October 26, 2023

Nine Mile Metals Ltd. (CSE: NINE, OTCQB: VMSXF, FSE: KQ9) (the “Company” or “Nine Mile”), is pleased to announce that it has received all necessary drill permits on its Wedge Project southwest of the Brunswick #12 Mine. Lantech Drilling has been engaged to drill these high priority targets once it completes the current hole at Nine Mile Brook. The Lantech track mount rig mobilizes this upcoming Monday after a required break during the NB Hunting season for the past 3 weeks.

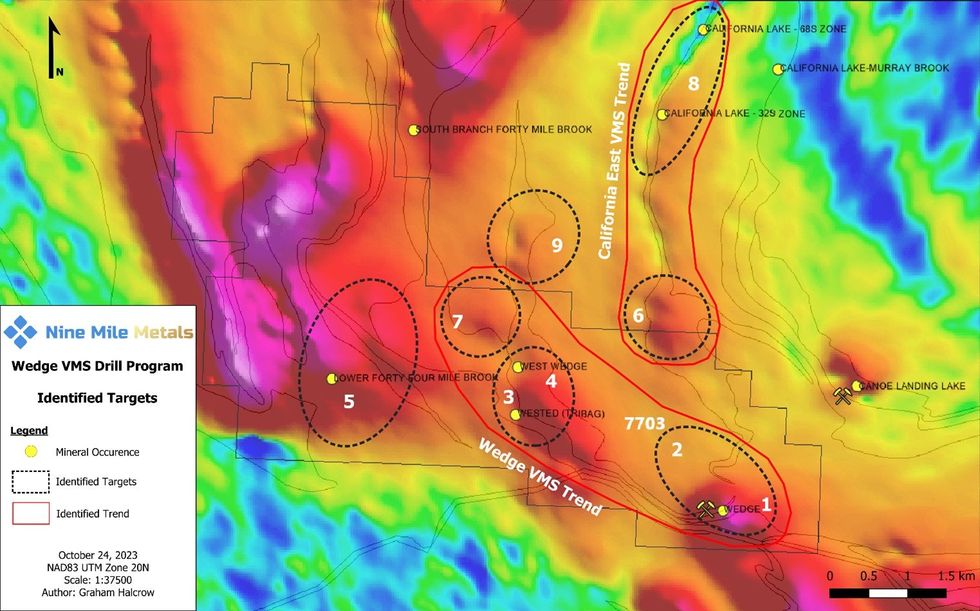

The Company has identified nine (9) high priority target areas in our western camp portfolio, the recently acquired Wedge Project, which is located 20 kilometers southwest of the Brunswick #12 mine. In addition to the historic Wedge Mine, the Cominco Wedge Mine Extension (never drill tested), the newly acquired Wedge North Target, which completes the California Lake East Trend, West Wedge and Tribag (representing a 4.5kms VMS Trend) and Lower 44 Mile Brook targets.

Figure 1: “New” Drill Program High Priority Targets, Wedge Project Area, New Brunswick

Discovered in 1956, the Wedge Mine is located at the northern terminus of a strong magnetic linear (Figure 1). Between 1962 and 1968, the mine produced 1.503MT grading (2.88% Cu, 0.65% Pb, 1.81% Zn, 20.6 g/t Ag). McCutcheon et al (2005) stated a historical measured resource of 545,200T* (1.75% Cu, 1.71% Pb & 5.21% Zn) to a depth of 274 meters.

To the northwest, both the West Wedge and Tribag lie along the west flank of a similar magnetic anomaly near parallel to the one at the Wedge. At Tribag, trenching by Slam Exploration Ltd. in 2017 identified massive to strongly disseminated Pb / Zn mineralization. At the West Wedge, previous drilling intersected 12.8% zinc, 5.35% lead, 0.78% copper, 70.6 g/tonne silver and 1.30 g/t gold over 3.8m. The mineralization at both the West Wedge and Tribag occur within the sediments and volcanics of the Spruce Lake Formation of the California Lake Group.

“With previous drilling focused on known occurrences, the VMS mineralization at the Wedge Project has considerable room for expansion. The favourable horizon is over 5 kilometers in length defined by anomalous base metal soil geochemistry and coincident zones of conductivity. We look forward to testing these high priority targets,” stated Gary Lohman, B.Sc., PGO, VP Exploration and Director.

