OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) ("OceanaGold" or the "Company") is pleased to announce positive results from its exploration and resource conversion drilling programs at the Haile Gold Mine ("Haile") in the United States .

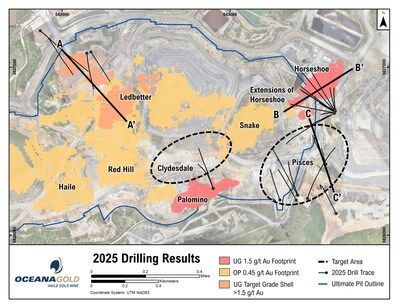

Gerard Bond , President and CEO of OceanaGold, said "With a record high exploration budget of $10 million at Haile this year, we are delighted by the excellent return on investment we continue to generate through exploration. These exciting results continue to demonstrate the continuity of high-grade mineralization at several deposits across the property, notably at Ledbetter Phase 4, Horseshoe Underground, and the promising new early-stage Pisces and Clydesdale targets. The exploration success continues to highlight the exceptional upside for low-risk organic growth we have within our existing portfolio of assets."

Drilling Highlights (core length):

Ledbetter Phase 4 (conversion drilling)

- 28.9 m @ 18.33 g/t Au (DDH1279)

- 8.7 m @ 22.30 g/t Au (DDH1281)

Horseshoe (conversion drilling)

- 16.1 m @ 16.33 g/t Au (UGD0082)

- 14.6 m @ 10.33 g/t Au (UGD0084)

- 24.0 m @ 7.99 g/t Au (UGD0085)

- 22.0 m @ 8.60 g/t Au (UGD0086)

- 10.2 m @ 11.12 g/t Au (UGD0084)

Pisces (Initial drilling, located 300 m south of Horseshoe)

- 7.6 m @ 10.39 g/t Au (DDH1271)

- 6.6 m @ 3.34 g/t Au (DDH1290)

Clydesdale ( initial drilling, located 100 m northwest of Palomino )

- 26.2 m @ 4.11 g/t Au (DDH1282)

Results can be viewed in 3D using VRIFY at the following link:

https://vrify.com/meetings/recordings/c880f1e8-449e-41a1-916c-125c8df72661

VRIFY note: Drill results reflect only those set forth in OceanaGold's press release dated September 11, 2025 , and do not include all historical drill results except those relevant to the current targets in this release.

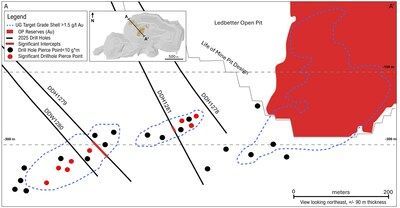

Ledbetter Phase 4 – High-Grade Results Targeting Underground Resource Conversion

Mineralization in Ledbetter Phase 4 is located within the current final phase of the open pit Mineral Reserve (Figure 1). An ongoing resource conversion drill program is enhancing resource confidence and providing samples for metallurgical testing in support of the current trade-off study for the evaluation of a potential underground mine at Ledbetter, which has potential for improved overall site economics.

A zone of mineralization, down-dip of Ledbetter Phase 4 extension, has been tested with a total of four holes, or 1,975 metres ("m"). The program has returned results with strong mineralized intersections: 28.9 m @ 18.33 g/t Au from 489.1 m including 1.3 m @ 189.22 g/t (DDH1279), and 8.7 m @ 22.30 g/t Au from 375.9 m including 5.0 m @ 35.86 g/t (DDH1281).

