North Bay Resources, Inc. (the " Company " or " North Bay ") (OTC: NBRI) is pleased to announce analyses and compilation of prior exploration work at the Fran Gold Project has resulted in the discovery of a mass tonnage gold deposit. This includes review of diamond drilling in 2001, 2005, 2006, 2012, and 2018 as well as geochemical, geophysical and 3D modelling data. Past exploration and development, including over 18,000m (55,000ft.) of diamond drilling, has shown very large intercepts of up to 149m (489 feet) of 0.95 gram per ton gold. The deposit area has been identified to be in excess of 1000m x 100m x 300m within a known strike length of 1700m. This represents an exploration potential of 79,500,000 tonnes at a specific gravity of 2.65. At an average grade of 0.8 grams per tonne the current potential is 2M ounces. There is sufficient data to immediately proceed with a NI 43-101 Compliant Mineral Resource Estimate . The Fran Gold Project is next to Centerra Gold's (TSX:CG) Mt. Milligan Project, with Reserves of 264Mt grading 0.3 gram per tonne gold and 0.2% copper and proximate to Artemis Gold's (TSXV:ARTG) Blackwater Mine, with Proven and Probable Reserves of 334Mt grading 0.8 grams per tonne gold. Both Mt. Milligan and the Blackwater Mine are two of the largest new mines in North America in the modern era. The Blackwater Mine has a Measured and Indicated Resource in excess of 10M ounces of gold.

Historical exploration and development planning at Fran focused on delineation of mid-high grade veins with an eye to underground mining of these veins. Very limited focus was placed on bulk tonnage and disseminated gold, although discussed in reports from 2006, no follow-up appears to have occurred. North Bay's recent ongoing focus has been the development of mid-high grade surface material as feedstock for its Bishop Gold Mill. This in turn has led to a re-evaluation of the project potential resulting in what is currently a dual focus with high grade surface material going to the Company's mill and further evaluation of the larger potential of the mass tonnage gold deposit. Data indicates substantial expansion potential at depth (beyond 300m) and extensions of the disseminated gold zones to a limited extent to the West and to significant extent to the East and North-East where copper grades begin to rise. Drilling was stopped in these directions due to the loss of the mid-high grade veins that were the focus of historical exploration and these areas remain largely unexplored.

Significant Drill Intercepts from data compilation to date:

| Hole ID | From (m) | To (m) | Width (m) | Grade g/t |

| 2005-47 | 35.1 | 81.6 | 46.5 | 1.3 |

| 2006-49 | 104.0 | 133.0 | 29.0 | 1.0 |

| 2006-50A | 44.3 | 118.1 | 73.8 | 0.4 |

| 2006-51 | 60.4 | 100.7 | 40.2 | 0.8 |

| 2006-53 | 79.8 | 92.9 | 13.1 | 2.3 |

| 2006-55 | 15.9 | 110.3 | 94.5 | 0.3 |

| 2006-56 | 90.5 | 116.5 | 26.1 | 1.2 |

| 2006-58 | 61.4 | 157.4 | 96.0 | 0.3 |

| 2006-59 | 21.8 | 74.1 | 52.3 | 0.6 |

| 2006-60 | 90.5 | 131.5 | 41.0 | 0.7 |

| 2006-61 | 9.1 | 46.8 | 37.6 | 0.8 |

| 2006-62 | 79.9 | 150.3 | 70.5 | 0.4 |

| 2018-91 | 249.4 | 296.0 | 46.6 | 0.4 |

| 2018-94 | 222.0 | 339.2 | 117.2 | 0.6 |

| 2018-95 | 202.7 | 309.0 | 106.3 | 1.0 |

| 2018-96 | 134.7 | 284.0 | 149.3 | 0.9 |

| 2018-103 | 105.7 | 178.6 | 72.9 | 1.4 |

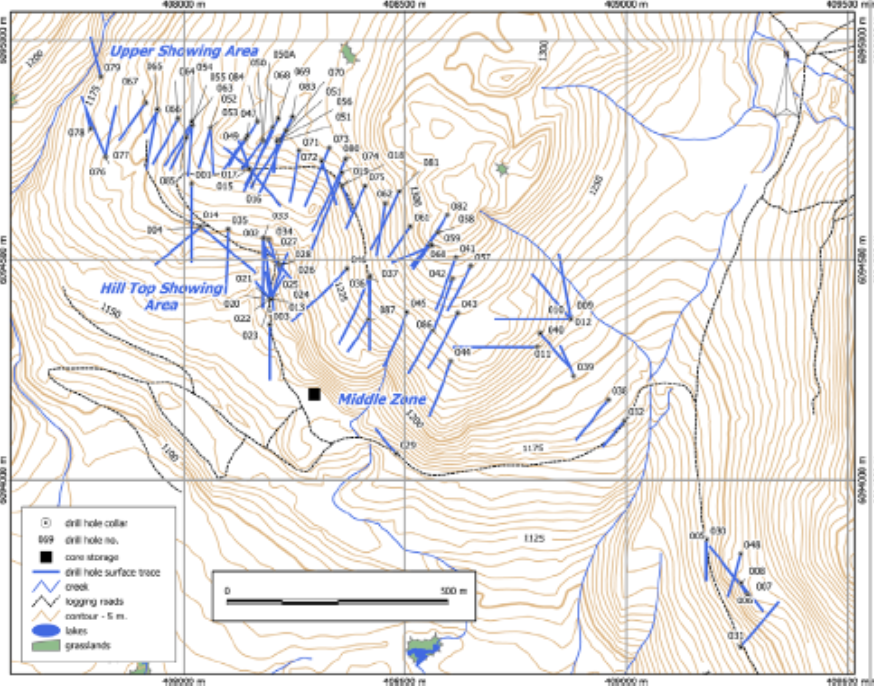

Figure 1. Fran Gold Diamond Drilling 2001-2012

Fran Gold exploration data and reports may be found on-line at ARIS BC, as well as the Company's website.

Corporate Update

The Company has reached an impasse with River Resources the Owner/Operator of the Mt. Vernon Mine whereby River Resources, has refused to operate or otherwise allow North Bay to operate the mine as per the Purchase Agreement regardless of payments, planning, permitting, metallurgy, and mine engineering. The origin of the dispute revolves around River Resources attempted cancellation of the Purchase Agreement, whereby River Resources foisted a number of unreasonable last minute demands on North Bay days before commencement of operations at Mt. Vernon, including demanding 50% of gold produced and $20M in General Liability insurance be obtained by North Bay at a cost of over $1M. The timing of these demands was highly disruptive due to the time, energy, investment and cooperative work that had gone into preparation for operations in addition to the valid standing agreement. As a result, North Bay engaged counsel and sought to find a mutually beneficial solution to allow operations to proceed. Despite these efforts River Resources recently corresponded with counsel indicating this was not likely. North Bay has retained Hall, Estill Law Firm who, as a result of the impasse, responded to River Resources that net direct damages of $390,000 per day for 10 weeks amounting to $19.5M was now due and damages if not remedied would be ongoing, as well as reservation of rights to the gold, mine, equipment, and other valuable minerals.

The Company has reached a mutual agreement with the lease-holders of the Taber Mine to terminate the Joint Venture Agreement effective April 1, 2025. The lease-holders have agreed to refund all payments to date.

On behalf of the Board of Directors of

North Bay ResourceS INC.

Jared Lazerson

CEO

X: @NorthBayRes

YouTube: North Bay Resources - YouTube

LinkedIn: North Bay Resources Inc | LinkedIn

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9c29f766-2620-4f85-abac-5f44ea18aff8