TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to report the preliminary assay results from sampling of its former producing Shasta Creek Zone Pit, located at the southeast corner of the Baker-Shasta project, Toodoggone, B.C

Assay results from chip samples within the exposed Creek Zone Pit of the Shasta deposit further demonstrate that the mineralized halo surrounding higher grade pods of quartz carbonate breccia was left unmined. Chip samples were taken along approximately 37 metres ("m") of the stockwork body at regular intervals. The samples are not representative of true width of the breccia body. Chip sample results include up to 8.22 grams per tonne ("g/t") gold ("Au") with 2 g/t silver ("Ag"), and 4.23 g/t Au with 123 g/t Ag - see Table 1 below for chip sample highlights.

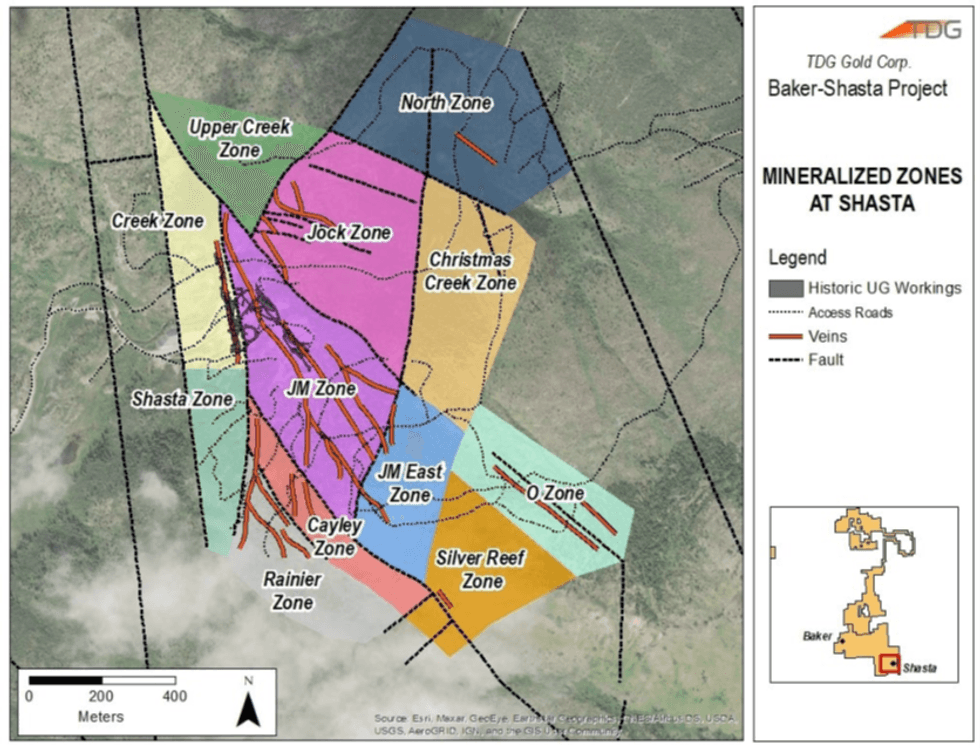

Figure 1. Showing the location of the Creek Zone at Shasta. The exposed pit is located above the historical workings marked on the map.

Table 1. Showing Shasta Zone Creek Pit chip sample highlights.

Sample ID | Au (g/t) | Silver (g/t) |

SH21-CH01 | 4.23 | 123 |

SH21-CH03 | 4.13 | 16 |

SH21-CH20 | 2.07 | 221 |

SH21-CH27 | 8.22 | 2 |

SH21-CH28 | 1.52 | 163 |

SH21-CH32 | 1.84 | 18 |

SH21-CH33 | 2.31 | 59 |

SH21-CH34 | 1.38 | 95 |

SH21-CH39 | 1.68 | 72 |

Image 1. Showing the location of the Shasta Creek Zone Pit and JM Zone Pit - looking approximately south-southwest.

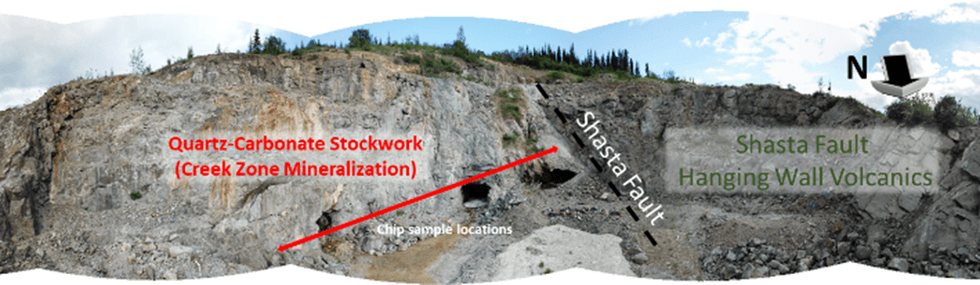

Image 2. Shows the location of the sampling over an approximate distance of 37 m.

Table 2: full list of samples from the quartz-carbonate zone marked on Image 2 (above).