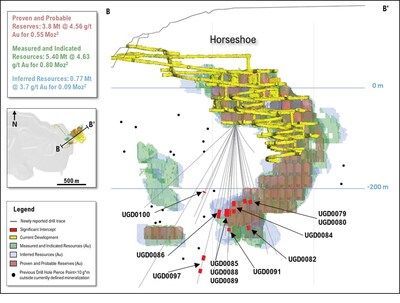

Horseshoe Underground – Support for Additional Resource Growth

At Horseshoe Underground, drilling continues on both resource conversion and definition programs, totalling 7,467 m from 24 holes since the February 2025 news release. Conversion drilling totalling 4,261 m in 14 holes has targeted Inferred Mineral Resources in the lower levels of the deposit. Notable intercepts include: 16.1 m @ 16.33 g/t Au from 274.3 m (UGD0082) and 14.6 m @ 10.33 g/t from 235.6 m (UGD0084), 24.0 m @ 7.99 g/t from 258.6 m (UGD0085) and 22.0 m @ 8.60 g/t from 259.3 m (UGD0086); the latter three holes extending high-grade mineralization to the southwest.

Definition drilling totalling 10 holes for 3,206 m has targeted step-out opportunities, primarily south and west of the current resource. Assay results for nine holes have been received with the following significant intercepts: 7.6 m @ 3.63 g/t Au from 271.0 m and 9.1 m @ 3.40 g/t Au from 299.9 m (UGD0097) and 5.0 m @ 5.64 g/t Au from 267.9 m (UGD0100). The definition drill program is ongoing with 2,600 m remaining to be drilled in 2025. These results demonstrate the potential for continued resource growth, and drilling will remain focused on further defining step-out targets to support future underground development.

Pisces – Initial Drilling of High-Grade Target

The Pisces target is located along the prospective corridor between the Horseshoe and Palomino deposits at approximately 550 m below surface and close to existing and planned underground infrastructure.

A total of nine holes for 6,167 m has been drilled in 2025, with the testing of geological and grade continuity. Significant intercepts include: 7.6 m @ 10.39 g/t Au from 647.0 m (DDH1271), 6.8 m @ 2.60 g/t Au from 571.0 m (DDH1285) and 6.6 m @ 3.34 g/t Au (DDH1290), demonstrating continuity of mineralization in the eastern area of the target towards Horseshoe. See the VRIFY link for visual representation of the results.

In conjunction with previously reported results, 44.2 m @ 10.85 g/t Au from 591 m (DDH1267), 9.4 m @ 44.14 g/t Au from 686.1 m (DDH1269) and 42.7 m @ 6.07 g/t Au from 560.2 m (DDH1257), (released February 24, 2025 ), the highest-grade mineralization defines a 150 m strike length. This zone of higher-grade mineralization remains to be further tested, while the target remains open to the northeast towards Horseshoe and down-dip.

Clydesdale – Successful Early-Stage Result

The early-stage Clydesdale drill target is located 100 m northwest of Palomino and approximately 300 m stratigraphically lower at approximately 800 m below surface. The target is defined by anomalous gold grades in wall rock metasediments, anomalous pathfinder geochemistry, and alteration mineralogy (Table 2). A total of two holes totalling 1,600 m have been drilled in 2025 to test the target. Initial results have returned one significant intercept of 26.2 m @ 4.11 g/t Au from 780.7 m including 14.6 m @ 6.21 g/t Au (DDH1282). See the VRIFY link for visual representation of the results.

Follow-up drilling is ongoing with two additional holes to be completed by the end of the year for a total of 1,800 m .

| Table 1: Haile drill intersections subsequent to the February 24, 2025, drill results update. | |||||||||

