February 27, 2024

Trinex Minerals Limited (ASX: TX3) (Trinex Minerals or the Company) is pleased to announce that its wholly-owned Canadian subsidiary, Trinex Lithium Ltd (Trinex Canada), has executed a binding Letter of Intent (LOI) with TSX-V listed ALX Resources Corporation (TSX-V: AL) (ALX) in relation to the acquisition by Trinex Canada of up to a 75% interest in the Gibbons Creek Uranium Project in Northern Saskatchewan by way of an option and earn-in arrangement (Gibbons Creek Earn-In).

Key Points:

- Option to acquire an initial 51% interest in the highly prospective Gibbons Creek Uranium Project in the Athabasca Basin, Northern Saskatchewan, Canada, with the potential to increase to a 75% interest.

- Project fully permitted for exploration drilling with three high priority target areas identified for immediate follow-up work and drilling.

- Exclusivity for 90-day period to negotiate and finalise definitive agreements for an option/earn-in agreement.

- Firm commitments received from sophisticated and institutional investors for a placement to raise A$1.25 million (before costs), giving the Company a cash balance of over A$4 million at settlement.

- Funds raised will be used towards exploration at Gibbons Creek Uranium Project.

The Company is also pleased to announce that it has received firm commitments from Australian and overseas institutional and sophisticated investors (including certain Directors of the Company) to raise approximately A$1.25 million (before costs) under a oversubscribed placement of 250,000,000 fully paid ordinary shares (Shares) at an issue price of A$0.005 per share (Placement) to fund exploration at Gibbons Creek during the first year of the earn-in period.

Further details in relation to the Gibbons Creek Uranium Project, the Gibbons Creek Earn-In and the Placement are set out below.

Trinex Minerals’ Managing Director, Will Dix said:

“The Athabasca Basin is an outstanding jurisdiction for uranium deposits and Trinex is delighted to gain exposure in this world class region.

“This earn-in represents a unique opportunity to gain further exposure to energy minerals in Canada, to complement our existing portfolio of prospective lithium projects in the Northwest Territories. With the on- ground assistance of our major shareholder, Dahrouge Geological Consulting, we are excited to bring local exploration expertise to unlock the value of this new asset.

“The funds realised from the placement will enable the Company to conduct exploration activities for the first year on this advanced project. Three target areas have already been identified and an ALX drilling program will commence in March, after which point Trinex will lead exploration activities.

“I would like to thank our shareholders for their ongoing support and look forward to providing updates from the drill program as we make progress.”

