NV Gold Corporation (TSXV:NVX)(OTCQB:NVGLF) ("NV Gold" or the "Company") is pleased to announce it has received all necessary drill approvals for its 2020 reverse circulation drill campaign at its 100% controlled Slumber Gold Project ("Slumber") located approximately 50 miles northwest of Winnemucca, Humboldt County, Nevada, USA. NV Gold's 2020 drill program, anticipated to commence in early November, will encompass up to 2,500 meters in up to 10 reverse circulation ("RC") drill holes

"Targets generated at Slumber by recent CSAMT geophysical surveys are exceptional. Our technical team, which includes Dr. Quinton Hennigh and Dr. Odin Christensen, believes the Slumber Gold Project may potentially host a buried high grade gold system at depth beneath shallowly drilled areas tested last year," commented Peter A. Ball, President and CEO of NV Gold. "In addition to planned drilling at Slumber, NV Gold's Sandy Gold Project drill campaign is now underway in western Nevada, and work at the Exodus Gold Project in British Columbia continues to advance the project to drill readiness. This fall season is quickly shaping up to be NV Gold's busiest and most exciting exploration period in many years."

For additional information on the Slumber Gold Project, which was leased in 2019, please refer to NV Gold's press release, dated September 25th, 2020. In addition, see below for a recap of the drill targets generated from the recent controlled source audio-magnetotelluric ("CSAMT") geophysical survey.

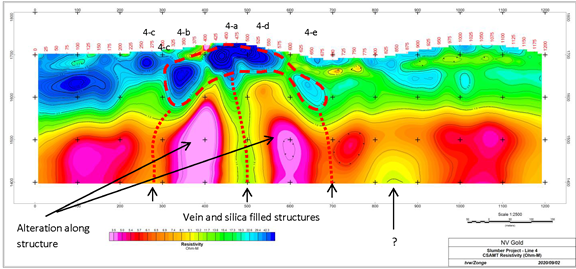

Interpretation of the recent CSAMT data highlighted several high-angle high-resistivity zones within a north-northeast-oriented focus area generally coincident with the area of reduced magnetic response. Such high-resistivity zones, surrounded by zones of greater conductivity, are a key feature characteristic of epithermal veins. These relationships are illustrated on one representative geophysical cross-section in Figure 1. Similar features are present on five of the six CSAMT lines.

Figure 1. Slumber Project Area CSAMT Line 4 viewed looking northeast. Cooler colors image rock masses with greater resistivity. The image has been interpreted to show several high-angle resistive zones, surrounded by more conductive rock. The blue resistive cap corresponds to silicified outcrops.

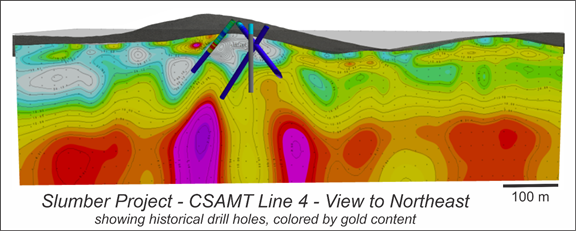

When compared to past drilling, the new model suggests that the drilling, primarily targeted by surface geologic features, and did not test deep enough as illustrated in Figure 2.

Figure 2: Slumber Project Area CSAMT Line 4 viewed looking northeast. Cooler colors image rock masses with greater resistivity. The traces of several historic drill holes are shown and indicates that the holes were not drilled deep enough to intersect possible zones of high-angle veining and mineralization.

Quinton Hennigh (Ph.D., P.Geo.) is a Qualified Person pursuant to National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. Dr. Hennigh is a director of NV Gold and is not independent and is also the President, Chairman and a Director of Novo Resources Corp.

About NV Gold Corporation

NV Gold (TSXV: NVX, OTCQB: NVGLF) is a well-financed junior exploration company based in Vancouver, British Columbia that is focused on delivering value through mineral discoveries in North America, leveraging its highly experienced in-house technical knowledge, and identifying and drilling 2-3 priority projects per year. NV Gold controls multiple drill-ready projects in Nevada, and has entered into an Option Agreement on the high-grade Exodus Gold Project in British Columbia, Canada.

On behalf of the Board of Directors,

Peter A. Ball

President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

Peter A. Ball, President & CEO

Phone: 1-888-363-9883

Email: peter@nvgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, including executing a drill program at the Sandy, Slumber and Exodus Gold Projects in the Fall of 2020, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/612402/NV-Gold-Receives-Permits-for-Its-Phase-II-Drill-Program-at-Its-Slumber-Gold-Project-in-Nevada