| | |||||||||

| Hole ID | From | To | Interval | Au | Target | Activity | | ||

| DDH1278 | NSR | Ledbetter 04 | Conversion | | |||||

| DDH1279 | 489.1 | 519.2 | 28.9 | 18.33 | Ledbetter 04 | Conversion | | ||

| Including | 505.5 | 506.8 | 1.3 | 189.22 | Ledbetter 04 | Conversion | | ||

| DDW1280 | NSR | Ledbetter 04 | Conversion | | |||||

| DDH1281 | 375.9 | 384.5 | 8.7 | 22.30 | Ledbetter 04 | Conversion | | ||

| Including | 375.9 | 380.9 | 5.0 | 35.86 | Ledbetter 04 | Conversion | | ||

| UGD0079 | 197.2 | 206.4 | 9.1 | 2.49 | Horseshoe | Conversion | | ||

| And | 275.5 | 276.9 | 1.4 | 12.14 | Horseshoe | Conversion | | ||

| UGD0080 | 207.6 | 213.5 | 5.9 | 3.56 | Horseshoe | Conversion | | ||

| UGD0081 | NSR | Horseshoe | Conversion | | |||||

| UGD0082 | 274.3 | 290.3 | 16.1 | 16.33 | Horseshoe | Conversion | | ||

| UGD0083 | NSR | Horseshoe | Conversion | | |||||

| UGD0084 | 235.6 | 250.2 | 14.6 | 10.33 | Horseshoe | Conversion | | ||

| Including | 244.8 | 247.8 | 3.1 | 37.14 | Horseshoe | Conversion | | ||

| And | 263.0 | 273.3 | 10.2 | 11.12 | Horseshoe | Conversion | | ||

| UGD0085 | 258.6 | 282.6 | 24.0 | 7.99 | Horseshoe | Conversion | | ||

| UGD0086 | 259.3 | 281.3 | 22.0 | 8.60 | Horseshoe | Conversion | | ||

| UGD0088 | 238.6 | 247.8 | 9.2 | 1.97 | Horseshoe | Conversion | | ||

| UGD0089 | 217.2 | 231.7 | 14.5 | 2.46 | Horseshoe | Conversion | | ||

| And | 236.0 | 243.8 | 7.8 | 9.24 | Horseshoe | Conversion | | ||

| Including | 242.7 | 243.4 | 0.7 | 42.60 | Horseshoe | Conversion | | ||

| UGD0090 | NSR | Horseshoe | Conversion | | |||||

| UGD0091 | NSR | Horseshoe | Conversion | | |||||

| UGD0092 | NSR | Horseshoe | Conversion | | |||||

| UGD0093 | NSR | Horseshoe | Conversion | | |||||

| UGD0094 | NSR | Horseshoe | Definition | | |||||

| UGD0095 | NSR | Horseshoe | Definition | | |||||

| UGD0096 | NSR | Horseshoe | Definition | | |||||

| UGD0097 | 271.0 | 278.6 | 7.6 | 3.63 | Horseshoe | Definition | | ||

| And | 299.9 | 309.1 | 9.1 | 3.40 | Horseshoe | Definition | | ||

| UGD0098 | NSR | Horseshoe | Definition | | |||||

| UGD0099 | NSR | Horseshoe | Definition | | |||||

| UGD0100 | 267.9 | 272.9 | 5.0 | 5.64 | Horseshoe | Definition | | ||

| UGD0101 | NSR | Horseshoe | Definition | | |||||

| UGD0102 | NSR | Horseshoe | Definition | | |||||

| UGD0103 | NSR | Horseshoe | Definition | | |||||

| DDH1271 | 647.0 | 654.6 | 7.6 | 10.39 | Pisces | Initial Drilling | | ||

| DDH1272 | 551.4 | 563.6 | 12.2 | 0.26 | Pisces | Initial Drilling | | ||

| DDH1274 | 607.5 | 609.0 | 1.5 | 3.21 | Pisces | Initial Drilling | | ||

| DDH1277 | 599.4 | 600.8 | 1.4 | 1.02 | Pisces | Initial Drilling | | ||

| DDH1285 | 522.3 | 529.8 | 7.5 | 1.79 | Pisces | Initial Drilling | | ||

| And | 571.0 | 577.8 | 6.8 | 2.60 | Pisces | Initial Drilling | | ||

| DDH1286 | 627.7 | 632.0 | 4.3 | 0.57 | Pisces | Initial Drilling | | ||

| DDH1290 | 642.4 | 648.9 | 6.6 | 3.34 | Pisces | Initial Drilling | | ||

| DDH1293 | 536.2 | 543.4 | 7.2 | 2.56 | Pisces | Initial Drilling | | ||

| UGD0109 | 413.0 | 431.3 | 18.3 | 0.22 | Pisces | Initial Drilling | | ||

| DDH1276 | 400.5 | 406.6 | 6.1 | 2.30 | Clydesdale | Initial Drilling | | ||

| DDH1282 | 768.6 | 772.4 | 3.8 | 5.27 | Clydesdale | Initial Drilling | | ||

| DDH1282 | 780.7 | 806.9 | 26.2 | 4.11 | Clydesdale | Initial Drilling | | ||

| Including | 792.2 | 806.9 | 14.6 | 6.21 | Clydesdale | Initial Drilling | | ||

| | | | | | | | | | |

Notes:

- Intervals are core length, not true width.