Sample ID | Au (ppm) | Silver (ppm) |

SH21-CH01 | 4.23 | 123 |

SH21-CH02 | 0.7 | 16 |

SH21-CH03 | 4.13 | 16 |

SH21-CH04 | 0.83 | 16 |

SH21-CH05 | 0.05 | 3 |

SH21-CH06 | 0.06 | 3 |

SH21-CH07 | 0.06 | 2 |

SH21-CH08 | 0.15 | 2 |

SH21-CH09 | 0.04 | 3 |

SH21-CH10 | 0.04 | 3 |

SH21-CH11 | 0.68 | 12 |

SH21-CH12 | 0.28 | 7 |

SH21-CH13 | 0.31 | 4 |

SH21-CH14 | 0.48 | 6 |

SH21-CH15 | 0.24 | 26 |

SH21-CH16 | 0.03 | 2 |

SH21-CH17 | 0.02 | 1 |

SH21-CH18 | 0.01 | 1 |

SH21-CH19 | 0.02 | 2 |

SH21-CH20 | 2.07 | 221 |

SH21-CH21 | 0.04 | 3 |

SH21-CH22 | 0.23 | 21 |

SH21-CH23 | 0.14 | 12 |

SH21-CH24 | 0.08 | 6 |

SH21-CH25 | 0.51 | 62 |

SH21-CH26 | 0.22 | 22 |

SH21-CH27 | 8.22 | 2 |

SH21-CH28 | 1.52 | 163 |

SH21-CH29 | 0.28 | 22 |

SH21-CH30 | 0.31 | 22 |

SH21-CH31 | 0.72 | 7 |

SH21-CH32 | 1.84 | 18 |

SH21-CH33 | 2.31 | 59 |

SH21-CH34 | 1.38 | 95 |

SH21-CH35 | 0.33 | 28 |

SH21-CH36 | 1.14 | 45 |

SH21-CH37 | 0.23 | 19 |

SH21-CH38 | 0.91 | 80 |

SH21-CH39 | 1.68 | 72 |

SH21-CH40 | 0.96 | 24 |

SH21-CH41 | 1.18 | 62 |

QA/QC

Samples for the Shasta 2021 drill program followed chain of custody between collection, processing and delivery to an SGS laboratory in Burnaby, B.C. The samples were collected directly by TDG geologists or geological contractors and taken to the core shack at TDG's Baker Mine site. Geological material was then processed by geologists who inserted certified reference materials into the sampling sequence (when/where appropriate). Samples were placed in zip-tied polyurethane bags, then in security-sealed rice bags before being delivered directly from the Baker Mine site to Bandstra Transportation Systems in Prince George, B.C., and ultimately to SGS laboratory Burnaby, B.C, or delivered from source to destination directly by TDG staff or contractors. Samples were prepared for analysis according to SGS method PRP89: dry samples to 105°C, crush to 75 % passing 2 mm, split 250 g, pulverize 85 % passing 75 microns.

Gold was tested by fire assay with ICP-OES finish on a 50-gram nominal sample (method GE_FAI30V5). Method GE_FAI50V10 (ore grade geochemistry) has an upper detection limit of 100 ppm (100 g/t). Silver was tested by digesting at least 0.5 g sample in multi-acid (four acid) followed by an ICP-OES finish (method GE_ICP40Q12). Method GE_ICP40Q12 has an upper detection limit of Ag of 100 ppm (100 g/t), and any overlimit samples are being subsequently run with method GE_ICM40Q12 that has an upper detection of 0.1 % (1,000 g/t).

Quality assurance and control ("QAQC") is maintained internally at the lab through rigorous use of internal certified reference materials, blanks, and duplicates. An additional QAQC program was administered by TDG Gold through the use of certified reference materials ("CRMs") that were blindly inserted into the sample batch. If a QAQC sample returns an unacceptable value an investigation into the results is triggered and when deemed necessary, the samples that were tested in the batch with the failed QAQC sample are re-tested. For the purposes of this news release, results are ‘preliminary' and despite having undergone rigorous internal SGS QAQC (returning ‘final' results), TDG has not completed its DQA investigations at this time.

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., a qualified person as defined by National Instrument 43-101.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG has advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. The Company has entered into a binding agreement to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile, subject to closing conditions being satisfied. TDG currently has 70,867,903 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "ambition", "estimate", "concluded", "offers", "objective", "may", "will", "should", "potential" and similar expressions are intended to identify forward looking statements. In particular, this news release contains forward looking statements concerning the completion of the Acquisition, the completion of SR Offering and the Offering, the intended uses of the proceeds of the Offering, regulatory acceptance of the Acquisition, the SR Offering and the Offering, and the potential development of the Project and the Company's existing mineral properties, including the completion of feasibility studies or the making of production decisions in respect thereof. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the completion of other conditions precedent to the Acquisition, including the receipt of regulatory approvals, the state of equity financing markets, and results of future exploration activities by the Company. Management has provided the above summary of risks and assumptions related to forward looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/677978/TDG-Gold-Corp-Samples-up-to-822-gt-Gold-at-Shasta-Creek-Zone-Pit-Toodoggone-BC