RC Drilling Returns 0.90 g/t Gold Over 4 Metres and 0.43 g/t Gold Over 10 Metres

Trading Symbol - TSXV: NAR

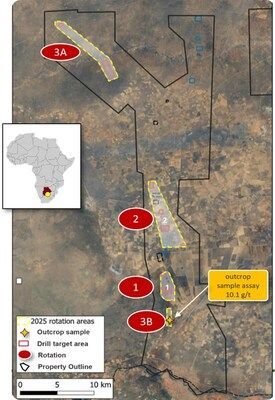

North Arrow Minerals Inc. (TSXV: NAR,OTC:NHAWF) reports initial reverse circulation ("RC") drilling results from its Kraaipan Gold Project ("Kraaipan") comprising approximately 724 km² of mineral concessions covering the entire ~60km northern extension of the prospective Kraaipan Greenstone Belt ("KGB") in Botswana . Results from 109 of 175 RC holes have now been received and returned anomalous gold in five separate areas including three areas with bedrock samples ("BK") up to 0.9 gt Au and 2 areas with overburden samples up to 0.28 gt Au collected from the base of the Kalahari ("BOK").

"Our proprietary, low-cost, technology-driven exploration approach has allowed for a rapid and systematic first-pass assessment of the entire Botswana portion of an Archean greenstone belt hiding beneath the Kalahari sands. Results thus far, have identified five priority areas for follow up including a 13 m hole into bedrock at Target AE that ended in mineralization and returned an overall grade of 0.4 g/t Au, including a 4 m section grading 0.9 g/t Au which is on par with grades observed in the multi-million-ounce Kalgold mine situated in the same geology just 40 km to the south. These results provide further confirmation that the gold endowment of the KGB extends into Botswana in potentially economic concentrations. Importantly, four out of the five gold anomalies identified to date also occur in areas of overburden under 8m in depth."

North Arrow and partner Rockman Resources have now completed an initial US$1 million regional reconnaissance program consisting of property-wide UAV magnetics followed by a comprehensive 175-hole RC drilling campaign targeting 45 km of KGB strike-length for the purposes of collecting base of Kalahari ("BOK") overburden geochemistry samples together with bedrock samples ("BK") targeting priority structural targets.

Priority Target Areas Identified

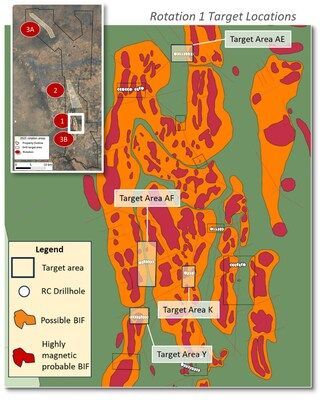

Target AE

- 0.90 g/t Au over 4 m in hole KR25-051

- Within 0.40 g/t Au over 13 m

- Drill hole ended at 13 m depth

- Hosted in quartz-hematite fault/alteration zone

- Average overburden thickness in area: 4 m

Target AF

- 0.43 g/t Au over 10 m (including 0.71 g/t Au over 3 m ) in hole KR25-060

- Located near surface sample returning 3.65 g/t Au

- Drill hole ended at 10 m depth

- Hosted in BIF (Banded Iron Formation) with associated structural controls

- Average overburden thickness in area: 9 m

Target Y

- Elevated gold concentrations in bedrock samples (up to 0.091 g/t) over 6m in KR25-038

- Drill hole ended at 13 m

- Average overburden thickness: 8m

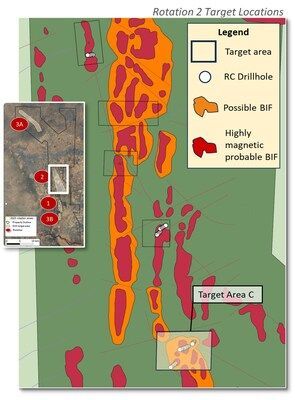

Targets C and K

- Elevated gold concentrations in overburden samples from Targets C and K (0.24 g/t Au and 0.28 g/t Au, respectively)

- Average overburden for Target K: 1 m

- Average overburden for Target C: 50 m

2025 Drilling Program Summary

- 175 RC holes completed across 16 target areas covering 45 km of KGB strike length

- 4,975 m of drilling of Kalahari overburden and the underlying bedrock

- Average Kalahari overburden for the entire program of 20.6 m

- A total of 193 BOK and 561 BR samples taken and submitted for laboratory analysis.