"Initial Drilling" intercepts are associated with early-stage exploration drilling, "Definition" drilling intercepts are intercepts outside the current resource model shell directed at defining mineralization to an Inferred Resource category and "Conversion" drilling are intercepts converting Inferred Resources to Indicated Resources category. NSR = No Significant Result.

| Table 2: Historical and OGC Haile drill intersections relevant to the Ledbetter 04, Pisces, and Clydesdale target areas. | ||||||

| | ||||||

| Hole ID | From | To | Interval | Au | Target | Activity |

| DDH0436 | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0439 | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0450 | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0451 | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0461 | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0632^ | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0638^ | 469.2 | 478.9 | 9.8 | 2.42 | Ledbetter 04 | Initial Drilling |

| DDH0646^ | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0653^* | 465.8 | 478.1 | 12.3 | 1.82 | Ledbetter 04 | Initial Drilling |

| DDH0686^ | NSR | Ledbetter 04 | Initial Drilling | |||

| DDH0841^ | 401.4 | 407.5 | 6.1 | 3.81 | Ledbetter 04 | Initial Drilling |

| DDH1201^ | NSR | Ledbetter 04 | Advanced Drilling | |||

| DDH1207^ | NSR | Ledbetter 04 | Advanced Drilling | |||

| DDH1208^ | NSR | Ledbetter 04 | Advanced Drilling | |||

| DDH1213^ | 468.3 | 481.8 | 13.5 | 2.95 | Ledbetter 04 | Advanced Drilling |

| DDH1252^ | NSR | Ledbetter 04 | Conversion | |||

| DDH1253^ | NSR | Ledbetter 04 | Conversion | |||

| DDH1255^ | 431.9 | 443.8 | 11.9 | 2.88 | Ledbetter 04 | Conversion |

| DDH1256^ | 431.5 | 438.2 | 6.7 | 2.63 | Ledbetter 04 | Conversion |

| DDH1260^ | NSR | Ledbetter 04 | Conversion | |||

| RC2002 | NSR | Ledbetter 04 | Initial Drilling | |||

| RC2019 | NSR | Ledbetter 04 | Initial Drilling | |||

| RC2058 | 441.9 | 461.8 | 19.8 | 5.27 | Ledbetter 04 | Initial Drilling |

| RC2064 | NSR | Ledbetter 04 | Initial Drilling | |||

| RC2067 | NSR | Ledbetter 04 | Initial Drilling | |||

| RC2108 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0050 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0067 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0068 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0088 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0134 | 432.8 | 445.0 | 12.2 | 2.16 | Ledbetter 04 | Initial Drilling |

| RCT0149 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0161 | 428.5 | 441.9 | 13.5 | 42.40 | Ledbetter 04 | Initial Drilling |