Figure 1: above, displays the newly identified (9) VMS priority targets.

1. Wedge Mine

2. Wedge Mine Extension

3. TriBag Target

4. West Wedge Target

5. Lower 44 Mile Brook Target

6. Wedge North Target

7. Upper 44 Mile Brook Target

8. California East Drill Holes 2022

9. Canoe South Target

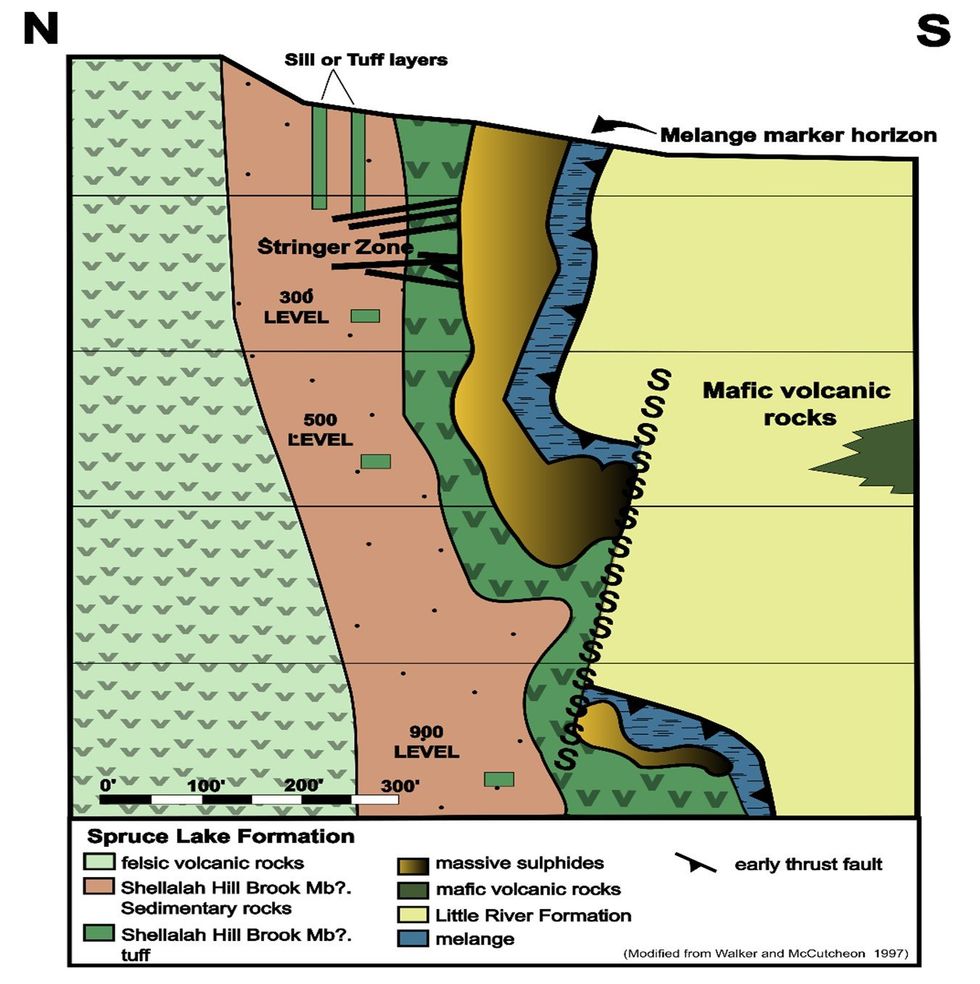

Our strategic acquisitions have now secured that Nine Mile owns the entire California East VMS Trend (targets 6 & 8). We believe the acquisition of claims over target (6) completes the strike extension of the mineralization intersected in the 8 highly successful California Drill hole results of 2022. The California East VMS Trend is approximately 3kms in length along a parallel trend to the rocks hosting the Canoe Landing Lake Deposit to the east (33.8MT Deposit). Target (2) is the Wedge Mine Extension that was identified and scheduled to drill by Cominco but never commenced. The original Wedge Mine cross-section of the deposit is displayed below in Figure 2:, the deposit is open at depth and along strike. We look forward to testing the historic mine and intersecting the high-grade mineralization we have previously released. The entire Wedge VMS Trend has been identified by EarthEx and their proprietary re-processing algorithm technology. The trend is 5kms in length.

