Prosper Gold Corp. ("Prosper Gold" or the "Company") (TSXV: PGX) is pleased to announce that it has acquired an additional 4,576 hectares of mineral claims, through staking and acquisitions from prospectors, adjacent to the Golden Sidewalk & Skinner projects (the "Project") that the Company has optioned from Sabina Gold and Silver Corp. ("Sabina") (see the Company's August 10th, 2020 news release). The Company is also pleased to announce details of Prosper Gold's regional till sampling program on the Project.

"We were able to stake and acquire claims that more than double our land position at the Golden-Sidewalk," said Peter Bernier, President & Chief Executive Officer. "The focus of the increased land package is to cover the southward extension of the regional unconformity between the Balmer and Narrow Lake Assemblages. In addition to sampling historic showings and trenches Prosper completed a till sampling program. We anticipate receiving the results of the sampling and till survey over the coming weeks and will use them to target high priority areas."

Till Survey

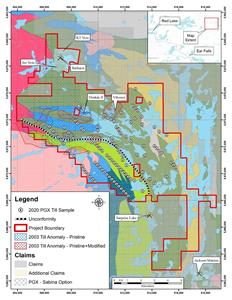

The till survey expands southeastward from earlier till sampling by Teck and Fronteer. Teck's survey identified many samples with pristine gold grains in a down-ice dispersal zone measuring 5 km wide by 3 km long which was concentrated along the regional unconformity.

Glacial dispersion gold targets are found near the regional unconformity between the Balmer Assemblage and the Narrow Lake Assemblage. Several northeast to north-northeast trending structures intersect this near the gold-in-till anomalies. The unconformity is thought to be important as a possible gold bearing hydrothermal fluid conduit similar to Balmer/Confederation assemblage boundary and the unconformity near the Red Lake gold deposits.

Dispersion gold anomalies extend along the unconformity to the east and south onto the newly acquired claims (See Figure 1). 112 samples were collected on a 250m x 1000m grid and were hand dug by Prosper Gold exploration personnel. Samples were put through a 4-mesh classifier into a 5-gallon pail and shipped to Overburden Drilling Management Limited ("ODM") for gold grain analysis and sieving. After the gold grain analysis, the fine fraction samples will be sent for multi-element analysis. ODM, based in Ottawa, are recognized specialists in sampling and analyzing glacial till material for gold. Prosper will provide results from the till survey after they are received and interpreted.

Geology

The Project area is underlain by rocks of the Balmer Assemblage in the southern portion of the property and the Narrow Lake Assemblage in the remaining portion of the property. The boundary between the Balmer and Narrow Lake Assemblages is taken where few pillowed flows and interbedded tuffaceous and sedimentary rocks (Balmer Assemblage) give way to abundant pillowed flows (Narrow Lake Assemblage). In the Narrow Lake area, the unconformity is also marked by the presence of quartz and feldspar xenocrystic, dacitic to rhyolitic crystal tuff, termed the Skinner porphyry.

Figure 1. Prosper Gold's 2020 Till Sampling

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf4f849c-4fe3-4e8e-bdb5-da5237b6b373

Corporate Update

The Company is also pleased to announce that it has completed its previously announced consolidation (the "Consolidation") of the common shares in the capital of the Company (the "Common Shares") at a ratio of ten (10) pre-Consolidation Common Shares for one post-Consolidation Common Share (the "Consolidated Shares"). The Consolidated Shares will begin trading on a consolidated basis under the existing trading symbol at market open on September 8, 2020. The Consolidation reduced the number of the Company's outstanding Common Shares from 80,558,916 Common Shares to 8,055,091 Common Shares. As a result of the Consolidation, the Company's outstanding warrants will also be adjusted with proportionate adjustments made to the exercise prices of the outstanding warrants.

The Company has also issued 50,000 post-Consolidation Common Shares to Sabina pursuant to its previously announced option agreement on the Project.

Please refer to the Company's August 10th, 2020 news release for additional information regarding the Consolidation and the option agreement with Sabina.

Qualified Person

The scientific and technical information in this news release has been reviewed by Dr. Dirk Tempelman-Kluit, PhD, P.Geo., a Qualified Person under National Instrument 43-101.

For a detailed overview of Prosper Gold please visit www.ProsperGoldCorp.com

ON BEHALF OF THE BOARD OF DIRECTORS

Per: "Peter Bernier"

Peter Bernier

President & CEO

For further information, please contact:

Peter Bernier

President & CEO

Prosper Gold Corp.

Cell (250) 316-6644

Email: Pete@ProsperGoldCorp.com

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. All statements, other than statements of historical fact, included herein including, without limitation; exploration potential of the Property, the results of the till survey on the Property and the planned exploration of the Property are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; the Company's ability to satisfy conditions precedent under the option agreement with Sabina; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of our common share price and volume and the additional risks identified the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.