(TheNewswire)

Nexus Gold Corp. (" Nexus " or the " Company ") (TSXV:NXS ) ( OTC:NXXGF ) ( FSE: N6E) is pleased to announce it has engaged Forage Technic Eau ("FTE") Drilling to conduct a minimum 3000 meters of Reverse Circulation ("RC") Drilling on the company's 100% owned Dakouli 2 Gold Project, located 100 kilometers north of the capital of Ouagadougou, Burkina Faso, West Africa

The maiden Dakouli drill program, scheduled to commence in late October, will be testing depth extensions of geochemical gold anomalies identified through termite mound sampling, soil grid geochemistry that identified three anomalous gold trends crossing the property (see Company news release dated June 11, 2019) and finally rock geochemistry which has returned higher grade gold results from selective grab samples extracted from artisanal mining areas ("Orpaillages") (see Company news releases dated January 8 and 15, 2019, June 23, 2020, and September 10, 2020) .

"We're eager to conduct the first ever drill program at Dakouli," said president & CEO, Alex Klenman. "Dakouli offers a number of compelling attributes you like to see prior to drilling. Favourable geology and defined geochemical signatures, strong assay results from subsurface sampling, and a very active artisanal mining presence, all indicate the mineralization is abundant across this large main zone. It's basically ripe for discovery. This round of drilling will focus in this main area, but it's also worth noting there are several other hot spots across the nearly 10,000 hectares. The project has many layers to peel, we're excited to begin the next phase of more advanced exploration activities," continued Mr. Klenman

Exact commencement of the drill program will be announced later in October once crew and drill rig availability are firmed up.

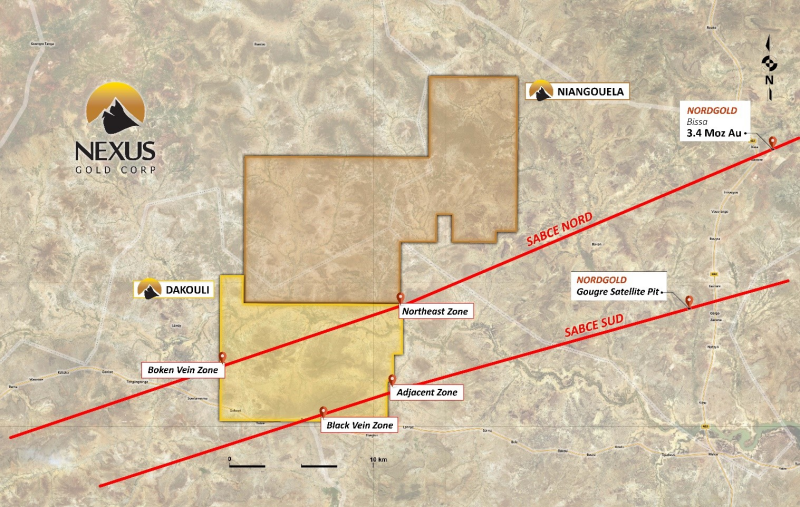

The Dakouli 2 permit is located on the Goren greenstone belt, proximal to Nordgold's Bissa Mine, and is bisected by the gold bearing Sabce Shear zone. Ground reconnaissance and sampling has been ongoing at Dakouli 2 for over a year now. During this period, the Company collected 40 grab samples from below surface in artisanal shafts ("pits"). The highlights are tabled below:

