(TheNewswire)

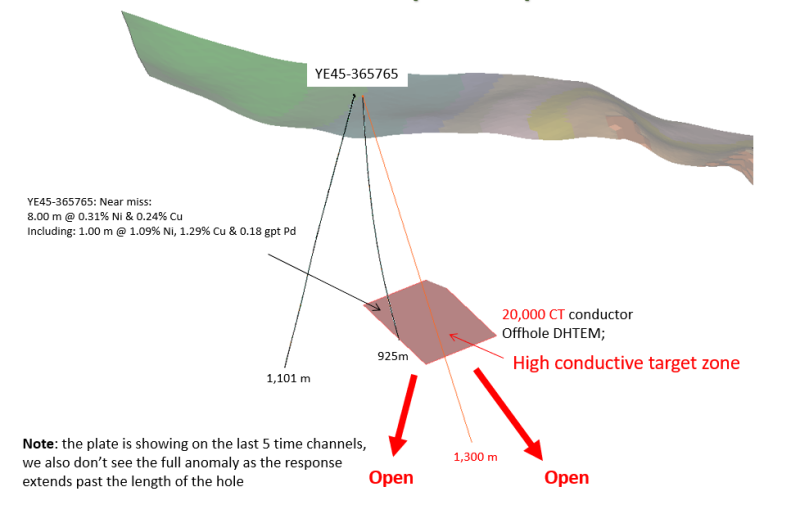

Montreal, Quebec - TheNewswire - December 16 th , 2020 - Sama Resources Inc. (" Sama " or the " Company ") (TSXV: SME ) ( OTC: SAMMF) is pleased to announce that downhole electromagnetic ("EM") surveys ("DHTEM") have been completed in a deep drill hole at the Yepleu target zone and in a deep drill hole at the Bounta target zone. The holes at Yepleu and Bounta were drilled in the early months of 2020, with both zones part of the large Yacouba Ultramafic-Mafic intrusive complex discovered by Sama in 2010. The DHTEM surveys used HPX TechCo Inc.'s ("HPX") proprietary Typhoon™ electromagnetic geophysical transmitter ("Typhoon"), maximising power transmission for higher resolution at depth. The Company has identified the highest conductivity target recorded to date (20,000 Conductivity Thickness " CT ") and it will be the number one priority in early 2021 for confirmation drilling (Figure 1):

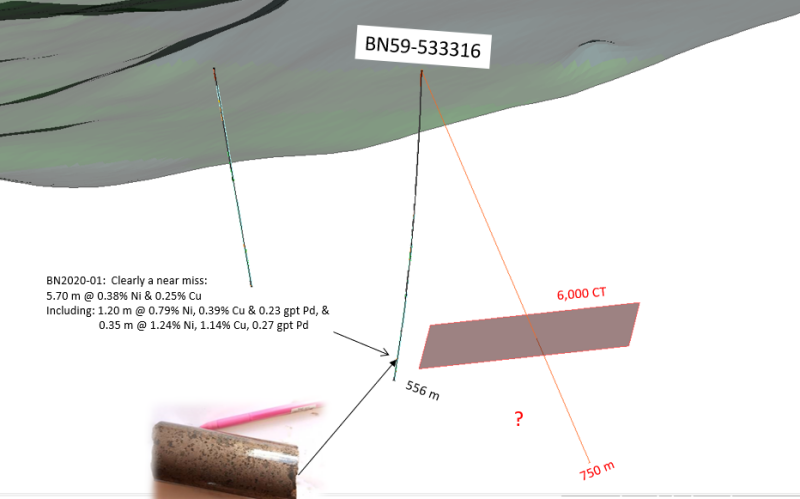

The downhole interpretation at Bounta awaits final interpretation (Figure 2):

" Following-up on the excellent DHTEM results at Yepleu is the joint HPX-Sama team primary focus on the re-start of work in early 2021" stated Dr. Marc-Antoine Audet President, CEO and Director of Sama Resources Inc.

Stock Options

Pursuant to its Stock Option Plan and subject to regulatory acceptance, the Company has granted an aggregate total of 1,885,000 incentive stock options to certain officers, employees and consultants, subject to certain vesting provisions . These options will be exercisable at a price of $0.115 per common share and will expire on December 14, 2030.

About Sama Resources Inc.

Sama is a Canadian-based mineral exploration and development company with projects in West Africa.

For more information about Sama, please visit Sama's website at https://www.samaresources.com .

FOR FURTHER INFORMATION, PLEASE CONTACT:

SAMA RESOURCES INC./RESSOURCES SAMA INC.

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

OR

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835

Toll Free: 1 (877) 792-6688, Ext. 5

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Copyright (c) 2020 TheNewswire - All rights reserved.