Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1) ("Idaho Champion" or the "Company") is pleased to announce that fieldwork for the 2021 exploration program (the "Field Program") has commenced at the 100% controlled Champagne Gold Project ("Champagne") near the city of Arco, Butte County, Idaho

This year's program will push geological mapping, sampling, and geophysics farther north across the full extent of the +27 km2 land position. Geologists will also begin the preparations for the exploration drilling program planned for third quarter 2021.

2021 Field Program Highlights

- The geology staff and technical advisors completed a thorough field-based technical review of the 2020 results and plans for the 2021 drill campaign.

- Sited drill pad locations on IP lines 4 and 5 to test the NW anomaly. Access roads and drill pads will be constructed when final approval is received from the Bureau of Land Management. Core drilling is slated to start in July 2021.

- Initiated geologic mapping and outcrop sampling over a newly identified occurrence of intense alteration, veining, and brecciation spanning an area of more than 1,000 by 800 meters in the northern part of the property.

- Follow-up sampling and geologic investigations will be conducted at another northern target where several dump samples returned anomalous gold and silver.

- Up to 5,000 line-metres of additional Induced Polarization (IP) geophysical surveys will also be carried out.

"This will be a transformative year for Champion and the Champagne Gold project as we move beyond the areas of historic mining on the property. Our focus will be exploring the large IP anomaly located northwest from the past producing pits, which is interpreted to represent the larger roots of the mineral system that was mined in the 1990's. Our technical team is mobilized and will begin surface work to support a drill program planned for Q3," stated President and CEO, Jonathan Buick. "Our 27 square kilometer property package hosts several important exploration targets, and we will prioritize a portion of our Field Program to regional exploration."

Champagne Gold Project Exploration 2021 Summary

The 2021 field program, currently in progress, is guided by insights gained from the 2020 exploration season. The primary purpose of this program is to define the full northern extent of outcropping alteration and mineralization. For instance, a recent reconnaissance traverse running north from IP line-5 found that evidence of alteration and mineralization continues for another 1.4 kilometers to the north.

