November 23, 2025

CuFe Limited (ASX: CUF) (the Company), is pleased to announce a significant update to the Orlando Copper / Gold Resource at its 55% owned Tennant Creek Project. The update is a result of incorporating and estimating the bismuth, silver and other metals contained within the drill hole data into the Mineral Resource Estimate (MRE), with the previous June 2025 Resource update being restricted to copper and gold only.

KEY POINTS

- JORC 2012 Mineral Resource Estimate update has been completed for the Orlando Deposit located at the Tennant Creek Project now including Bismuth and Silver.

- The new Mineral Resource Estimate has seen the inclusion of 4,421t of Bismuth contained metal and 266k ounces of silver.

- The Combined Tennant Creek Resource operated by CuFe now totals 24.4 Mt at 1.80% Cu and 0.55 g/t Au, including 18,224 tonnes of contained bismuth metal and 2.03 Moz of silver metal, consolidating it as one of Australia’s largest Bismuth Resources.

- The Bismuth and Silver mineralisation are coincident with the copper and gold mineralisation envelopes, occurring as high-grade pods within the ore lenses and are likely to add significant value to the project economics.

- Orlando Scoping Study to be updated to reflect the inclusion of these sought after commodities

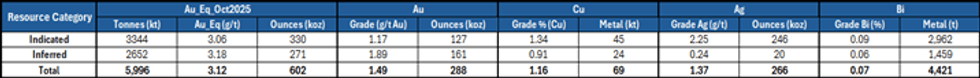

MEC as a technical consultant to CuFe has produced a MRE update for the Orlando deposit based on the inclusion of Bismuth and Silver from the drill hole data base, the results are summarised in Table 1. This update follows a detailed technical review into bismuth (refer to CUF ASX announcement dated 21 October 2025) where significant intercepts of bismuth were identified in both historical and more recent drilling.

Notes:

- Mineral Resources are reported above a 1.0 g/t Au equivalent cut-off.

- The model has been depleted with open pit and underground workings and a 5m buffer around underground workings applied to account for sterilised, unstable and or unrecoverable ore.

- A 5% buffer zone had been applied to historical underground workings and these tonnes are sterilised and not included in the resource

- The gold equivalent value is derived from the following formula: Au_eq = Au (g/t) + (Cu (%) x 1.38) + (Ag g/t *0.0095) + (Bi % *0.00015)

- The gold equivalent calculation used for reporting at Orlando only assumes a gold price of US$4,000/oz for gold, US$9,250/t for total copper, bismuth price of US$15,000/t and silver price of US$30/oz and assumes an 88% recovery for gold, 87% recovery for copper, 80% recovery for bismuth and 80% recovery for silver. US/AUD exchange rate of $0.67.

- Apparent differences may occur due to rounding.

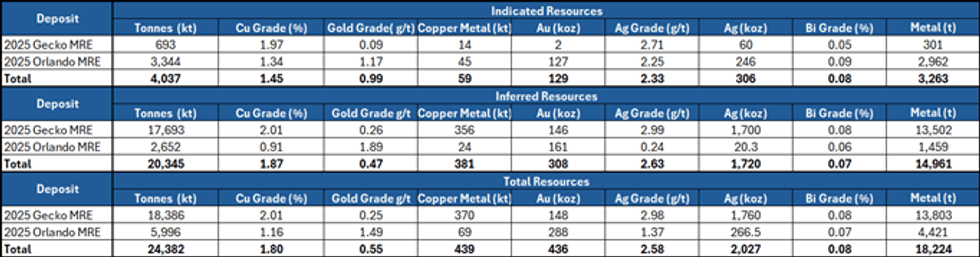

The update to the Orlando Resource increases the Tennant Creek Project Resource to 24.4 Mt at 1.80% Cu and 0.55 g/t Au, and includes 18,224t of bismuth metal and 2.03 Moz of silver (See Table 2), cementing the assets as significant deposits within both the Tennant Creek Mineral Field and the Northern Territory.

- Gecko MRE is reported above a 1.0% copper cut-off (reported in CUF ASX release dated 18th August 2025).

- The Gecko MRE copper equivalent value is derived from the following formula: 𝐶𝑢𝐸𝑞 = 𝐶𝑢 %+(𝐴𝑢 𝑔/𝑡 ×0 .68)+ (𝐴𝑔 𝑔/𝑡 ×0.0089)+ (𝐵𝑖 𝑔/𝑡×0.00014)

- The Gecko MRE copper equivalent calculation used for reporting at Gecko assumes a US$9,250/t for total copper, gold price of US$2,200/oz for gold, bismuth price of US$15,000/t and silver price of US$30/oz and assumes an 94% recovery for copper, 83.8% recovery for gold, 80% recovery for bismuth and 80% recovery for silver. US/AUD exchange rate of $0.67.

