Ion Energy Limited (TSXV: ION) (OTCQB: IONGF) (FSE: 5YB) ("ION" or the "Company") is very pleased to announce that the Company has made a new lithium discovery, the White Wolf Prospect, at its 100% owned Baavhai Uul Lithium Salar Project in south eastern Mongolia.

Highlights

A total of 222 auger drill holes have been completed for 1304.5 metres.

To date only 12.5% of drill holes results have been returned.

Initial drilling results are highly encouraging with a new discovery highlighted at the White Wolf Prospect.

Drill hole AU-17 returned results up to 1,502ppm Lithium in clays and evaporites with the hole averaging 700ppm Lithium from 0.5m to 3.5m depth.

Drill hole AU-20 averaged 650ppm Lithium from 4m to 6m depth with the last sample in the hole returning 860ppm Lithium.

The Company has deployed three Auger Rigs on the Baavhai Uul Lithium Salar project and has now completed an initial shallow drilling program consisting of 222 drill holes. Holes were drilled to a maximum depth of six metres with samples being collected every 0.50 metre. Drill holes were located over 1 kilometre apart, and this represents a broad first pass of the licences prospectively. Initial drilling results received from only 12.5% of samples collected have been highly encouraging with a new lithium discovery being made at the White Wolf Prospect. Results of additional drill holes will be delivered to the Company over the coming months.

"The ION team is extremely pleased with these very early drilling results. This is an extensive regional drilling program and we are already seeing new prospects being discovered at White Wolf that will warrant follow-up drilling. Exploration programs at the company's projects in Mongolia remain ongoing and further results are expected over the coming months," says Ali Haji, CEO & Director of ION Energy Ltd.

Figure 1: Auger Rig at Baavhai Uul.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6906/106091_205637a61431d8f0_002full.jpg

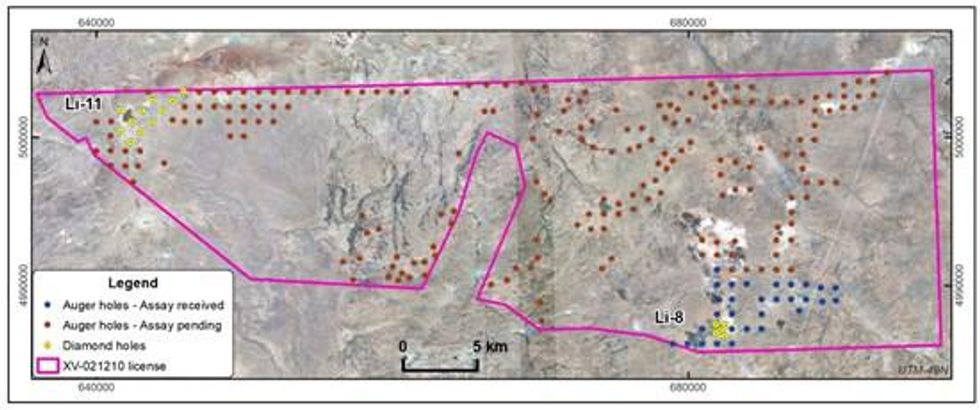

Figure 2. Drilling program at Baavhai Uul

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6906/106091_205637a61431d8f0_004full.jpg.

