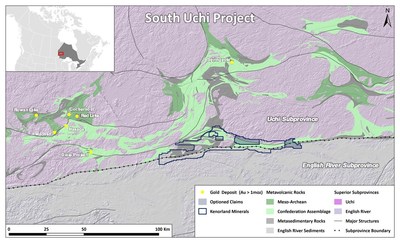

Kenorland Minerals Ltd. (TSXV: KLD) (FSE: 3WQ0) ( "Kenorland" or "the Company" ) is pleased to announce that is has acquired, through staking, 65,657 hectares of mineral claims within the Birch-Uchi Greenstone Belt, in the Red Lake district of Northwestern Ontario . In addition, Kenorland has entered into an option agreement, dated April 29, 2021 (the " Option Agreement ") with a private Ontario company pursuant to which Kenorland has been granted the sole and exclusive option (the " Option ") to acquire a 100% interest in the Curie Lake and Root Lake West properties (the " Properties "). The staked and optioned claims combine for a total of 76,511 hectares and are referred to as Kenorland's South Uchi Project ( "the Project" ).

About the South Uchi Project

The Project covers a portion of Confederation Assemblage volcanic rocks, as well as the boundary between the volcanic-dominated Uchi subprovince to the north and the sedimentary-dominated English River subprovince to the south. Multiple major east-west striking shear zones associated with the subprovince boundary transect the Project along its 90km strike-length. Deformation associated with these structures has resulted in zones of strong shearing, alteration and complex folded geometries of the metavolcanic-clastic metasedimentary-iron formation stratigraphy, which are favorable settings for orogenic gold mineralization.

The majority of gold deposits in the Red Lake District ( Red Lake , Madsen , Hasaga, and others) are located on the northern margin of the Confederation Assemblage, however, the recent discoveries such as the LP Fault on the Dixie Project by Great Bear Resources Ltd. highlight the prospectivity of the entire Confederation Assemblage along the southern margin of the Uchi subprovince.

In addition to the gold prospectivity, the Project meets many of the criteria for potential lithium pegmatite deposits, including the presence of the large Alison Lake batholith (a fertile peraluminous granite), which is partly covered by the project. Numerous lithium pegmatite occurrences are located in the region, including the McCombe deposit (Ardiden Ltd.) located immediately to the east of the Project.

"The South Uchi Project is an excellent addition to our pipeline of greenfields exploration assets," said Zach Flood , President and CEO of Kenorland. "The project meets all of the criteria we look for, including an extensive amount of prospective geology concealed by glacial till, vastly under-explored, and favourable access and infrastructure. Our plan is to carry out a large-scale systematic geochemical survey over the entire property this summer. This approach has worked very well for us in Quebec and we will apply a similar methodology here in the Birch-Uchi belt."

Option Agreement

In order to exercise the Option, Kenorland will make aggregate cash payments of $175,000 and issue common shares with an aggregate value of $175,000 over a two-year period from the date of the option agreement. Upon the exercise of the option, Kenorland will also grant to the optionor a 2% net smelter return royalty on the Property, of which ½ (1%) may be purchased by Kenorland at any time for an aggregate payment of $1,000,000 which may be paid in cash or through the issuance of common shares of Kenorland, at the discretion of the optionor.

All common shares of Kenorland issuable pursuant to the Option Agreement will have a deemed issuance price equivalent to the 20 day volume-weighted average trading price of Kenorland's shares, for the period immediately prior to the date on which such common shares are due, subject to a floor price of $0.70 per share. The shares will also be subject to a four month and one day resale restriction from the date of their issuance.

The Option Agreement remains subject to the approval of the TSX Venture Exchange.

Qualified Person

Mr. Jan Wozniewski , B. Sc., P. Geo., OGQ (#2239) is the "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSX.V KLD) is a mineral exploration Company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia , Canada. Kenorland's focus is early to advanced stage exploration in North America. The Company currently holds three projects where work is being completed under an earn-in agreement from third parties. The Frotet and Chicobi Projects, which are both located in Quebec, Canada , are optioned to Sumitomo Metal Mining Canada Ltd. and the Chebistuan Project, also located in Quebec , is optioned to Newmont Corporation. The Company also owns 100% of the advanced stage Tanacross porphyry Cu-Au project as well as an option to earn up to 70% from Newmont Corporation on the Healy Project, both located in Alaska, USA .

Further information can be found on the Company's website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

President and CEO

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Kenorland Minerals Ltd.

Francis MacDonald

Executive Vice President

Tel: +1 778 322 8705

francis@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/kenorland-acquires-district-scale-land-package-in-ontarios-birch-uchi-greenstone-belt-301281203.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/kenorland-acquires-district-scale-land-package-in-ontarios-birch-uchi-greenstone-belt-301281203.html

SOURCE Kenorland Minerals Ltd.