| Including | 429.8 | 431.3 | 1.5 | 318.52 | Ledbetter 04 | Initial Drilling |

| RCT0167 | 410.7 | 441.9 | 31.2 | 4.85 | Ledbetter 04 | Initial Drilling |

| RCT0203 | NSR | Ledbetter 04 | Initial Drilling | |||

| RCT0204 | 438.9 | 445.0 | 6.1 | 4.51 | Ledbetter 04 | Initial Drilling |

| DDH0599^ | NSR | Pisces | Initial Drilling | |||

| DDH0636^ | 545.4 | 550.9 | 5.5 | 2.81 | Pisces | Initial Drilling |

| And | 597.9 | 611.6 | 13.7 | 2.31 | Pisces | Initial Drilling |

| DDH1067^ | NSR | Pisces | Initial Drilling | |||

| DDH1204^ | NSR | Pisces | Initial Drilling | |||

| DDH1245^ | NSR | Pisces | Initial Drilling | |||

| DDH1247^** | NSR | Pisces | Initial Drilling | |||

| RCT0012 | 356.6 | 358.1 | 1.5 | 9.10 | Pisces | Initial Drilling |

| And | 399.3 | 413.0 | 13.7 | 3.24 | Pisces | Initial Drilling |

| RCT0028 | NSR | Pisces | Initial Drilling | |||

| RCT0077 | NSR | Pisces | Initial Drilling | |||

| RCT0080 | 144.8 | 152.4 | 7.6 | 2.21 | Pisces | Initial Drilling |

| And | 193.6 | 202.7 | 9.1 | 3.89 | Pisces | Initial Drilling |

| And | 251.8 | 262.1 | 10.4 | 4.31 | Pisces | Initial Drilling |

| RCT0091 | 528.8 | 538.0 | 9.1 | 5.61 | Pisces | Initial Drilling |

| RCT0146 | NSR | Pisces | Initial Drilling | |||

| DDH1177^ | 527.7 | 535.2 | 7.5 | 3.65 | Palomino | Initial Drilling |

| RCT0051 | 510.5 | 521.4 | 10.9 | 1.65 | Clydesdale | Initial Drilling |

| And | 634.0 | 649.8 | 15.9 | 1.90 | Clydesdale | Initial Drilling |

| And | 713.2 | 725.4 | 12.2 | 3.16 | Clydesdale | Initial Drilling |

| RCT0110 | 269.8 | 281.9 | 12.2 | 1.89 | Clydesdale | Initial Drilling |

| And | 507.2 | 511.9 | 4.7 | 3.33 | Clydesdale | Initial Drilling |

| And | 526.8 | 538.0 | 11.2 | 3.41 | Clydesdale | Initial Drilling |

| And | 774.2 | 780.3 | 6.1 | 3.39 | Clydesdale | Initial Drilling |

| And | 823.0 | 827.5 | 4.6 | 5.36 | Clydesdale | Initial Drilling |

| RCT0117 | 502.9 | 509.0 | 6.1 | 2.22 | Clydesdale | Initial Drilling |

| And | 600.5 | 614.2 | 13.7 | 3.35 | Clydesdale | Initial Drilling |

| And | 641.6 | 649.2 | 7.6 | 1.66 | Clydesdale | Initial Drilling |

| And | 688.9 | 693.4 | 4.6 | 4.70 | Clydesdale | Initial Drilling |

| RCT0118 | 519.6 | 527.3 | 7.7 | 2.37 | Clydesdale | Initial Drilling |

Notes:

- Intervals are core length, not true width.

- "Initial Drilling" intercepts are associated with early-stage exploration drilling, while "Conversion" drilling are intercepts converting Inferred Resources to Indicated Resources category. NSR = No Significant Result. All data, apart from holes marked "^"represent historical drilling conducted by Romarco Minerals prior to OceanaGold's ownership of Haile

- "^" represents OceanaGold holes.

- "*" represents drill hole results reported by OceanaGold in its press release dated November 8, 2017 .

- "**" represents drill hole results reported by OceanaGold in its press release dated February 24, 2025 .

- All historical drill data collected by Romarco Minerals are considered historical in nature and based on prior data and reports prepared by Romarco Minerals. A qualified person from the Company has not undertaken independent investigation of the sampling nor has it independently analyzed the results of the historical drilling to verify the results. OceanaGold is not treating the historical data as current. There can be no assurance that any of the historical drill data is representative.

For further information relating to drill hole data please refer to the Company's website at https://investors.oceanagold.com/additional-drillhole-data .

