NV Gold Corporation (TSXV:NVX)(OTCQB:NVGLF) ("NV Gold" or the "Company") has received all assays of the Phase 2 drill program at its 100% controlled Slumber Gold Project ("Slumber") located approximately 50 miles northwest of Winnemucca, Humboldt County, Nevada, USA. The drill program was comprised of 9 reverse circulation ("RC") drill holes, totaling 1,859 m (6,100 ft

Key Highlights from Phase 2 Drill Program at Slumber Gold Project

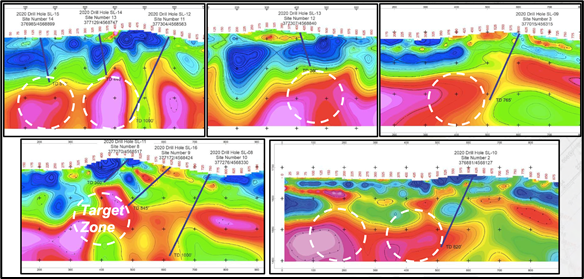

Drilling has outlined a new 600 meter-wide mineralized oxide gold zone close to surface with notable drill intercepts, including a very encouraging 18.3 m @ 0.52 g/t Au beginning at 48.7 m in Hole SL-11, and hosted in an oxidized and silicified rhyolite which correlates with a resistive blanket as seen in CSAMT data (please refer to Figure 1). Another hole, SL-14, intersected 134.2m @ 0.14 g/t Au starting from surface.

The near surface oxidized gold intersection is of signficance noting Argonaut Gold (U.S.) Corp.'s Florida Canyon Gold Mine, down the highway from Slumber, is in operation with reserves grading 0.43 g/t Au.

This newly discovered zone is separate from that discovered during the 2019 drill program, and will be prioritized for follow up work in 2021.

Recent stream sediment and rock chip sampling has identified two additional parallel structures which remain untested.

The source of the mineralized resistive blanket is believed to be higher grade feeder structures at depth.

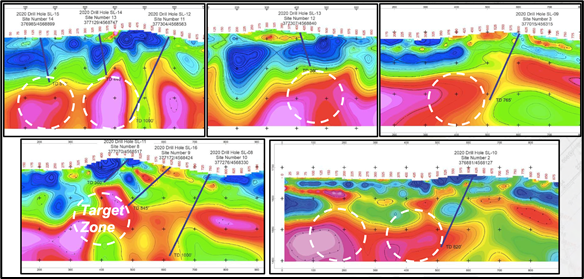

As previously reported, due to unexpected high volumes of ground water, priority targets in drill holes SL-9, SL-10, SL-13, SL-14, SL-15 and SL-16 were not adequately tested, due to the holes being terminated short of planned depth (refer to Figure 2 below).

The primary CSAMT-interpreted targets, where NV Gold was targeting a potential "Sleeper-type" gold system at Slumber, remain untested.

"It is exciting to discover a new near surface oxide gold zone at Slumber. Hole SL-11, intersected 18.3m grading 0.52 g/t Au in silicified rhyolite. To follow up, NV Gold will be initiating its new field season at Slumber with additional detailed mapping and execution of a new soil sampling grid to assist in delineating this newly discovered near-surface oxide gold zone. Structural data from mapping will also help us target the potentially higher grade mineralized structures that fed this system. We anticipate being able to conduct follow up drilling later this year," commented Peter A. Ball, President and CEO of NV Gold. "In addition, we appreciate the incredible response to our recent private placement announced May 5th, 2021, which is expected to close in the next few days."

In a future Phase 3 drill program, NV Gold's plans to utilize RC and diamond core drilling to overcome groundwater issues faced during Phase 2 drilling. Phase 3 drilling will be planned once additional mapping and soil sampling programs are complete.

Figure 1- Newly Discovered Resistor / Interpreted Near Surface Oxide Gold Mineralization

Figure 2 - Slumber holes terminated before reaching desired depth due to water in holes.

Quinton Hennigh (Ph.D., P.Geo.) is a Qualified Person pursuant to National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. Dr. Hennigh is a director of NV Gold and is not independent and is also the President, Chairman and a Director of Novo Resources Corp.

Gold was assayed using fire assay with an atomic-absorption finish (ALS Code Au-AA23), and silver was assayed using standard atomic-absorption spectrometry (ALS Code Ag-AA61). All standards and blanks inserted by NV Gold returned values coincident with expectations.

About NV Gold Corporation

NV Gold (TSXV:NVX)(OTCQB:NVGLF) is a well-financed exploration company based in Vancouver, British Columbia that is focused on delivering value through mineral discoveries in Nevada, USA, leveraging its highly experienced in-house technical knowledge.

On behalf of the Board of Directors,

Peter A. Ball

President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

Peter A. Ball, President & CEO

Phone: 1-888-363-9883

Email: peter@nvgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, including the planned Phase 3 deep core hole program at the Slumber Gold Project, that source of the mineralized resistive blanket is believed to be higher grade feeder structures at depth, the potential for a discovery at its properties, and the closing of the May 5th, 2021 private placment, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals, the extent to which mineralized structures extend on to the Company's Projects and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/648308/NV-Gold-Identifies-New-Near-Surface-Gold-Mineralizing-System-at-Slumber-High-Grade-Targets-Remain-Untested-at-Depth