Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) ("Maple Gold" or the "Company") is pleased to announce that results from recently completed geophysical surveys have allowed definition of a new and highly prospective target area south of the known mineral resource at the Company's Douay Gold Project in northern Quebec, Canada. The Company now plans to incorporate drilling at this target as part of its Fall 2020 drill program which is currently underway.

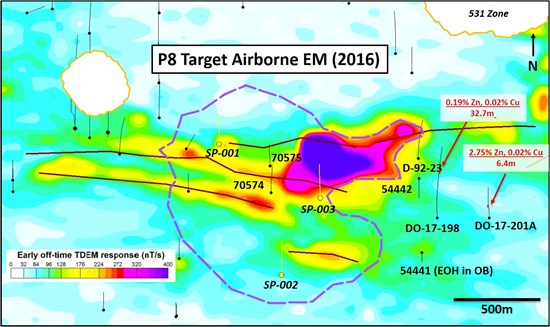

The Company recently completed geophysical surveys consisting of an Induced Polarization ("IP") grid extending well south of the mineral resource area, which outlined one of the strongest chargeability anomalies (up to 30 mV/V) known across the entire Douay property. The newly defined chargeability anomaly, named the P8 Target, covers a 1.2 km2 area starting approximately 0.7 km south of the Porphyry Zone and partially overlaps one of the broadest (>400 m strike) airborne Electromagnetic ("EM") conductors identified on the property from an airborne survey completed during 2016 (see Figures 1, 2 and 3 below).

Fred Speidel, Vice-President, Exploration for Maple Gold, commented: "The P8 Target is geophysically unlike any other known mineralized zone at Douay for the strength and scale of overlapping chargeability and conductivity responses. While there are some geological similarities to our existing gold resources such as the higher grade Douay West and 531 zones, the target also exhibits geological and geophysical similarities with the pyritic gold mineralization characteristic of the past-producing Telbel mine area, which was discovered by drilling coincident ground magnetic and EM anomalies."

"This new chargeability target is another example of the significant discovery potential across the Company's large property package. Similar environments are also found in several areas on the Douay property, where the Company continues to apply models and target concepts that leverage the Company's understanding of other high-grade gold mines in the immediate area," concluded Mr. Speidel.

The Company has requested additional permits to include drill sites at this target to test the area for potentially higher-grade gold and base metal mineralization. Up to three deeper (~400 m) holes are expected to be drilled towards the end of the Fall 2020 exploration program (see holes SP-001, SP-002 and SP-003 in Figures 2 and 3 below).

Fig. 1: Location map for the new P8 Target. Note scale of this target relative to different resource zones. Syenitic bodies with associated (proximal) gold mineralization are present at the Nika and Porphyry Zones, while more distal mineralized zones such as Douay West (DW) and 531, and including the P8 Target area, are characterized by stronger structural control and spatial association with sedimentary horizons within a predominantly basaltic sequence.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3077/68034_5618879804f90a70_001full.jpg

Fig. 2 & 3: P8 Target (purple dashes) defined as combined and overlapping 2016 airborne EM conductor (Fig. 2, above) and 2020 chargeability anomaly at 300 m depth (Fig. 3, below). Solid brown lines represent historical INPUT conductor axes. SP holes are currently being permitted.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3077/68034_5618879804f90a70_002full.jpg

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/3077/68034_5618879804f90a70_003full.jpg

Historical Drilling and Geological Setting

Drill holes in the immediate P8 Target area are sparse. However, the Company's geologists recently reviewed two short historical drill holes (70574 and 70575) completed by Inco in 1988 (to a maximum 244 m downhole or approximately 190 m vertical depth), and observed a strong mineralized system in the core over tens of metres with elevated pyrite and anomalous gold values (30-580 ppb), developed within thick interflow exhalite horizons as well as in the adjacent biotite-altered basalts. These two holes provide proof-of-concept for the existence of a mineralized system in this area, but were too short to adequately test the P8 Target chargeability anomaly which extends to at least 450 m depth (over twice the vertical interval tested by the historical holes).

The core of the associated EM conductor target, offset by about 350 m to the east relative to the core of the chargeability anomaly, remains completely untested by drilling. The five holes adjacent and to the east of this target include DO-17-198, which cut several base-metal-rich intervals with anomalous gold, the best being 0.19% Zn, 0.02% Cu and 25 ppb Au over 32.7 m, at a mafic-felsic contact again marked by a broad interflow sedimentary horizon with abundant exhalites. Hole DO-17-201A, collared a further 300 m to the southeast, cut strongly graphitic sediments with carbonatitic injections with 2.75% Zn, 0.02% Cu and 44 ppb Au over 6.4 metres (see Figure 4 right). Historical hole 54441 was abandoned before reaching bedrock and hole D-92-23 had broad but weak anomalous gold without any base metal assays having been performed.

Historical drilling in the P8 Target area clearly indicates there is a strong mineralized system including and extending beyond the Company's new chargeability anomaly (Figure 4 left). Furthermore, the base metal results well to the east of the most significant EM conductor on the property also support the potential for elevated base metals in the area.

Fig 4: Left, new mineralization style from historical hole 70575, beginning at top of bedrock: pyritic quartz breccia in thickened interflow sedimentary/exhalite horizon. Right, core from historical hole DO-17-201A: another new mineralization style including white carbonatitic injections with coarse brown sphalerite in strongly graphitic black interflow sediments and sericite-Fe-carbonate (paler green) altered volcanics.

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/3077/68034_5618879804f90a70_004full.jpg

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President, Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work. For a complete description of protocols, please visit the Company's QA/QC page on the website.

About Maple Gold

Maple Gold Mines Ltd. controls the 357-square-kilometre Douay Gold Project located within the prolific Abitibi Greenstone Gold Belt in northern Quebec, Canada. The Project has an established National Instrument 43-101 gold resource (RPA 2019) of 422,000 ounces in the Indicated category (8.6Mt grading 1.52 g/t Au) and 2.35 million ounces in the Inferred category (71.2Mt grading 1.03 g/t Au) with significant potential for resource expansion and new discoveries. The Project benefits from exceptional infrastructure access and the Company is currently focused on carrying out aggressive exploration programs to expand and update the known resource. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF Maple Gold Mines LTD.

"Matthew Hornor"

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

Executive Vice President

Cell: 778.686.6836

Email: jlang@maplegoldmines.com

Ms. Shirley Anthony

Director, Corporate Communications

Cell: 778.999.2771

Email: santhony@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This press release contains "forward-looking information" and "forward-looking statements" (collectively referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation in Canada, including statements about the completion of the JV and Financing and use of proceeds of the Financing. Forward-looking statements are based on assumptions, uncertainties and management's best estimate of future events. Actual events or results could differ materially from the Company's expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.'s filings with Canadian securities regulators available on www.sedar.com or the Company's website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/68034