Patrick J Cruickshank, CEO & Director stated, “Our strategic acquisitions now allow us to execute our exploration program without limitations. We now own the entire California East and Wedge VMS Trends. We are excited to test these high priority targets identified by our (3) technology systems and now that the Hunting season break is over, we are ready to get back to our Fall Drill Program. We will also test the Wedge Mine at depth and along trend “the Cominco Extension” that Cominco identified and scheduled to drill but never executed. We are highly encouraged by our Wedge Ore assays representing high grade Copper up to 29% and Lead-Zinc up to 41% previously reported. We continue to evaluate new technologies in the exploration space, the BMC has only 1% outcrop and 99% is subsurface hidden vertical deposits. Every 20 years a new technology causes the discovery of many new deposits. Our technical team of professionals including EarthEx and our AI partner, are working to uncover the next signature for exploration successes in the BMC. As you can see in Figure 1, EarthEx proprietary technology has clearly identified the existing Canoe Landing Lake & The Wedge Deposits in their processes and we are highly encouraged to test their newly identified targets. We look forward to our next news release sharing our progress.

Figure 2: The Original Wedge Mine Deposit Cross-section

The disclosure of technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and reviewed and approved by Gary Lohman, B.Sc., P. Geo., Director who acts as the Company’s Qualified Person, and is not independent of the Company.

About Nine Mile Metals Ltd.:

Nine Mile Metals Ltd. is a Canadian public mineral exploration company focused on Critical Minerals Exploration (CME) VMS (Cu, Pb, Zn, Ag and Au) exploration in the world-famous Bathurst Mining Camp, New Brunswick, Canada. The Company’s primary business objective is to explore its four VMS Projects: Nine Mile Brook VMS; California Lake VMS; Canoe Landing Lake (East–West) VMS and our new Wedge VMS Projects. The Company is focused on Critical Minerals Exploration (CME), positioning for the boom in EV and green technologies requiring Copper, Silver, Lead and Zinc with a hedge with Gold.

McCutcheon, S., et al, , 2005 - Stratigraphic setting of base-metal deposits in the Bathurst Mining Camp, New Brunswick; Geological Association of Canada, Mineralogical Association of Canada, Petroleum Geologists, Canadian Society of Soil Sciences, Joint Meeting - Halifax, May 2005, Field Trip B4; Department of Earth Sciences Dalhousie University, Halifax, Nova Scotia, Canada B3H 3J, AGS Special Publication Number 30, 107p.

Social Media

| X, formerly known as Twitter | @NineMileMetals |

| Nine Mile Metals | |

| @ Nine Mile Metals | |

| Nine Mile Metals | |

| YouTube | @ninemilemetals |

ON BEHALF OF NINE MILE METALS LTD.

“Patrick J. Cruickshank, MBA”

CEO and Director

T: (506) 804-6117

E: patrick@ninemilemetals.com

Forward-Looking Information:

This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of Nine Mile. Forward-looking information is based on certain key expectations and assumptions made by the management of Nine Mile. In some cases, you can identify forward-looking statements by the use of words such as “will,” “may,” “would,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “could” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Forward-looking statements in this press release include that (a) the Company will also test the Wedge Mine at depth and along trend of the Cominco Extension, (b) the Company believes the acquisition of claims over target (6) completes the strike extension of the mineralization intersected in the 8 highly successful California Drill hole results of 2022, and (c) the Company continues to evaluate new technologies in the exploration space. Although Nine Mile believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Nine Mile can give no assurance that they will prove to be correct.

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

NINE:CNX

Sign up to get your FREE

Nine Mile Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

03 February

Nine Mile Metals

Advancing copper-rich critical mineral projects in Canada’s world-class Bathurst Mining Camp

Advancing copper-rich critical mineral projects in Canada’s world-class Bathurst Mining Camp Keep Reading...

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Sign up to get your FREE

Nine Mile Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00