Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTC PINK:TKRFF) is pleased to announce that the Company has commenced a 7,000 metre drill program at the Company's 100% owned Ayawilca zinc-silver project in central Peru. The 20-hole program is anticipated to take approximately three months to complete. The timing of the completion of the drill program may vary as a result of the Company's health and safety measures implemented to prevent the spread of COVID-19

The drill program has two objectives: firstly, to convert inferred resources to indicated resources in areas at the project with thick, high grade zones of mineralization; and, secondly, to test for extensions of zinc and silver mineralization down-dip of known zones in several planned step-out holes. Later in the program, step-out holes will also be drilled to test new exploration targets at the Colqui Silver Zone.

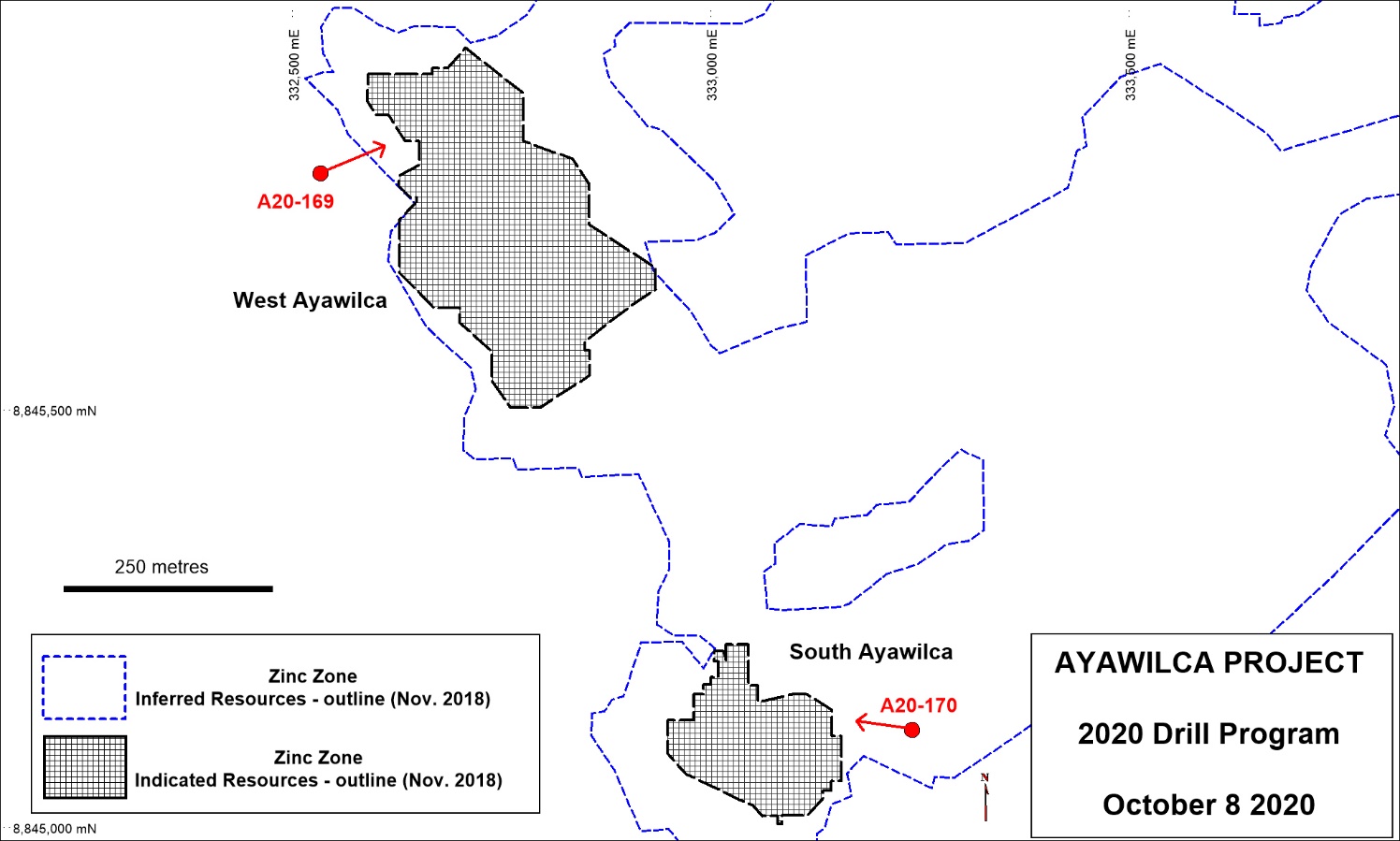

Two drill rigs are on site and will test the extensions of the high-grade mineralization within the Ayawilca Zinc Zone (West and South areas - Figure 1). A third rig is expected to be added to the program by the end of October. Hole A20-169 is designed to test a zone within the inferred resource which is 50 to 75 metres down-dip of hole A18-118 which intersected 23.9 metres grading 9.2% zinc & 15 g/t silver from 270 metres and 9.8 metres grading 17.0% zinc & 25 g/t silver from 334 metres. Hole A20-170 is testing an area 70 metres from A17-071 which intersected 12.6 metres grading 11.6% zinc & 35 g/t silver from 332 metres depth.

President and CEO of Tinka, Dr. Graham Carman, stated: "It is exactly 12 months since Tinka was last drilling at Ayawilca, and our team is very excited to be back drilling again after what has proven to be a challenging year due to the severe impact of the pandemic in Peru. This will be a busy time for the Company, as we aim to increase our mineral resource inventory especially in the indicated resource category as well as test new targets. We are targeting two styles of mineralization; zinc-rich massive sulphide mineralization typical of the Ayawilca Zinc Zone, and silver-rich mineralization which occurs in carbonate veins and replacements on the margins of the sulphide deposit. We expect to release the drill results as soon as they become available and can be interpreted within the context of our geological model. Tinka has put in place enhanced health protocols to keep our employees, contractors and community workers as safe as possible."

About Ayawilca: The Ayawilca Zinc Zone (sulphide) contains an estimated 1.8 billion pounds zinc and 5.8 million ounces silver in the Indicated category, and 5.6 billion pounds zinc and 25.2 million ounces silver in the Inferred category (see news release dated November 26, 2018). The Colqui Silver Zone (oxide) contains an estimated 14.3 million ounces silver in the Indicated category and 13.2 million ounces silver in the Inferred category, with mineralization starting from surface (see link to Technical Report dated July 2, 2019).

On behalf of the Board, | Investor Information: |

Figure 1. Progressive 2020 drill hole map

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver project in central Peru. The Ayawilca Zinc Zone has an estimated Indicated resource of 11.7 Mt grading 6.9% zinc, 15 g/t silver & 0.2% lead and an Inferred resource of 45.0 Mt grading 5.6% zinc, 17 g/t silver & 0.2% lead (dated November 26, 2018). The Colqui Silver Zone (oxide) has an estimated Indicated resource of 7.4 Mt grading 60 g/t silver, and an Inferred resource of 8.5 Mt grading 48 g/t silver occurring from surface (dated May 25, 2016). A Preliminary Economic Assessment for the Zinc Zone was released on July 2, 2019 (see release). The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned drill programs and results varying from expectations; delay in obtaining results; expectations regarding the Ayawilca Project PEA; the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on the Company's business, operations and financial condition; changes in world metal markets; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/609670/Tinka-Commences-Drilling-at-the-Ayawilca-Zinc-Silver-Project