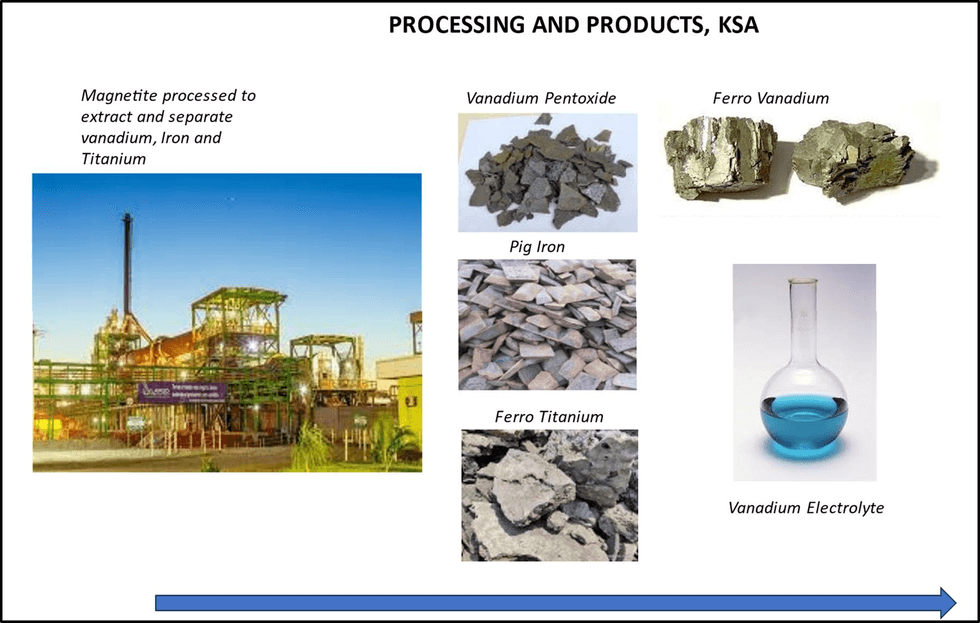

- The operation will involve an optimal mining rate of 4 Mt/a of ore to produce approximately 1.25 Mt/a of high-grade magnetite concentrate to be processed into six end products.

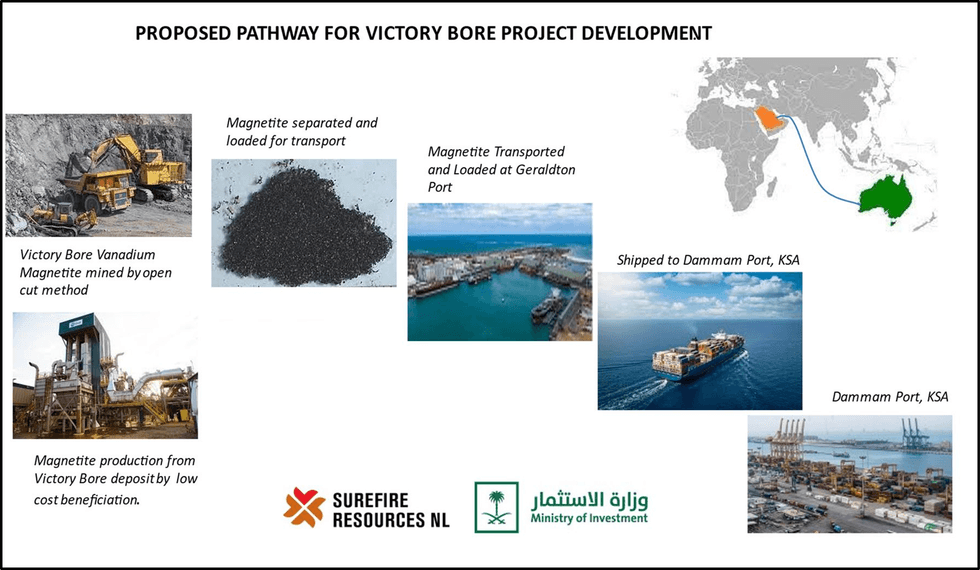

- Mining and magnetite concentration to occur at Victory Bore in Western Australia. Magnetite concentrates to be bulk shipped to the Kingdom of Saudi Arabia (KSA) for downstream processing into final high value end products.