- Orlando MRE is reported above a 1.0 g/t Au equivalent cut-off.

- The gold equivalent calculation used for reporting at Orlando only assumes a gold price of US$4,000/oz for gold, US$9,250/t for total copper, bismuth price of US$15,000/t and silver price of US$30/oz and assumes an 88% recovery for gold, 87% recovery for copper, 80% recovery for bismuth and 80% recovery for silver. US/AUD exchange rate of $0.67.Apparent differences may occur due to rounding.

Commenting on the Mineral Resource Estimates, CuFe Executive Director, Mark Hancock, said:

“This resource update has boosted the project’s bismuth resources of Orlando and Gecko to 18,224 tonnes, and over 2Moz of silver and has consolidated CuFe’s position as a holder of one of the largest bismuth resources in Australia at a point in time where global supply concerns for this critical mineral are growing. As context the Tennant Creek bismuth resource is now approximately one year of global production for this critical mineral, which is an excellent position for an emerging company such as ours. The resource update allows us to study and determine what the optimum revenue streams of what are now truly poly metallic deposits and understand their impacts of capital and operational costs. The mineral field has been a producer of a considerable amount of bismuth and silver in the past as by-products of copper and gold and the quantum of the metal content across the Orlando and Gecko resource provides numerous opportunities to explore which have not been tested under modern day metal prices and economics”.

Click here for the full ASX Release

This article includes content from CuFe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CUF:AU

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

02 February

Government Funding to Unlock Critical Metals Processing

CuFe Limited (CUF:AU) has announced Government Funding to Unlock Critical Metals ProcessingDownload the PDF here. Keep Reading...

29 January

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

20 October 2025

Review Highlights High Grade Bismuth Intercepts at Orlando

CuFe Limited (CUF:AU) has announced Review Highlights High Grade Bismuth Intercepts at OrlandoDownload the PDF here. Keep Reading...

14 October 2025

Placement to Raise $5.4 Million

CuFe Limited (CUF:AU) has announced Placement to Raise $5.4 MillionDownload the PDF here. Keep Reading...

6h

Nuvau Closes Acquisition of Matagami Property from Glencore

Gains ownership and control over one of the largest, strategically located, prolific geologic environments for critical and precious metals in Quebec, CanadaNuvau Minerals Inc. (TSXV: NMC,OTC:NMCPF) (the "Company" or "Nuvau") has achieved a significant milestone on the road toward a production... Keep Reading...

7h

Bold Ventures Inc.: Invitation to PDAC 2026 Booth 2610

Visit Bold Ventures Inc. (TSXV: BOL,OTC:BVLDF) at Booth #2610 at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Sunday, March 1 to Wednesday, March 4, 2026. About Bold Ventures Inc.At PDAC 2026, Bold (Booth 2610) will... Keep Reading...

7h

Transition Metals Corp. Vests 100% Interest in Pike Warden Property; Announces $1M Financing

Transition Metals Corp. (TSXV: XTM) ("Transition", "the Company"), is pleased to announce that it has vested a 100% interest in the Pike Warden property, a porphyry-epithermal exploration asset located in southern Yukon. This acquisition consolidates the Company's control over the property and... Keep Reading...

7h

Oreterra Announces Closing of $9.3 Million First Tranche of Oversubscribed and Upsized $9.7 Million Non-Brokered Private Placement, Second Tranche to Close March 4

Oreterra Metals Corp. (TSXV: OTMC,OTC:RMIOD) (OTCID: OTMCF) (OTCID: RMIOD) (FSE: D4R0) (WKN: A421RQ) ("Oreterra" or the "Company") is pleased to announce that, further to its press releases of February 10, 2026, February 12, 2026, February 18, 2026 and February 19, 2026, it has closed the first... Keep Reading...

21h

Closing date for director nominations

Cygnus Metals Limited (ASX:CY5) advises, in accordance with ASX Listing Rule 3.13.1, that the Annual General Meeting of the Company ("Meeting") will be held in West Perth, Western Australia on Friday, 1 May 2026. Further details in respect of the Meeting will be provided in the Notice of Meeting... Keep Reading...

01 March

Bold Ventures Signs Agreement to Acquire 6 Key Claims Contiguous to its Joutel Property, Quebec

Bold Ventures Inc. (TSXV: BOL,OTC:BVLDF) (the "Company" or "Bold") is pleased to announce that it has signed an agreement dated February 27, 2026 (the "Vending Agreement") with 2099840 Ontario Inc. oa Emerald Geological Services ("EGS") to acquire 6 staked mining claims (the "Additional Claims")... Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00