-------------------------------------------------------------------- |Sample |Utm E |Utm N |Description |Depth|Au | |ID | | | | |g/t | |------------------------------------------------------------------| |DKL-001|636687|1445630|Quartz from orpaillage pit |8m |3.15| |------------------------------------------------------------------| |DKL-004|636763|1445627|Milky quartz vein from pit, VG |8m |27.5| |------------------------------------------------------------------| |DKL-009|636828|1445661|Milky quartz vein from pit |18m |2.9 | |------------------------------------------------------------------| |DKL-010|636767|1445652|Light grey quartz vein from pit |-- |4.93| |------------------------------------------------------------------| |DKL-011|636738|1445670|Quartz from pit, VG |10m |29.5| |------------------------------------------------------------------| |DKL-012|636677|1445642|Quartz from pit, VG |8m |12.4| |------------------------------------------------------------------| |DKL-021|625232|1441439|Quartz from pit, |15m |2.72| | | | |white to light | | | | | | |grey | | | |------------------------------------------------------------------| |DKL-022|625269|1441469|Quartz from pit |25m |11.1| |------------------------------------------------------------------| |DKL-023|636901|1445515|Quartz from pit, VG |40m |17.6| |------------------------------------------------------------------| |DKL-024|636903|1445514|Quartz from pit |40m |1.74| |------------------------------------------------------------------| |DKL-025|636967|1445530|Quartz from pit |17m |3.68| |------------------------------------------------------------------| |DKL-027|-- --- |Crushed Material, very fine gold|40m |10.8| |------------------------------------------------------------------| |DKL-029|-- --- |Quartz from pit |20m |1.6 | |------------------------------------------------------------------| |DKL-031|636942|1445649|Quartz vein from orpaillage pit |30m |10.9| |------------------------------------------------------------------| |DKL-032|636937|1445638|Quartz vein from orpaillage pit |50m |12.8| |------------------------------------------------------------------| |DKL-033|636937|1445638|Crushed material very fine gold |50m |2.3 | |------------------------------------------------------------------| |DKL-036|637034|1445648|Quartz vein from orpaillage pit |40m |98.9| |------------------------------------------------------------------| |DKL-037|637033|1445704|Quartz vein from orpaillage pit |40m |1.86| |------------------------------------------------------------------| |DKL-038|637033|1445704|Crushed material, very fine gold|50m |49.7| |------------------------------------------------------------------| |DKL-039|637025|1445710|Quartz vein from orpaillage pit |50m |11.1| |------------------------------------------------------------------| |DKL-040|637025|1445710|Quartz vein + volcanic sediment |50m |7.48| --------------------------------------------------------------------

Table 1: Sample Highlights to date, Dakouli 2 Gold Concession, Burkina Faso, West Africa (Utm coordinates are in Adindad 30 Projection)

*Grab samples are selective by nature and may not represent the true grade or style of mineralization across the property

As announced in a Company news release dated June 23, 2020, during recent site visits Nexus personnel noted an increase in artisanal mining activity along strike at the main mineralized zone. The increased strike activity now extends the limits of the eastern zone some 200 meters to the east, thus expanding the zone of mineralization to over 400 meters along an east-west trend while also measuring 200 meters north-west.

About the Dakouli 2 Gold Concession

The Dakouli 2 exploration permit is a 98-sq km (9,800 hectares) gold exploration property located approximately 100 kilometers due north of the capital city Ouagadougou.

In late 2018 Company geologists conducted a comprehensive ground reconnaissance program to the west and south of the main orpaillage (artisanal zone) and identified new near surface workings being exploited by artisanal miners. Rock samples collected from these new zones contained various concentrations of visible gold, including coarse nuggety samples. Of the first 25 samples collected, 11 returned assay values greater than 1 g/t Au, with multiple samples showing various concentrations of visible gold returning values between 11.1 g/t Au and 29.5 g/t Au (see Figure 1, and Company news release dated January 8, 2019).

Follow up work outlined an anomalous zone extending some 500 meters west from the sample zones. Based on those results the Company initiated a 150-line kilometer soil geochemical survey covering the northern half of the Dakouli 2 property and southern portions of the contiguous Niangouela property. This survey identified three prominent gold geochemical trends.

The primary gold trend parallels the Sabce fault zone and extends for approximately 10 kilometers in a northeast-southwest direction and bisects the property from the north east corner of the property to its western boundary. The Sabce fault hosts multiple deposits including Nordgold's 3.4M oz Bissa Mine, located approximately 25km east of the Dakouli ground.

Two secondary gold trends which extend for approximately 6.5 kilometers each are oriented in a northwest to southeast direction and bisect the primary trend. All three gold geochemical trends are coincidental to geophysical trends identified from the national regional airborne geophysics.

The Dakouli 2 permit lies immediately south of, and contiguous to, the Company's Niangouela Gold Concession, which has been explored over the past three years. Drilling at Niangouela has returned significant intercepts, including 26.69 g/t Au over 4.85m, including 132 g/t Au over 1m, and 4 g/t Au over 6m, including 20.5 g/t Au over 1m (see Company news releases dated March 7, 2017 and April 5, 2017).

Figure 1: Dakouli 2 concession with bisecting Sabce faults in red

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for, and has approved, the technical information contained in this release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of eleven projects in Canada and West Africa. The Company's West African-based portfolio totals five projects encompassing over 750-sq kms of land located on active gold belts and proven mineralized trends, while it's 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario; the New Pilot Project, located in British Columbia's historic Bridge River Mining Camp; and four prospective gold and gold-copper projects (3,700-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit nexus.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2020 TheNewswire - All rights reserved.