Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) ("Maple Gold" or the "Company") is pleased to provide an update on exploration activities at its Douay Project (the "Project") located in Quebec, Canada. The Company has expanded its Fall 2020 drill program to consist of 10 holes totalling over 4,000 metres with completion expected in early January 2021 and assay results pending. The Company has also commenced one of the largest Induced Polarization ("IP") surveys to be carried out on the project totalling approximately 117 line km over three grids, including over a 15 km2 area along the northern flank of the Douay resource area.

"We are pleased to have expanded our Fall 2020 drill campaign with a significantly larger program than we initially planned due to encouraging indications of a significant sulphide system at the high-priority Northeast IP target," stated Fred Speidel, VP Exploration for Maple Gold. "While assay results are taking longer than anticipated to be returned, we made the decision to mobilize a second drill rig to further test this regional anomaly along its full 2-km-long strike length with two additional holes."

"Additionally, one of the key themes at Maple Gold has been the generation and testing of new discovery targets at our district-scale Douay property and this will continue to be a focus for us in 2021. The IP work that has begun covers a large area along an important shear zone just north of the currently known resource and includes an undrilled potential source area for the highest gold-in-till anomaly on the property. There are many exciting opportunities like this at the property and we look forward to systematically detailing more targets for upcoming drill campaigns," concluded Mr. Speidel.

Fall 2020 Drilling Campaign

The Company has expanded its Fall 2020 drill program to consist of 10 holes, eight of which have been completed and two pending completion in January 2021, for a total of approximately 4,050 metres drilled to date (see Figure 1 for drill hole locations). Key details are as follows:

Three holes were completed at the high-priority regional Northeast IP Target ("NE IP Target") with one additional hole in progress and pending completion in early January 2021. Additional holes may be drilled at three remaining permitted sites on this target in the Company's Winter 2021 program.

An initial hole was completed at the high-priority regional P8 Target. Two additional permitted sites may be drilled in the Winter 2021 drill program.

Five holes were drilled in and around the Douay mineral resource - one step-out hole at the Main Zone, one infill hole at the 531 Zone and three infill holes at the Porphyry Zone.

The initial assay process is taking longer than expected and results will be announced in Q1/2021 once they have been received, vetted, compiled and interpreted. Planning is also well underway for the Company's winter drilling program which is expected to commence in mid-January and will cover approximately 10,000 metres with multiple drill rigs.

Figure 1: Fall 2020 campaign drillhole locations on 2011 airborne total magnetic field intensity image. Survey coverage did not extend to the NE IP Target area at the time.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3077/71378_66246fd8b4f92bfc_001full.jpg

Winter 2021 IP Survey

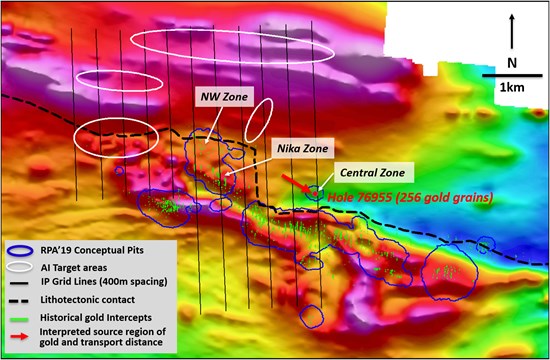

During December, the Company commenced line cutting for a large IP survey to cover an initial 15 km2 target area extending up to 4 km northwest of the Central Zone at the Douay mineral resource (see Figure 2). Line cutting on the first grid is now nearing completion and IP surveying will begin in early January. This area is considered high priority for several reasons:

Presence of a major lithotectonic boundary or shear zone known to be spatially associated with gold mineralization at the Main, Central and NW zones;

Presence of one of the richest overburden/top-of-bedrock historical drill results on the property at the Central Zone: hole 76955 (see Figure 2) encountered 256 gold grains within the basal till sample, with 240 gold grains being delicate and therefore likely transported no more than 500 m down-ice to the southeast. This potential source area remains undrilled;

Presence of multiple drilling gaps extending over hundreds of metres; and,

Presence of several undrilled linear Artificial Intelligence targets to the north of the NW Zone (see Figure 2 and press release from November 30, 2020).

The Company expects to complete a total of approximately 117 line km during this IP program including the area shown in Figure 2. A second grid to be tested will include a new target located approximately 2.2 km southeast of the P8 Target (shown in Figure 1), and a third grid located about 9 km to the southwest of the P8 Target will be surveyed to test a structural concept on the Joutel property, which is contiguous with the Douay property. The Company aims to delineate new high-priority drill targets upon the completion of the IP surveys in these three areas.

Fig. 2: NW IP grid on total magnetic intensity background, testing lithotectonic boundary/shear zone between Central and NW Zones, as well as several Artificial Intelligence targets (white ellipses) further to the north and west of the NW zone. Note position of basal till anomaly (red dot represents hole 76955 = 256 gold grains) referred to in text; red arrow shows interpreted source region and transport distance of gold grains.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3077/71378_66246fd8b4f92bfc_002full.jpg

Grant of Stock Options

The Company has granted a total of 600,000 incentive stock options at a price of $0.385 to a Director and Officer. The Company's Equity Incentive Plan governs these incentive options, as well as the terms and conditions of their exercise, which is in accordance with policies of the TSX Venture Exchange.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President, Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work. For a complete description of protocols, please visit the Company's QA/QC page on the website.

About Maple Gold

Maple Gold Mines Ltd. controls the 357-square-kilometre Douay Gold Project located within the prolific Abitibi Greenstone Gold Belt and approximately 200 km by road north of Val d'Or, Quebec. The Project has an established gold resource with significant potential for resource expansion and new discoveries. On October 8, 2020, the Company announced the signing of a binding term sheet with Agnico Eagle Mines Limited ("Agnico") that contemplates the formation of a 50-50 joint-venture (the "JV"), which will combine Maple Gold's Douay Gold Project and Agnico's Joutel Project into a consolidated joint property package. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF Maple Gold Mines LTD.

"Matthew Hornor"

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Ms. Shirley Anthony

Director, Corporate Communications

Cell: 778.999.2771

Email: santhony@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This press release contains "forward-looking information" and "forward-looking statements" (collectively referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation in Canada, including statements about the completion of the JV and the continuation into British Columbia. Forward-looking statements are based on assumptions, uncertainties and management's best estimate of future events. Actual events or results could differ materially from the Company's expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.'s filings with Canadian securities regulators available on www.sedar.com or the Company's website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/71378