- Mining will be by standard open cut methods: low strip ratio, drill and blast, load and haul.

- Downstream processing will use traditional methods with modern applications and state of the art flow processing.

- Processing in KSA has significant advantages with lower Operating and Capital Costs and close proximity to markets. The KSA Government has proposed downstream processing to be located in one of the industrial hubs specifically designated for Ferro-Alloy processing.

The Company has commenced discussions with interested Saudi companies as partners in the KSA processing operation, and is arranging meetings at the forthcoming Future Minerals Forum (FMF) being held January 2024 in Riyahd, KSA.

The PFS was completed to an accuracy of +/- 25% to 35%, on time, and on-budget and undertaken by METS Engineers, Snowden Optiro, together with other specialist groups providing reliable cost estimates, and using conservative commodity pricing.

The Company’s approach to this maiden and landmark study of the Victory Bore Project is to use industry standard processing for a range of products to maximise the value, allowing for a reliable and demonstrable low-risk business concept. These outstanding financial results demonstrate that offshore processing is the correct approach in a global economic backdrop of rising capital and operating costs (Figure 1).

The Company has a non-binding Memorandum of Understanding (MoU) in place with the Ministry of Investment Saudi Arabia (MISA) for vanadium and critical mineral processing in the Kingdom of Saudi Arabia (see ASX announcement 16 August 2023).

The Company’s engagement with the Kingdom of Saudi Arabia (KSA) as a low power and fuel cost jurisdiction, allows the project significant advantages of reduced operating costs, and producing final products for nearby markets. The KSA has a significant steel sector with demand for vanadium products, including ferrovanadium and vanadium electrolyte for Vanadium Redox Batteries.

Management Comment: Mr Paul Burton, Surefire Resources Managing Director said “This is an outstanding result for our world class critical minerals project and shows that in the current economic environment, offshore processing is the right approach to getting this project into development and production. We look forward to taking this project forward, completing the next significant milestones and engaging with KSA companies interested in being part of our project and development”.

SUMMARY OF KEY PFS RESULTS

Surefire has based the PFS on producing approximately 1.25 million tonnes per year (Mt/a) of high quality vanadium- titanium magnetite concentrate at the Victory Bore mine site in Western Australia, and to produce up to six products from that concentrate in KSA:

- 2,580 t/a High purity vanadium

- 5,760 t/a of Ferrovanadium

- 192,880 t/a of Titanium slag

- 364,480 t/a of Pig iron

- 245,480 t/a of High purity iron oxide pigment

- 245,480 t/a of High grade iron ore

Note: The final product mix may differ in a future Feasibility Study as processes may be optimised further to maximise recoveries and revenues.

Click here for the full ASX Release

This article includes content from SUREFIRE RESOURCES NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Vanadium Market Forecast: Top Trends for Vanadium in 2026

The vanadium market remained subdued in H1 2025, weighed down by persistent oversupply and weak usage from the steelmaking sector, even as new demand avenues like energy storage gained attention.Price data shows that vanadium pentoxide in major regions such as the US, China and Europe traded in... Keep Reading...

20 January

Carbon Black Substitute Memorandum of Understanding

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer and developer of the large Balasausqandiq vanadium deposit in Southern Kazakhstan, is pleased to announce that it has entered into a non-binding, non-exclusive, memorandum of understanding ("MOU") for the supply of up to 360,000... Keep Reading...

25 July 2025

Top 5 Australian Mining Stocks This Week: Vanadium Resources Soars on DSO Offtake Deal

Welcome to the Investing News Network's weekly round-up of Australia’s top-performing mining stocks on the ASX, starting with news in Australia's resource sector.This week, gold companies continued to shine in Australia, joined by battery and base metals explorers and developers. In corporate... Keep Reading...

02 July 2025

QEM Appoints Robert Cooper as Director, following Leadership Transition

Critical minerals and energy company QEM Limited (ASX: QEM) is pleased to announce completion of the previously announced Leadership Transition (refer ASX Announcement 29 May 2025). Highlights: Seasoned global mining executive Robert Cooper has completed a comprehensive handover and is appointed... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00