About OceanaGold

OceanaGold is a growing intermediate gold and copper producer committed to safely and responsibly maximizing the generation of Free Cash Flow from our operations and delivering strong returns for our shareholders. We have a portfolio of four operating mines: the Haile Gold Mine in the United States of America ; the Didipio Mine in the Philippines ; and the Macraes and Waihi operations in New Zealand .

Qualified Person Statement

The scientific and technical information relating to the Haile exploration results contained in this press release has been reviewed and approved by Craig Feebrey, a Member of the Australasian Institute of Mining and Metallurgy and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101"). Mr. Feebrey is the Executive Vice President and Chief Exploration Officer of OceanaGold.

Quality Assurance and Quality Control ("QA/QC")

From July 2017 to 2025 almost all Haile exploration core samples have been prepared at the ALS lab in Tucson, Arizona , and analyzed at the ALS lab in Reno, Nevada , each of which is independent from OceanaGold. Select resource conversion core samples were also prepared and analyzed at the SGS lab in Kershaw, South Carolina in 2025 which is also independent from OceanaGold, with confirmation pulp duplicates sent to the ALS lab in Reno, Nevada . Samples are pulverized from a 250g (ALS) or 450g (SGS) sample to 85% passing 75 mesh. Approximately 225g of pulp sample is used for fire assay. Assays are based on a 30g fire assay aliquot for gold with Atomic Absorption finish. If the gold value from Atomic Absorption is >10g/t, an additional 30g of pulp sample is fire assayed for gold using a gravimetric finish. Some holes are composited and analyzed for carbon, sulphur and multi-elements using LECO and ICP-OES methods. Both ALS and SGS labs used for OceanaGold samples are ISO 17025 certified.

Blanks and standards are each inserted every 20th sample. Precision and accuracy of certified reference materials ("CRMs") compared to expected values have been consistently within 5% RSD and often within 3%. Barren marble and sand are inserted as blanks every 20th sample. CRMs from RockLabs and OREAS are inserted every 20th sample (5%). All blanks and CRMs are handled by the OceanaGold Geology Team and are stored in the locked OceanaGold office.

All drill hole samples are handled and transported from the drill rigs to the secured Haile Exploration warehouse by OceanaGold personnel or contractors. Access to the property is controlled by locked doors and cameras monitored by OceanaGold security. The main gate requires an electronic employee badge to enter. Samples are packaged at the Haile Exploration warehouse by OceanaGold geologists and geotechnicians. Samples are trucked in sealed plastic barrels by certified couriers with submittal forms that are verified during sample pick-up and delivery to ALS. No sample shipments have been recorded as missing or tampered with.

Technical Report

For further information, please refer to the following NI 43-101 technical report available on the SEDAR+ website at www.sedarplus.com under the Company's profile or on the Company's website at www.oceanagold.com : "NI 43-101 Technical Report Haile Gold Mine Lancaster County, South Carolina " dated March 28, 2024 , with an effective date of December 31, 2023 , prepared by D. Carr , D, Londoño, J. Moore and B. Drury (OceanaGold); L. Standridge and R. Cook (Call & Nicholas, Inc.); J.N. Janney-Moore and W.L. Kingston (NewFields Mining & Technical Services LLC); and M. Sullivan and B. Miller Clarkson (SRK Consulting (U.S.), Inc.).

Cautionary Statement for Public Release

This press release contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities laws which may include, but is not limited to, statements with respect to the estimation of Mineral Reserves and Resources, potential Mineral Reserves and Resources growth, the realization of Mineral Reserves and Resources estimates, costs and timing of the development of new deposits and, costs and timing of future exploration and drilling programs. Forward-looking statements and information relate to future performance and reflect the Company's expectations regarding the generation of Free Cash Flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking. They include, among others, those risk factors identified in the Company's most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR+ at www.sedarplus.com under the Company's name and on the Company's website. There are no assurances the Company can fulfil forward-looking statements. Such forward-looking statements are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/oceanagold-announces-ongoing-exploration-success-at-haile-302553815.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/oceanagold-announces-ongoing-exploration-success-at-haile-302553815.html

SOURCE OceanaGold Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/11/c8769.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/11/c8769.html