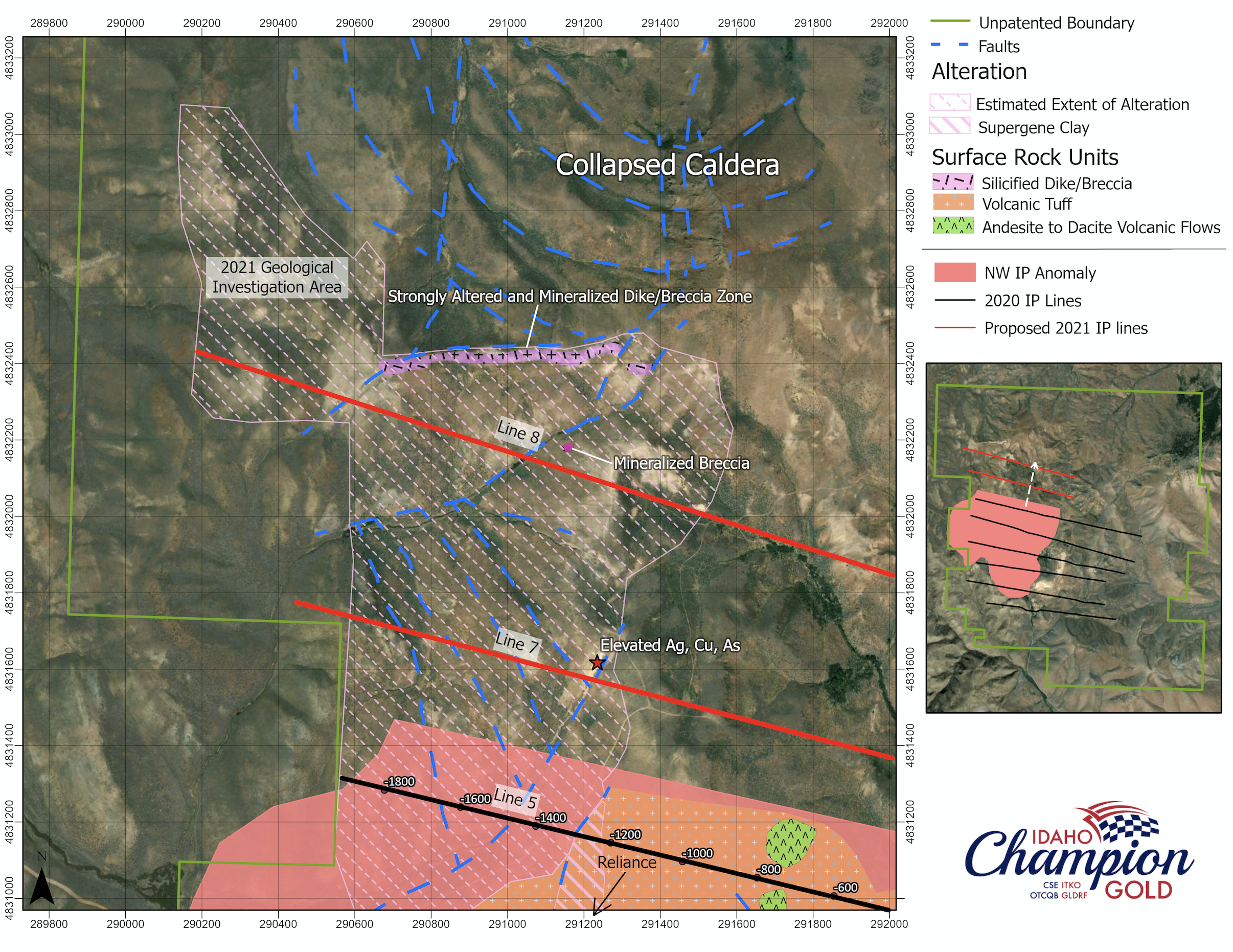

The NW anomaly was identified by the company's IP survey conducted in 2020. The anomaly shows a high chargeability response in the western area of the claim block. The 2020 IP survey also confirmed that the Mine Hill area, where historic mines exploited veins and vuggy silica breccia, has a strong chargeability response, but represents the decapitated and displaced top of a larger mineralized system. Fortunately, the intact downward continuation of the mineralized system was identified in the form of a massive geophysical anomaly concealed beneath a flat-lying detachment fault located within the western part of the Champagne Creek property holdings. The IP anomaly currently measures +1,500 meters long (open-ended to the north) and 800 to 1,000 meters across with a depth extent of over 600 meters, also open-ended (see news release dated 2 February 2021).

The initial 2021 IP survey will include two additional IP lines (Line 7 and 8) which will be executed concurrent with reconnaissance mapping and sampling in the area. Lines 7 and 8 will each measure approximately 1,500 meters long and line spacing will be 400 meters, beginning at the northernmost line of the 2020 survey. These lines will test the northwestern extent of the large IP anomaly, which is currently open-ended.

Results from 2020 drilling, soil, and rock chip sampling show that gold occurring in vuggy silica breccia and veins is associated with advanced argillic alteration and shares a positive correlation with pathfinder elements: silver, arsenic, antimony, bismuth, tellurium, and tin. The nature of alteration, sulfide/sulfosalt mineral assemblages, and pathfinder metal associations indicate a high level in the mineralized system at Mine Hill. It is expected that the NW Anomaly, which represents the intact downward continuation of the Mine Hill system, will contain similar gold and silver-bearing sulfide/sulfosalt assemblages and pathfinder metal associations. Mapping and soil sampling in the vicinity of the NW Anomaly has turned up significant alteration and geochemical anomalies, often associated with mineralized structures.

The project geological team has mobilized to the Champagne Gold Project to commence mapping and sampling over the northern portion of the property. The team will also begin preparing drill pads and the core logging and handling facilities for what promises to be a busy field season.

Figure 1. Priority area for geologic work to begin 2021 field program.

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 567- 9087

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/646710/Idaho-Champion-Gold-Commences-2021-Field-Program-at-Champagne-Gold-Project