- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

May 31, 2022

Advanced explorer set to hit the ground running with an expansive exploration program in one of the world’s premier nickel sulphide belts

International nickel sulphide explorer Nordic Nickel Limited (ASX: NNL) (Nordic or the Company) is pleased to advise that its shares will commence trading on the Australian Securities Exchange at 9.00am (AWST)/11.00am (AEDT) today, Wednesday 1 June 2022.

HIGHLIGHTS

- Nordic Nickel shares commence trading at 9.00am WST/11.00am AEST today under the ASX Code: NNL.

- Oversubscribed IPO raised $12M at $0.25 per share (115.2M shares on issue).

- Strong investor, broker and seed capital support backed by Starboard Global Ltd.

- High quality asset base with two projects in Finland’s world-class Central Lapland Greenstone Belt.

- Tier 1 jurisdiction hosting several world-class deposits, historically underexplored.

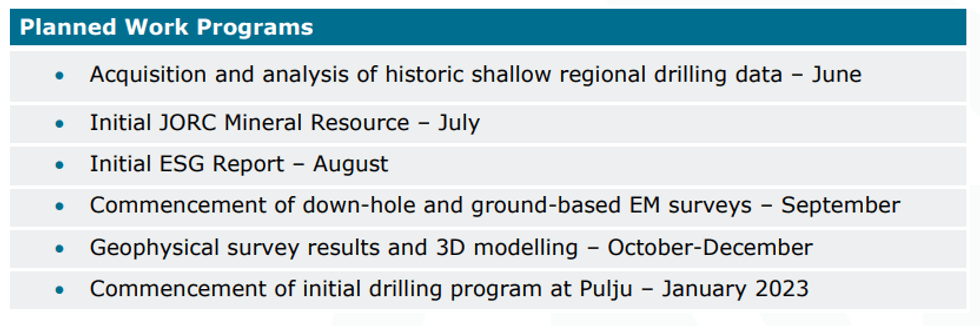

- Strong expected news-flow during H2 2022 including a maiden JORC Mineral Resource, extensive geophysics and an additional regional drilling dataset on order.

- Multiple strong drill targets to be drilled throughout 2023.

The successful ASX listing follows the completion of an oversubscribed $12 million Initial Public Offering (IPO), including $4 million worth of oversubscriptions. The IPO was managed by Taylor Collison Limited and Vert Capital.

The successful IPO puts Nordic in a strong position to commence exploration across its exciting portfolio of highly prospective nickel sulphide exploration assets in Finland’s world-class Central Lapland Greenstone Belt (CLGB), positioning it as a unique investment opportunity in the global battery metals sector.

Nordic Nickel Managing Director Todd Ross said the Company was looking forward to following up on known nickel mineralisation occurrences utilizing best-practice modern exploration techniques to explore high-potential targets, while also delivering a maiden JORC Mineral Resource in the near term based on extensive shallow mineralisation drilled historically at the Pulju Project by Outokumpu.

“Our vision is to discover and develop traceable, sustainably sourced, low-carbon, highpurity class-1 nickel sulphides in Finland, at a time when demand for battery metals is growing exponentially,” he said.

“Thanks to the backing of Starboard Global, we have been able to assemble a unique suite of assets including a district-scale landholding in one of the world’s premier nickel sulphide provinces, the Central Lapland Greenstone Belt.

“Despite hosting some of the world’s largest nickel and gold deposits such as Boliden’s Kevitsa nickel-copper-gold mine and Anglo American’s Sakatti copper-nickel-PGE deposit, this region is significantly under-explored for komatiite/intrusive hosted nickel deposits using modern exploration techniques – unlike more mature belts like Kambalda in Western Australia.

“The CLGB offers a generational opportunity for nickel exploration and the advanced exploration already conducted within the Pulju project area allows Nordic to expand known mineralisation and drill outstanding deeper geophysical targets that could deliver company-changing discoveries.

“Battery metals are critical for decarbonisation and the global energy transition, however it is vital to ensure that the upstream exploration, development and production of these metals is conducted in a responsible and sustainable manner.

“Finland is a fantastic location to be doing this, not only because of its geological prospectivity but also because it has a robust legal and permitting regime, high environmental standards, a commitment to best-practice ESG and is incentivising nickel sulphide projects through a National Battery Strategy.

“To support Nordic’s ESG objectives we have commenced ESG reporting using leading impact and measurement platform Socialsuite to report against the World Economic Forum framework.

“Thanks to the strong relationships we have developed with local communities and key stakeholders, the strong in-country partnerships we have in place with Magnus Minerals and Kati Drilling and the shared vision we have developed to create a world-class minerals company, Nordic Nickel is incredibly well placed to generate significant wealth for our shareholders. We have an exciting journey ahead of us, one that we are all looking forward to.”

About Nordic Nickel

Nordic is focused on nickel sulphide exploration across two key projects, Pulju and Maaninkijoki 3, in the Central Lapland Greenstone Belt (CLGB) in Finland. This world-class mineral belt already hosts several Tier-1 deposits including Europe’s largest gold mine, Agnico-Eagle’s 7.4Moz Kittilä mine, Boliden’s 307Mt Kevitsa nickel-copper-gold open pit mine and Anglo American’s high-grade 44Mt Sakatti copper-nickel-PGE underground development project.

Nordic has secured a 395km2 exploration project area over the Pulju Project comprising exploration licence applications and a granted exploration licence within a larger granted exploration reservation (a Finnish tenement category that confers to the company, for a period of two years, the ability to conduct non ground-disturbing exploration activity along with an exclusive right to submit exploration licence applications) covering a large area of the greenstone belt. Based on historic drilling, this area contains widespread nickel sulphide mineralisation that includes a number of high nickel tenor massive sulphide veins within a district-scale land package which contains mafic-ultramafic lithologies analogous to Finland’s world-class Sakatti deposit.

Click here for the full ASX Release

This article includes content from Nordic Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NNL:AU

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

28 May 2025

Total Finland Gold Resources Increase to 961,800oz AuEq

Nordic Resources (NNL:AU) has announced Total Finland Gold Resources Increase to 961,800oz AuEqDownload the PDF here. Keep Reading...

25 May 2025

A$3.5M Institutional Placement and New Chairman Appointed

Nordic Resources (NNL:AU) has announced A$3.5M Institutional Placement and New Chairman AppointedDownload the PDF here. Keep Reading...

21 May 2025

Trading Halt

Nordic Resources (NNL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

11 May 2025

Excellent Gold Intersections Verified at Kiimala Project

Nordic Resources (NNL:AU) has announced Excellent Gold Intersections Verified at Kiimala ProjectDownload the PDF here. Keep Reading...

23 April 2025

Quarterly Activities Report & Appendix 5B

Nordic Resources (NNL:AU) has announced Quarterly Activities Report & Appendix 5BDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00