June 06, 2023

North Arrow Minerals (TSXV:NAR) leverages its decades of experience and knowledge exploring resources in Canada’s north to seize the opportunity in the fast-growing lithium market and bring to production several highly-promising spodumene pegmatite deposits in Northern Canada.

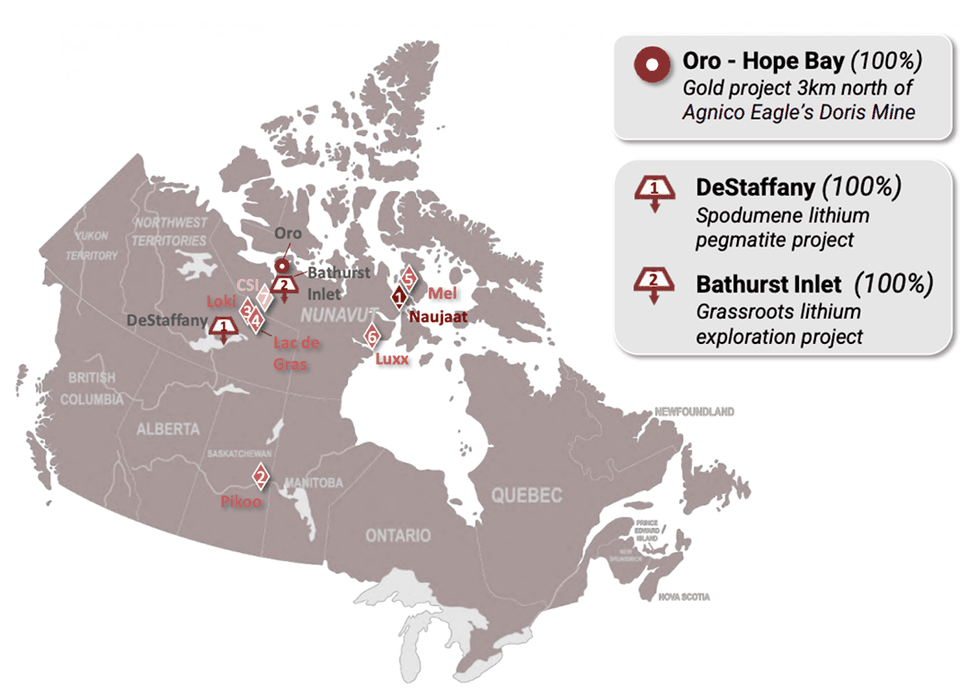

The company has had an extensive presence in Nunavut and the Northwest Territories for many years now. Its leadership is more than familiar with the many challenges of mining in the north establishing and maintaining strong relationships with both provincial governments and community leaders.

These community connections alongside North Arrow's expertise have already served it well. It has, thus far, established three major lithium projects in the North — DeStaffanay, Baffin Island and Bathurst Inlet.

Of these, DeStaffanay is the company's flagship and the resource with the greatest potential to rapidly bring spodumene lithium to market. Successfully staked at a significantly lower cost than its counterparts, the project hosts some incredibly promising lithium mineralization. It also has the benefit of being located on the shoreline of Great Slave Lake, ensuring easy access via barge, while old spodumene exposures, due to historical mining efforts, streamline both drilling and sample collection.

Company Highlights

- Lithium demand is rapidly outpacing supply, with a hard cap predicted as early as 2027.

- The market will reward any company that can bring spodumene lithium quickly to market.

- A junior mining and exploration company based primarily in Canada’s Northwest Territories and Nunavut, North Arrow Minerals has the potential to do precisely this.

- Its flagship project, DeStaffanay, was recently financed, and the company has plans to start an exploration program here in the very near term.

- North Arrow maintains two other promising lithium projects, both situated in Northern Canada.

- Through decades of experience, North Arrow's leadership has built strong relationships in the NWT and Nunavut. The company is a two-time winner of the Nunavut Mining Symposium Corporate Award, recognizing its contribution to the economic/social development of Nunavut.

- Strong relationships with governments and community leaders in the North.

- North Arrow’s management and directors have a successful track record of resource discovery and development in Canada’s North, with at least two discoveries going on to become successful mines.

- The company recently announced a successful non-brokered private placement financing run of $2 million.

- The company also maintains a strategic partnership with Panarc Resources, the goal of which is to identify additional spodumene targets in the NWT and Nunavut.

This North Arrow Minerals profile is part of a paid investor education campaign.*

Click here to connect with North Arrow Minerals (TSXV:NAR) to receive an Investor Presentation

NAR:CC

The Conversation (0)

01 March 2024

North Arrow Minerals

Unlocking the Lithium Potential of Canada's Far North

Unlocking the Lithium Potential of Canada's Far North Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00