Origen Resources Inc. (CSE: ORGN) (FSE: 4VXA) is pleased to announce results from the recently completed induced polarization ("IP") geophysical program on the Company's 100% owned Wishbone Gold-Silver Project (the "Property"), located in the prolific Golden Triangle in northern British Columbia.

Key Highlights:

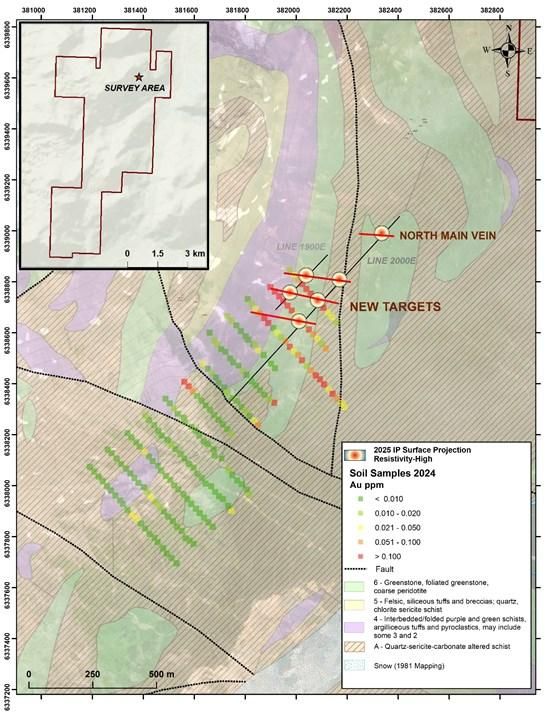

The survey tested known gold-silver vein mineralization at the Windy target and extended 700 m further SW to explore an extensive > 50 ppb Au-in-soil anomaly.

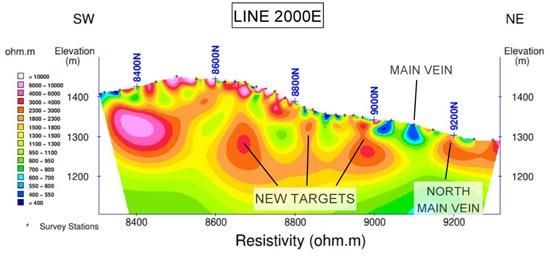

Two Au-bearing veins show distinct responses. North Main Vein corresponds to a resistivity high while the Main Vein corresponds to a distinct resistivity low with high chargeability.

Similar features are identified underlaying the Au-in-soil anomaly.

Survey results encourage a more extensive survey to support a 3D inversion model.

"We are pleased that IP appears to be a viable exploration tool to explore this target rich project. Known gold veins at the Windy showing were detected as resistivity features and a significant series of new resistivity targets have been revealed corresponding with strongly anomalous gold values in soil from the 2024 exploration campaign. We are excited to expand this survey over other targets on the Property in preparation for diamond drilling in summer 2026," states Gary Schellenberg, CEO and Director.

Wishbone is adjacent to the Galore Creek2 project jointly owned by Teck Resources and Newmont. Covering 3,941 ha, The Property has 11 target areas encompassing high-grade gold-silver quartz-carbonate vein as well as volcanogenic massive sulphide style mineralization, including the newly exposed Lake showing discovered in August of 2024 (see news release dated November 26, 2024). Here, several boulders have been found at the base of the rapidly retreating Central Glacier with values exceeding 90 ppm gold, including one returning 202.6 ppm gold1.

The IP Survey

In early September, SJ Geophysics performed a 2-line IP survey over the Windy mineralized area totalling 1.3 line-km. A Volterra Distributed Acquisition System was employed, and data was acquired using an in-line array with 25 m and 50 m dipoles. Current injections occurred every 25-50 m and were situated northeast of the in-line array. The two survey lines of 300m and 1000m length were spaced 100 m apart and ran roughly NE/SW (Figure 1).

The IP survey identified features interpreted to correspond with two known Au-bearing quartz veins (North Main Vein, Main Vein) at the Windy occurrence with distinct resistivity high and low features and chargeability low and high features respectively. Additionally, a series of signatures over a 400 m interval starting approximately 200 m SW of the Main Vein are interpreted to reflect similar structures crossing the survey line. Near surface combined resistivity and chargeability lows for 200 m south of the Main Vein correlate with alteration mapping. Based on the results of this initial survey, the Company plans to conduct an expanded IP survey that will support 3D modelling in preparation for a drilling campaign in 2026.

Figure 1 - Resistivity Highs on Surface with 2024 Au-in-Soil Geochemical Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7117/275955_6551d1e3e442c9c1_001full.jpg

Figure 2 - Line 2000E Showing Known Veins and New Targets on Section, Looking NW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7117/275955_6551d1e3e442c9c1_002full.jpg

1Grab samples are by definition selective. Grab samples are solely designed to show the presence or absence of mineralization and are not intended to provide nor should be construed as a representative indication of grade or mineralization at the Project.

2 Referenced nearby historic resources, deposits and mines provide geologic context for the Project, but are not necessarily indicative that the Project hosts similar potential, size or grades of mineralization.

John Harrop, P.Geo., a Qualified Person as that term is defined in NI 43-101, has supervised the preparation, or approved the scientific and technical disclosure in the news release. Mr. Harrop is employed by Coast Mountain Geological Ltd. He is not independent of the Company as defined in NI 43-101.

About Origen

Origen Resources Inc. is a project generator focused on identifying and advancing high-potential mineral exploration opportunities. The Company is currently conducting due diligence on a prospective rare earth element project in Brazil under a recently signed Letter of Intent, while continuing to advance its 100%-owned Los Sapitos Lithium Project in Argentina and the Wishbone Gold-Silver Project in the Golden Triangle of British Columbia. Origen also holds a portfolio of three additional precious and base metal projects in southern British Columbia for which it is actively seeking partners.

On behalf of Origen,

Gary Schellenberg

For further information, please contact:

Phone: 604-681-0221 / ir@origenresources.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Certain of the statements made and information contained herein may constitute "forward-looking information." In particular references to the private placement and future work programs or expectations on the quality or results of such work programs are subject to risks associated with operations on the property, exploration activity generally, equipment limitations and availability, as well as other risks that we may not be currently aware of. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275955