- Assay results pending for final 66 holes targeting four areas including:

- Area with 10.1 g/t Au surface sample

- Trend defined by three high-grade outcrop samples (>7 g/t Au)

- Specialized angled drilling to test historical mineralization

Regional Context - Proven Gold Endowment

The Kraaipan Project covers the northern extension of the same Archean greenstone belt hosting Harmony Gold's Kalgold Mine 40 km to the south in South Africa - a multi-million-ounce BIF-hosted gold deposit with:

(as of June 2024 )

- P&P Reserves: 0.645 Moz @ 1.07g/t Au

- M&I Resources: 1.60Moz @ 1.19g/t Au

- 2024 Production: 45,815 oz at a grade of 0.96 g/tonne

- Average annual production over 25 years : 52,597 oz

- Cut-off Grade : 0.58 g/tonne

From Harmony Gold's Mineral Resources and Mineral Reserves, June 2024 , pages 74-76. Kalgold production numbers provided for information purposes only. Does not suggest similar gold mineralization will be found within the Company's Kraaipan Project

Previous surface sampling at Kraaipan returned exceptional results with 25% of samples (22 of 89) returning anomalous gold (please see press release dated May 21, 2025 ) , including:

- 11 samples greater than 1 g/t gold

- 6 samples greater than 4 g/t gold

- Highest individual result of 10.1 g/t gold

Proprietary Exploration Technology Advantage

North Arrow's partner, Rockman Resources, through its operator Mineral Services, leverages over 25 years of operational experience in Botswana plus cutting-edge proprietary technologies that enabled this systematic exploration:

- High-resolution UAV magnetic surveys (>20,000 line-km completed)

- Mobile RC drilling platform optimized for variable Kalahari conditions

- In-house sample preparation for verified QA/QC protocols and faster turnaround

- Deep machine learning with potential for target generation with further accumulation of geophysical datasets

The three-rotation drilling program generated 754 representative RC samples including field duplicates.

Sampling, Laboratory Analyses and Quality Assurance/Quality Control (QA/QC)

RC samples collected in the field were driven to the Mineral Services' facility in Gaborone to be sorted and prioritized into Base of Kalarhari ("BOK") and Bed Rock ("BR") samples for assay. Samples were allocated unique samples numbers, sealed and shipped to ALS's laboratory in Johannesburg, South Africa using industry standard chain of custody protocols. Following an initial coarse crush (CRU-21), the entire sample is then pulverized (PUL-21) to better than 85% passing a 75-micron screen prior to geochemical analysis. All samples are analyzed for gold by fire assay with an ICP-AES finish, method code Au-ICP22 (50-gram sample). Samples returning gold values over 10 ppm are subjected to ore grade check assays using fire assay and a gravimetric finish using method code Au-GRA22 (50-gram sample). Samples are also subjected to lithium borate fusion and acid digestion for whole-rock analysis of major and trace elements by ICP-AES (major elements) and ICP-MS (trace elements); method codes ME-ICP06 and ME-MS81, respectively. In addition, a suite of base metals and other trace elements not included in the ME-MS81 method are analysed by ICP-AES on four-acid digestions (method code ME-4ACD81).

QA/QC protocols include ALS laboratory's own internal quality assurance controls as well as Rockman's field controls, including the insertion of duplicates and blanks, each at a rate of roughly one per 20 samples. QA/QC data are evaluated on receipt for failures, and appropriate action is taken if results for duplicates and blanks fall outside allowed tolerances.

Next Steps

Following receipt and evaluation of the remaining RC drill results, North Arrow and Rockman will develop a follow up program, likely consisting of additional RC drilling and sampling to further constrain and understand the nature of the anomalous gold identified so far, within priority areas. Angled RC or core-drilling will be an important next step given many of the mineralized structures identified to date appear to be vertical in nature and cannot be properly assessed with vertical holes. Continued regional assessment of permissive structures regionally throughout the belt will also remain a priority.

About the Kraaipan Gold Project

The Kraaipan Project comprises approximately 724 km² of mineral concessions covering the entire ~60km northern extension of the highly prospective Kraaipan Greenstone Belt. Over 80% of the belt is covered by Kalahari sands, presenting a significant underexplored opportunity in this gold-endowed geological terrain.

North Arrow can earn up to an 80% interest through:

- First Option (60% interest): US$5 million in exploration expenditures over 3 years ( US$1 million firm commitment by June 30, 2025 , achieved )

- PEA Option (additional 20% interest): Completion of a Preliminary Economic Assessment

About North Arrow Minerals Inc.

North Arrow is a Vancouver -based exploration company focused on evaluating the Kraaipan Gold Project. Management and advisors bring significant global exploration and mining experience including key roles in the discovery of the Ekati and Diavik diamond mines. The Company's exploration programs are conducted under the direction of Kenneth Armstrong , P.Geo. (NWT/NU, ON), Chairman of North Arrow and a Qualified Person under NI 43-101. Mr. Armstrong reviewed and approved the technical and scientific information in this news release.

North Arrow Minerals Inc.

Eira Thomas

President and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains "forward-looking statements" including but not limited to statements with respect to North Arrow's plans, the estimation of a mineral resource and the success of exploration activities. Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not restricted to, the amount of geological data available, the uncertain reliability of drilling results and geophysical and geological data and the interpretation thereof, and the need for adequate financing for future exploration and development efforts. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. The Company assumes no obligation to update forward-looking statements except as required by law.

SOURCE North Arrow Minerals Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/25/c9750.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/25/c9750.html