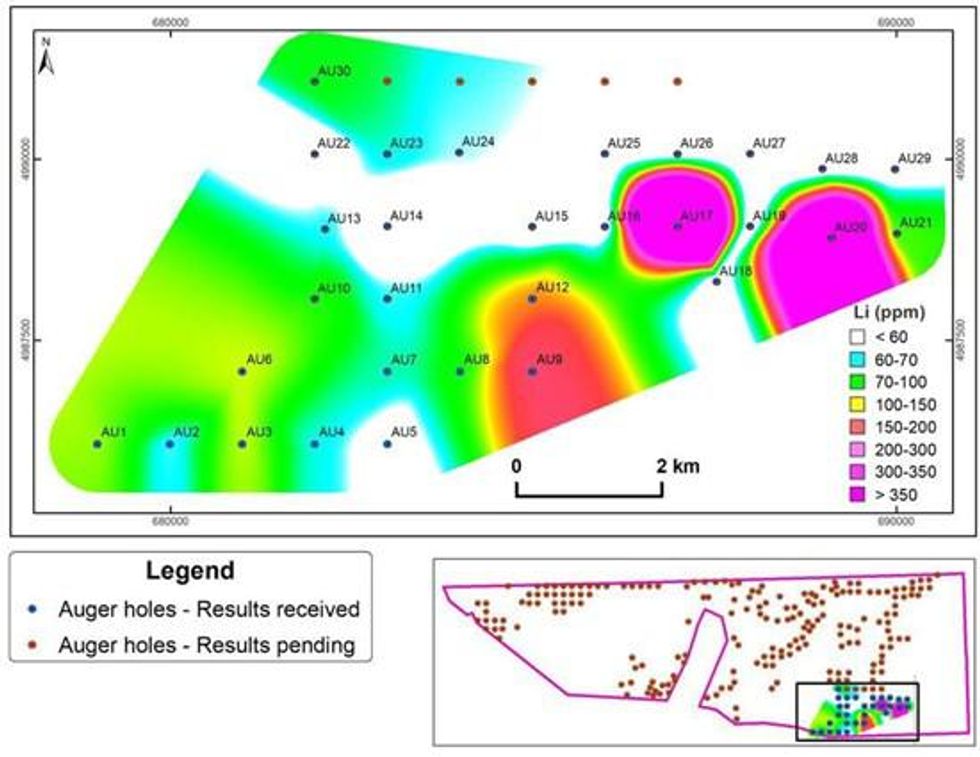

Figure 3. Drilling Results at Baavhai Uul

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6906/106091_205637a61431d8f0_007full.jpg.

All technical information disclosed in this press release has been reviewed and approved by Khurelbaatar Lamzav, P.Geo., an independent consultant to the Company and a "Qualified Person" under National Instrument 43-101.

Options

The Company also announces that it has granted to certain consultants and insiders of the Company an aggregate of 235,000 incentive stock options (the "Stock Options") to purchase common shares under the Company's incentive stock option plan (the "Plan"). Each Stock Option is exercisable into a common share of the Company at a price of $0.55 for a period of two years from the date of grant. The Stock Options will vest immediately and be subject to the terms and conditions of the Plan and the policies of the TSX Venture Exchange.

Ion Energy Engages Proconsul Capital Ltd. And Stonegate Capital Partners, Inc.

Ion Energy is also pleased to announce that it has retained the services of Proconsul Capital Ltd. ("Proconsul") and Stonegate Capital Partners, Inc. ("Stonegate") to assist with its investor relations activities. ION has partnered with Proconsul and Stonegate to enhance its visibility and profile in the investment advisor community.

Proconsul and Stonegate have agreed to comply with all applicable securities laws and the policies of the TSX Venture Exchange (the "TSXV") in providing the Services.

Proconsul has been engaged by the Company on a month-to-month basis which commenced on September 15, 2020, and is renewed automatically for successive one-month periods unless otherwise terminated by the Company in accordance with the agreement. Proconsul will be paid a monthly fee of $2,500, plus applicable taxes.

Stonegate has been engaged by the Company for an initial period of six months which commenced on September 15, 2020 (the "Initial Term") and then shall be renewed automatically for successive one-month periods thereafter, unless terminated by the Company in accordance with the Agreement. Stonegate will be paid a monthly fee of US$1,500, plus applicable taxes, during the Initial Term, and will be paid a monthly fee of US$3,000, plus applicable taxes, starting on the anniversary date of the agreement.

About ION Energy Ltd.

ION Energy Ltd. (TSXV: ION) (OTCQB: IONGF) (FSE: 5YB) is committed to exploring and developing Mongolia's lithium salars. ION's flagship, 81,000+ hectare Baavhai Uul lithium brine project, represents the largest and first lithium brine exploration licence award in Mongolia. ION also holds the 29,000+ hectare Urgakh Naran highly prospective Lithium Brine licence in Dorngovi Province in Mongolia. ION is well-poised to be a key player in the clean energy revolution, positioned well to service the world's increased demand for lithium. Information about the Company is available on its website, www.ionenergy.ca, or under its profile on SEDAR at www.sedar.com.

For further information:

COMPANY CONTACT: Ali Haji, ali@ionenergy.ca, 647-871-4571

MEDIA CONTACT: Siloni Waraich, siloni@ionenergy.ca, 416-432-4920

Cautionary Note Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Information set forth in this news release contains forward-looking statements. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, potential mineralization, exploration and development results, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Important factors that could cause actual results to differ materially from Ion Energy's expectations include, among others, uncertainties relating to availability and costs of financing needed in the future, changes in equity markets, risks related to international operations, the actual results of current exploration activities, delays in the development of projects, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of lithium, and ability to predict or counteract potential impact of COVID-19 coronavirus on factors relevant to the Company's business. There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/106091