Gibbons Creek Uranium Project

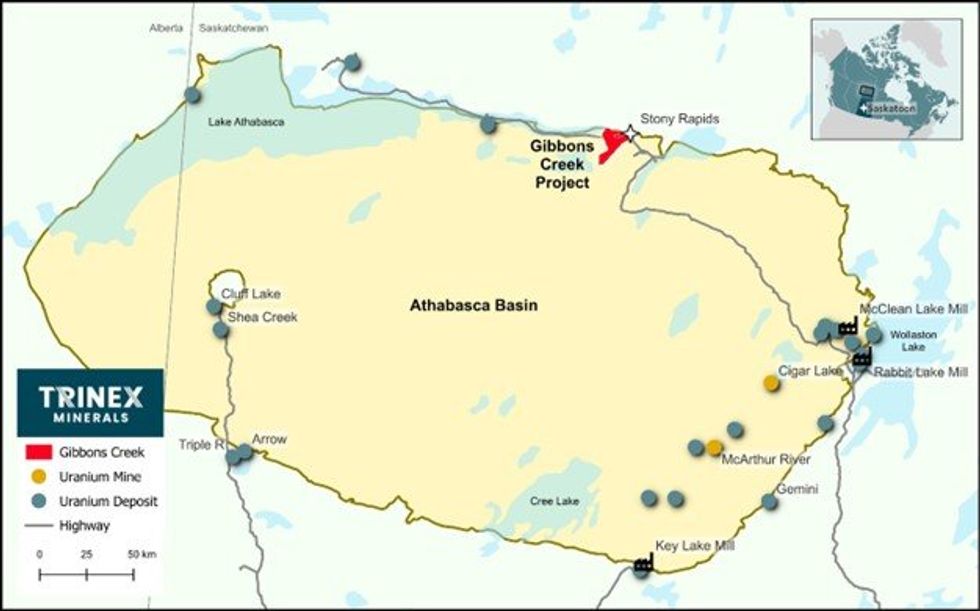

The Gibbons Creek Uranium Project (Project) comprises eight mineral dispositions covering an area of 139km2. The Project is located on the northern flank of the highly prospective Athabasca Basin in Northern Saskatchewan, home to all of Canada’s operating uranium mines and mills (see Figure 1 and Annexure A).

The Project offers immediate walk-up drilling opportunities (see Figure 2) with the first program to commence in March 2024 at the Airstrip Prospect. In this target area, ALX has planned up to six holes for around 1,200m to test unconformity-type and basement-hosted uranium mineralisation in the eastern part of the Project. This drilling follows up anomalous uranium mineralisation in previous drilling (discussed below). Mobilisation of equipment and personnel is planned for the first week of March with drilling scheduled to commence on or around March 7.

In addition, previously acquired geophysical data will be re-processed where appropriate using modern processing algorithms to ensure all material information is extracted to optimise exploration potential. A reassessment of geophysical requirements will then be made to address whether any additional data should be acquired in the vicinity of key target areas.

Gibbons Creek Uranium Project – Background and Historical Activities

Sporadic exploration has occurred in the Athabasca Basin since the first discovery of uranium there in the 1970s. Since discovery and production commenced in 1975, the basin has produced over 900 million pounds of U3O8 and is today the location of the only operating uranium mines in Canada (Cigar Lake and McArthur River) (see Figure 1).

At Gibbons Creek, exploration for uranium first commenced in the 1970s and over the following two decades a number of geophysical surveys and shallow drilling programs were completed. Notably, Eldorado Nuclear completed 23 drill holes during the 1980s in the northern part of the project which broadly intersected weakly anomalous uranium close to or on the contact between the overlying Athabasca Basin sandstone and underly mesoproterozoic rocks of the Tantato domain. Eldorado also noted the presence of radioactive boulders on the project, however their provenance is unknown at this stage.

Between 1986 and 2005 very little work was completed with the exception of one airborne EM (GeoTEM) survey and one ground EM (ProTEM) survey and a single gravity profile completed by Uranium Power in 1999 across what is now the southern section of the Gibbons Creek Project. Publicly available reports lodged with the Government of Saskatchewan state that the Fixed Loop survey returned “encouraging results” due to the presence of conductors interpreted to be “graphitic basement rocks”, however the conductors remain completely untested by drilling and require further work.

More recently, work has concentrated in the “Airstrip Zone” close to the community of Stony Rapids where a number of small scale, targeted gravity and Z-TEM surveys were completed between 2013 and 2017 by Lakeland Resources1 and ALX, with some data from the Z-TEM survey considered unusable due to uncertainties around georeferencing for locations.

In addition to the geophysics surveys, a small number of drillholes were completed in 2015 (18 holes) by Lakeland Resources and in 2022 (3 holes) by ALX. Two holes that intersected anomalous uranium include GC15-02 (drilled by Lakeland Resources) and GC22-02 (drilled by ALX). Both holes intersected anomalism on the unconformity between the Athabasca Sandstone and the basement and are associated with a graphitic unit. Of note, GC15-02 also intersected strongly anomalous boron within the graphitic schist on the unconformity. Boron is often used as the main pathfinder mineral to uranium mineralisation in the Athabasca. The location of these drill holes, as well as the target areas for the 2024 drill campaign, are shown in Figure 2. Figures 3 and 4 show strip logs of holes GC15-02 and GC22-02 with various elements shown.

Click here for the full ASX Release

This article includes content from Trinex Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00